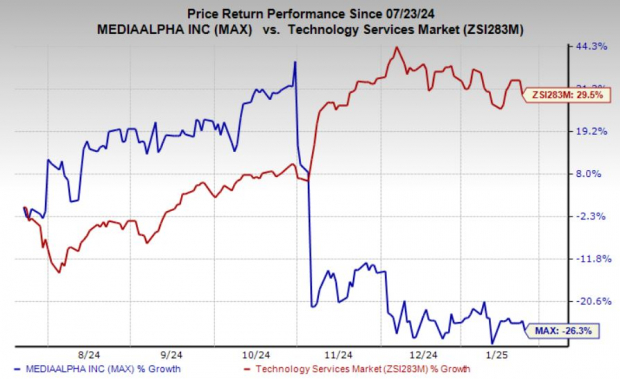

MediaAlpha, Inc. MAX has witnessed a significant stock decline of 26% over the last six months and 42% in the past three months. Nevertheless, the recent 5% gain in the past month suggests the stock may be on the verge of recovery from this downturn. Comparatively, its competitors have also experienced setbacks, with Angi ANGI down 23% and Nextdoor Holdings KIND declining 17% in the same time frame.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Let’s take a closer look at MAX’s performance to see if it presents a worthwhile investment opportunity.

Unpacking MAX’s Competitive Advantage

MediaAlpha operates in the specialized field of digital insurance advertising, using advanced data analysis to connect insurance companies with consumers ready to make a purchase. This targeted strategy allows insurers to make the most of their marketing budgets and enhance customer acquisition, securing MediaAlpha’s position as a leader in this sector.

Additionally, the digital advertising sector is rapidly expanding, especially within the insurance industry. As more providers move their marketing online, MediaAlpha’s technology-driven solutions are particularly well-suited to meet these evolving demands. Its data-focused strategy gives it a crucial edge in navigating industry trends.

MAX’s Operational Success and Innovative Approach

MediaAlpha’s drive for innovation is clear through its platform, which yields outstanding results. Designed for transparent, data-backed interactions between advertisers and publishers, this platform builds trust and guarantees superior returns on marketing investments—a key element for retaining and growing its client base.

In the third quarter of 2024, the company reported revenues of $259 million, marking an impressive 247% year-over-year growth. Furthermore, transaction value surged by 314%, reaching $451.8 million. Notably, the Property & Casualty insurance segment experienced a staggering 766% increase in transaction value, totaling $387 million. This performance underscores MediaAlpha’s capacity to harness industry trends effectively and leverage its platform for growth. Such robust results in a key market sector signal the company’s potential for sustained revenue and profit increases.

Moreover, the company has maintained operational efficiency, facilitating effective business scaling while preserving strong profit margins. Its commitment to optimizing technology and improving operations has led to significant financial progress, as reflected in its recent earnings report—boasting a gross margin of 15.1% and a contribution margin of 16%.

Favorable Industry Trends Strengthen MAX’s Position

Positive trends in the industry further bolster the case for MediaAlpha. The insurance sector’s shift towards digital tools and increased reliance on online customer acquisition methods serve as key drivers for growth. As insurers embrace data-driven advertising tactics, MediaAlpha is well-positioned as a trusted partner to help them achieve their objectives.

The company’s adaptability to market changes and its innovation within its niche establish it as a resilient player in a transforming industry landscape. These trends align with MediaAlpha’s growth strategy, positioning it as a primary beneficiary of the ongoing digital evolution in insurance advertising.

According to a recent report from Allied Market Research, the global auto insurance market, which can be seen as a gauge for how much insurance carriers spend on marketing, was valued at $923.4 billion in 2023. It is projected to reach $2,274.8 billion by 2032, translating to an estimated compound annual growth rate (CAGR) of 10.8% from 2024 to 2032.

MAX’s Strong Liquidity Health

MAX maintains a solid liquidity status with a current ratio of 1.22, indicating its ability to cover short-term debts comfortably. Although this figure trails behind the industry average of 2.15, it still reflects adequate financial health, emphasizing the company’s capability to manage its liabilities efficiently. Keeping a current ratio above 1 grants MAX stability and supports ongoing operations, which may enhance investor confidence. This financial resilience positions MediaAlpha to pursue growth opportunities without facing immediate liquidity issues, making it an attractive option for investors looking for balance between stability and potential growth in the digital advertising arena.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Optimistic Growth Projections for MAX

The Zacks Consensus Estimate anticipates that MAX’s sales for 2024 will reach $852 million, representing a 119.5% increase from the previous year, with a further 30% growth expected in 2025. The earnings estimate is projected at 48 cents per share for 2024, indicating a substantial 154% year-over-year rise, along with a subsequent 79.2% increase anticipated for 2025.

Notably, in the past 60 days, there has been one upward revision for both 2024 and 2025 estimates without any downward changes. During this time, the earnings consensus for 2024 climbed by 14.3%, and the 2025 estimate increased by 11.7%. These upward adjustments reflect analysts’ increasing confidence in MAX’s capacity to improve its performance moving forward.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

A Strong Recommendation for MAX

MAX emerges as a strong buy, thanks to its promising growth outlook and leading position in digital insurance advertising. Despite the recent downturn in stock prices, the 5% increase over the past month hints at a possible recovery. The company’s remarkable third-quarter results for 2024 showcased a 247% increase in revenues and a 314% rise in transaction value, driven primarily by a phenomenal 766% growth in its Property & Casualty segment.

With anticipated sales growth of 119.5% and a predicted earnings increase of 154% in 2024, along with upward adjustments in estimates, MAX is well-prepared to benefit from the ongoing digital transformation in insurance advertising. This makes it a compelling selection for investors focused on growth opportunities.

Currently, MAX holds a Zacks Rank #1 (Strong Buy). You can view the complete list of today’s Zacks #1 Rank stocks here.

Zacks’

Research Chief Unveils Top Stock with Potential to Double

Expert Selection Highlights Stock with 100% Growth Potential

Our team of experts has identified five stocks with the highest chance of achieving +100% growth in the upcoming months. Among these, Director of Research Sheraz Mian emphasizes one stock likely to see the biggest increase.

This standout stock belongs to a leading financial firm known for its innovative approach. With a rapidly growing customer base of over 50 million and a wide array of advanced solutions, this stock is set for significant appreciation. While not all of our top selections will win, this one has the potential to greatly exceed previous Zacks’ picks like Nano-X Imaging, which rose +129.6% in just over nine months.

Free: Discover Our Top Stock Along with Four Additional Picks

Angi Inc. (ANGI): Access Your Free Stock Analysis Report

MediaAlpha, Inc. (MAX): Access Your Free Stock Analysis Report

Nextdoor Holdings, Inc. (KIND): Access Your Free Stock Analysis Report

Read more about this stock on Zacks.com by clicking here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.