The Stock Plunge and Strategic Opportunity

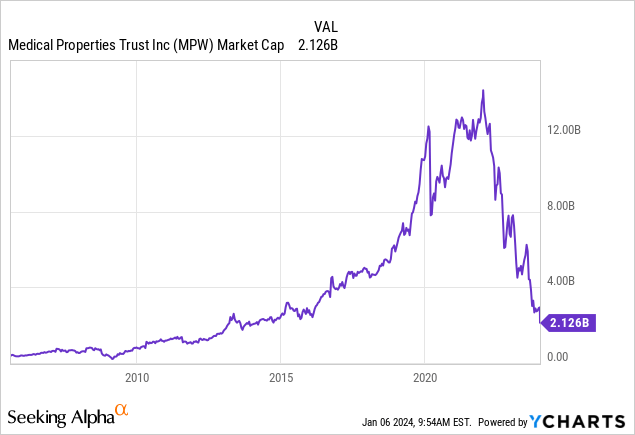

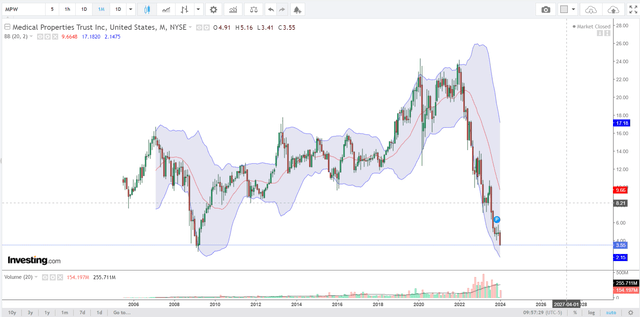

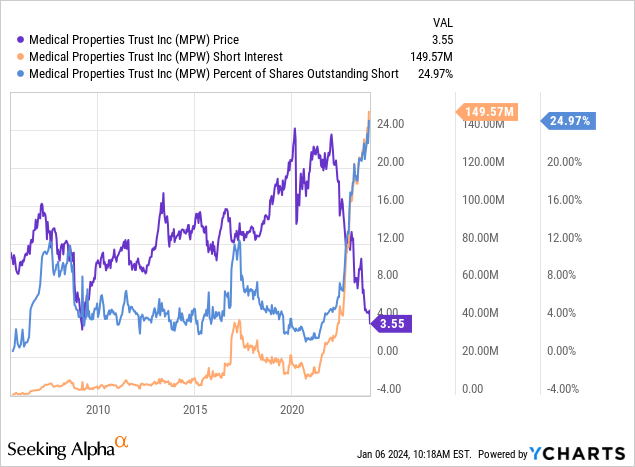

Medical Properties Trust (NYSE:MPW) took a nosedive of 29% on January 5, 2024, and has endured a staggering drop of over 70% in the past year, according to Seeking Alpha data. The sharp decline was primarily fueled by apprehensions about the management’s transparency, liquidity woes with the trust’s major tenant, and frets over the company’s significant debt-to-equity ratio, hinting at impending adversities in 2025 and beyond. Nevertheless, I hold firm that MPW’s current valuation renders it irresistibly inexpensive, especially in the face of a complete dividend reduction. This is particularly pertinent given the elevated short interest and sturdy support level reminiscent of the 2009 crisis. I contend that the risk-reward ratio in this narrative is tilting in favor of bargain hunters, at least in the medium run.

Steadfastness Amid Turbulence

Medical Properties Trust, established in 2003, has burgeoned into one of the largest proprietors of hospital real estate worldwide, boasting 441 facilities and 44,000 licensed beds as of September 30, 2023. It operates on a financing model that empowers operators to unlock real estate value for facility enhancements, technology upgrades, and operational investments.

In broader terms, the market in which the company operates is poised to ride a wave of positive forces in the medium run. We need only look at the surging demand from the aging baby boomer cohort, whose genuine need, coupled with financial capability, for medical services is set to underpin the industry’s robust growth trajectory for years to come.

Cutting to the chase with some specific figures: Projections by Precedence Research suggest that the global hospital services market will expand at a compound annual growth rate (CAGR) of 8.7% from 2022 to 2030. Per Statista, the US Hospitals market is anticipated to reach a revenue of $1.476 trillion by FY2024, leading the global charts in hospital market revenue and generating the highest per capita revenue, pegged at $4,320 in 2024. The encouraging backdrop for MPW, as opined earlier, finds validation in these concrete statistics.

However, it would be remiss to downplay the recent wrangle involving Steward, which triggered a freefall in MPW’s stock on January 5, 2024, and stirred consternation and a sense of revulsion among many stakeholders and external observers.

The future prospects of Steward have sparked intense speculation, fueled by apprehensions about its financial viability, including delayed rental payments and proposed closures of hospitals, prompting Medical Properties Trust (MPT) to escalate efforts to recoup outstanding rents and loans from Steward.

MPT enlisted financial and legal advisors, disclosing a total outstanding rent of roughly $50 million under their master lease. While Steward explores strategic deals, MPT extended a $60 million secured bridge loan, deferring unpaid rent and additional amounts to facilitate potential asset sales or re-leasing. MPT’s leadership voiced uncertainty about Steward’s capacity to fulfill lease payments, culminating in a non-cash impairment charge of approximately $225 million.

