“`html

Microsoft’s Latest Earnings Showcase AI Momentum

In its first quarter of fiscal 2025, Microsoft (MSFT) reported strong growth driven by its AI-driven Copilot services. Notably, nearly 70% of Fortune 500 companies are now using Microsoft 365 Copilot, with daily users more than doubling from the previous quarter. A study by Forrester indicates that small and medium businesses could see impressive returns on investment, ranging from 132% to 353% over three years, highlighting the attractive value for customers.

Growing AI Potential in Healthcare

Microsoft is poised to become a key player in the healthcare AI sector, which was valued at $19.27 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 38.5% from 2024 to 2030, according to Grand View Research.

Revenue and Earnings Projections

The Zacks Consensus Estimate estimates Microsoft’s fiscal 2025 revenues at $277.66 billion, marking a 13.27% increase from the previous year. Furthermore, the consensus forecast for earnings stands at $12.94 per share, a 9.66% growth year-over-year.

Image Source: Zacks Investment Research

Get the latest EPS estimates and surprises on Zacks Earnings Calendar.

Positive Signs from Major Enterprises

The adoption of Copilot shows strong support from major enterprises. Vodafone has decided to implement the service for 68,000 employees after successful trials that reported average time savings of three hours per employee per week. Similarly, UBS has committed to deploying 50,000 seats of Copilot, which is Microsoft’s largest deal in the financial services sector to date.

Expanding Developer Tools and Platforms

The GitHub ecosystem is thriving, as evidenced by a 55% increase in Copilot Enterprise customers from the previous quarter. Features such as GitHub Copilot Workspace and Autofix, which allow developers to address vulnerabilities three times quicker, reflect Microsoft’s dedication to enhancing its developer tools. GitHub Spark’s introduction broadens the scope for developers with natural language app creation.

Healthcare Innovations Fueling Growth

Microsoft’s success in vertical integration is particularly evident in healthcare. The DAX Copilot is now handling over 1.3 million physician-patient interactions each month across more than 500 healthcare organizations. This rapid revenue growth outpaces the early performance of GitHub Copilot, signaling promising prospects for specialized industry applications.

Commitment to Security and Infrastructure

Security remains a top priority for Microsoft, with its Secure Future Initiative engaging 34,000 engineers. Although such investments are vital, they may affect short-term profitability. Microsoft’s Defender technology has secured over 750,000 GenAI app instances, while its Purview tool has audited over a billion interactions with Copilot.

Strong Performance in Business Apps and LinkedIn

Dynamics 365 continues to attract users, with more than a 60% increase in monthly active Copilot users across its CRM and ERP solutions. LinkedIn’s growth is robust, experiencing double-digit growth in significant markets like India and Brazil, alongside a six-fold increase in weekly immersive video views.

Enterprise Integration Gaining Traction

Enterprise clients demonstrate significant trust in Copilot’s capabilities, as seen in deployments like Vodafone’s and UBS’s previously mentioned implementations. Vodafone’s reported efficiency savings can inspire wider adoption, highlighting the tangible business benefits of the service.

Developer Tools Making Headway

The continued momentum for GitHub Copilot is evident with a rapid 55% increase in Enterprise customers this past quarter. New features, including Workspace and Autofix, position Microsoft favorably within the developer tools landscape. Copilot Autofix proves to be three times quicker in helping developers resolve vulnerabilities compared to traditional methods.

Healthcare and Specific Solutions Showing Growth

The swift adoption of DAX Copilot in healthcare emphasizes Microsoft’s effective vertical strategy. Currently processing over 1.3 million patient encounters monthly, DAX Copilot’s growth outpaces GitHub Copilot’s initial performance, alluding to ongoing opportunities in industry-specific solutions.

Investment Outlook: Caution for Investors

While Microsoft remains a strong contender in the AI space with impressive adoption metrics, potential investors might consider waiting for better entry points. Management forecasts steady revenue growth in the second half of the year, suggesting that revenue from M365 Copilot seat licenses will expand gradually. Furthermore, significant investments in security and infrastructure could weigh on near-term profits.

The competitive terrain within the AI industry is heating up, with rivals like Alphabet (GOOGL), Nvidia (NVDA), and Oracle (ORCL) all making major advancements. Microsoft’s success will depend on maintaining its competitive edge and effectively monetizing its innovations. Additionally, looming regulatory scrutiny adds uncertainty to the future of AI growth in the industry.

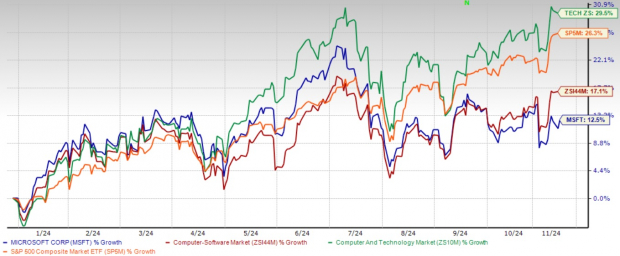

With a 12.5% gain year-to-date, Microsoft has lagged behind the Zacks Computer & Technology sector and the S&P 500 index, which have returned 29.5% and 26.3% respectively. This leads to the pressing question of whether Microsoft’s advancements in AI will translate into improved stock performance.

Current Year-to-date Performance

Image Source: Zacks Investment Research

Microsoft’s current stock valuation suggests that much of its near-term growth potential from AI investments is already reflected in prices. With a forward 12-month price-to-sales ratio at 10.78X, Microsoft’s valuation exceeds both the Zacks Computer – Software industry average of 7.93X and its historical median of 10.15X. This premium pricing reveals a strong investor belief in Microsoft’s future pathways for growth.

“`

Microsoft’s AI Ambitions: A Look at Market Challenges and Opportunities

Microsoft is currently positioning itself as a key player in the rapidly evolving fields of cloud computing and artificial intelligence (AI). This strong focus on AI drives excitement about its stock performance. However, it also leads to concerns about whether Microsoft can sustain its high valuation amidst potential challenges.

A Closer Look at MSFT’s Price-to-Sales Ratio

Image Source: Zacks Investment Research

Final Thoughts

For existing investors, the impressive adoption rates and new enterprise customers indicate that holding onto these stocks may be beneficial in the long term. Conversely, those looking to invest might want to wait for a better buying opportunity, especially given the current market’s volatility and the likelihood of short-term price swings. At present, Microsoft holds a Zacks Rank of #3 (Hold).

Explore Top Stock Picks

Recently, experts have identified seven top stocks from a pool of 220 Zacks Rank #1 Strong Buys that they believe are primed for quick price increases.

Historically, this list has outperformed the market by more than double since 1988, boasting an average annual gain of 23.7%. It might be wise to pay close attention to these carefully selected stocks.

Are you looking for the latest insights from Zacks Investment Research? Right now, you can download a report titled “5 Stocks Set to Double” for free.

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Oracle Corporation (ORCL): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

To view the original article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.