Medifast Reports Q3 2024 Earnings: A Challenging Quarter Amidst Competition

Medifast, Inc. MED recently revealed its third-quarter 2024 financial results, showcasing earnings and revenues that exceeded analyst expectations but still showed declines compared to the previous year. The company faced difficulties in customer acquisition, partly due to fierce competition from GLP-1 medications and changes in consumer spending habits.

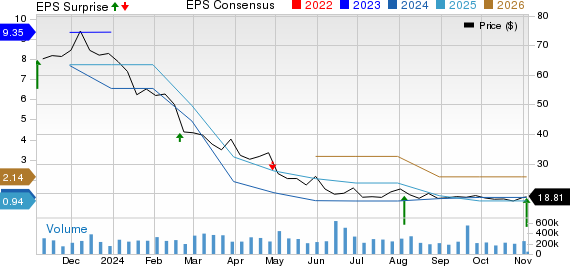

In the third quarter, Medifast’s adjusted earnings stood at 35 cents per share, a significant drop from $2.12 in the same quarter last year. Despite this decline, the earnings exceeded the Zacks Consensus Estimate, which had forecasted a loss of 15 cents per share.

Explore the latest EPS estimates and surprises on the Zacks Earnings Calendar.

Net revenues for the quarter reached $140.2 million, reflecting a staggering 40.6% decrease year over year. This decline was attributed to a reduction in the number of active-earning OPTAVIA Coaches and lower productivity among coaches. The average revenue from each active-earning OPTAVIA Coach fell to $4,672, down from $5,008 last year, as customer acquisition efforts softened. The total number of active-earning OPTAVIA Coaches dropped 36.3%, falling from 47,100 to 30,000. Nonetheless, revenues beat the Zacks Consensus Estimate of $135.5 million.

Breakdown of Medifast’s Q3 Financial Performance

Medifast reported a gross profit of $105.7 million, down 40.4% from the previous year, mainly due to decreased revenues. The gross profit margin improved slightly to 75.4%, compared with 75.2% from the year-ago quarter.

The company’s selling, general, and administrative (SG&A) expenses fell by 31.8% to $103.6 million. This reduction was largely a result of decreased compensation for OPTAVIA coaches, which coincided with a smaller number of coaches and lower sales volumes. There was also a drop in costs linked to coach-related events, including their annual convention. Analysts had estimated SG&A expenses to decrease by 38.2%, expecting them to be around $93.8 million in Q3.

As a percentage of revenue, SG&A expenses rose 950 basis points to 73.9%, driven by approximately 590 basis points attributed to customer acquisition initiatives and 340 basis points related to decreased leverage on fixed costs stemming from lower sales.

Adjusted income from operations fell 85.3% to $3.8 million, resulting in an adjusted operating margin that dropped 810 basis points year over year to 2.7%.

Financial Overview of Medifast

The company, currently holding a Zacks Rank of #3 (Hold), ended the quarter with $115.3 million in cash, cash equivalents, and investments, and reported no debt as of September 30, 2024. Shareholders’ equity totaled $207.3 million.

As of September 30, 2024, Medifast maintained a $225 million credit facility. Given its robust cash position, the company decided to terminate the credit agreement, which will be effective October 30, 2024. This decision aligns with the Fuel for the Future initiative.

Image Source: Zacks Investment Research

Outlook for Medifast in Q4

Looking ahead, Medifast anticipates fourth-quarter revenues between $100 million and $120 million. This projection indicates a continued drop in active-earning OPTAVIA Coaches, influenced by short-term challenges in acquiring customers due to the rising adoption of GLP-1 medication. Management expects a loss per share in the range of 10 to 65 cents for the upcoming quarter.

The guidance includes a planned expenditure of $7 million for marketing initiatives during this period. However, it does not factor in any potential gains or losses arising from fluctuations in the market price of MED’s LifeMD common stock, as these are difficult to predict.

Over the last three months, Medifast’s shares have declined by 7.2%, whereas the industry saw a modest increase of 0.5%.

Top Picks in the Consumer Staples Sector

Several stocks from the Consumer Staples sector rank higher than Medifast. Notable mentions include Freshpet FRPT, Vital Farms VITL, and United Natural Foods UNFI.

Freshpet, a manufacturer of pet food, currently has a Zacks Rank of #2 (Buy). The company has achieved an average trailing four-quarter earnings surprise of 132.9%. The Zacks Consensus Estimate forecasts Freshpet’s sales and earnings growth of 26.1% and 204.3%, respectively, for the current financial year compared to last year.

Vital Farms, which specializes in ethically produced food, is also rated #2 by Zacks. Its trailing four-quarter earnings surprise averages 82.5%. The sales and earnings growth estimates for Vital Farms stands at 27% and 88.1%, respectively.

United Natural Foods, which distributes organic and conventional grocery products, holds a #2 Zacks Rank as well. The earnings estimates for the current financial year suggest substantial growth compared to the previous year’s numbers, with an average trailing four-quarter earnings surprise of 199.3%.

Investment Insights: A Potential Game Changer Ahead

Our research team has identified a company with significant growth potential. Among thousands of stocks analyzed, five Zacks experts selected their favorites, each with the potential to gain +100% in the coming months. One standout, chosen by the Director of Research Sheraz Mian, is poised for explosive growth.

Targeting Millennial and Gen Z consumers, this company generated nearly $1 billion in revenue last quarter. A recent dip in stock price presents an excellent entry point. While not all selections guarantee success, this one might outperform previous Zacks recommendations like Nano-X Imaging, which rose +129.6% in just over nine months.

Download our free report to discover our top stock and four additional selections. Get insights into Freshpet, United Natural Foods, Medifast, and Vital Farms.

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.