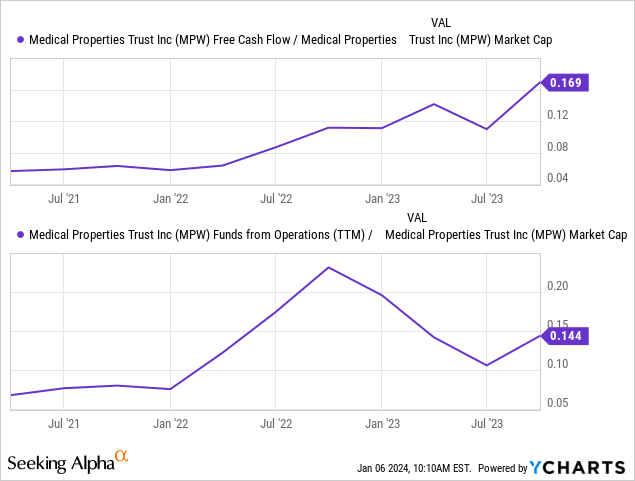

Even after deducting Steward’s and Prospect’s revenue contributions for Q3 – a prime concern for the market – we still arrive at an adjusted Funds From Operations (FFO) of ~$95 million (~$0.16 per share, based on my rough estimates). This figure more than suffices to stave off a complete dividend cut (another fear gripping Mr. Market).

Granted, a substantial portion of MPT’s net assets, tallying at $3.77 billion, is exposed to Steward (comprising ~19.8% of MPT’s overall assets). Undoubtedly, the potential floundering of Steward could imperil various passive equity investments, outstanding rent receipts, and loans held by MPT. Nonetheless, even in a hypothetical scenario assuming substantial write-offs of assets, MPT’s net asset value remains at $1.94 billion, suggesting that the current market cap nearly mirrors its net asset value.

Upcoming Earnings and Dividend Outlook

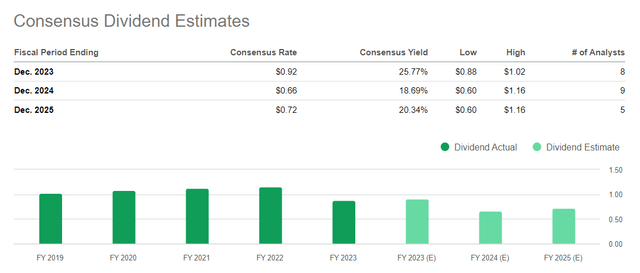

We are poised to witness MPW’s earnings report on February 22, 2024, in line with NASDAQ data. Given the fairly robust adjusted FFO payout ratio, I am of the view that the management is not compelled to execute as drastic a dividend cut as the Street may anticipate. In essence, a more moderate reduction should theoretically allay public anxiety.

Speaking of dividends, it’s worth highlighting that the forward dividend stands above 18% post the recent 29% plunge. This implies that even if this projection is overstated by 50%, we still arrive at an estimated yield of over 9% annually, with prospects of reclaiming the payout amount in 2025. Thus, the yield itself holds up reasonably well, even in a dire scenario.

MPW also presents an absolute bargain, not merely in terms of price-to-earnings (P/E), enterprise value to earnings before interest, taxes, depreciation, and amortization (EV/EBITDA), but also in the ratio of free cash flow and FFO to market capitalization. Hence, the scope for a rebound, should the fourth-quarter results and commentary outstrip expectations, seems remarkably substantial.

The technical analysis paints a bifurcated picture: while the momentum is disconcerting, we have edged toward a robust demand zone stemming from the 2009 crisis, from which a very high likelihood of buying pressure theoretically prevails. This is easily explicable on logical grounds: Many short sellers are anchoring their take-profit orders at local lows (or in this particular case, all-time lows) or slightly higher. We are almost there.

Medical Properties Trust: A Strong Buy Despite Risks

The level of shares sold short at today’s level is at an all-time high in the history of Medical Properties Trust (MPW). With such an unprecedented rise, it’s intriguing to contemplate the potential reaction of the stock in the event of a massive short covering.

Despite the combination of factors influencing MPW, the medium-term risk/reward ratio appears to be favorably skewed towards the upside.

Risks And Conclusion

Investing in Medical Properties Trust stock comes with significant risks, particularly regarding concerns about the quality of its assets and the worsening leverage and rent coverage metrics of its operators. The financial stability of MPW’s tenants, including hospitals and healthcare facilities, presents a critical risk factor. The company’s reliance on the financial well-being of its operators makes it vulnerable to market changes, potentially impacting rental income and overall asset values.

An escalating leverage risk adds another layer of concern as high levels of debt render MPW susceptible to economic fluctuations and changes in interest rates. Increased interest expenses could adversely affect the company’s profitability and cash flow, potentially straining its financial position. Additionally, deteriorating rent coverage metrics raise the specter of financial strain on MPW’s tenants, leading to missed or delayed rent payments. This not only endangers MPW’s revenue stream but also casts doubt on the financial stability of the healthcare providers crucial for its operational success.

Despite these compounded risks and the market’s general skepticism of management’s actions, it seems probable that MPW shares are more likely to recover than fall in the medium term. The current valuation appears reasonable even under the worst-case scenarios. Furthermore, the company’s FFO seems adequate to avoid a complete dividend cut. The critical low the company has approached is likely to result in strong buying pressure. The addressable market is expected to continue growing, providing a favorable backdrop for the company’s recovery in the foreseeable future.

Considering all the positive factors, it can be concluded that MPW is a ‘Strong Buy’. This appears to be a moment to be opportunistic when others are fearful and augment holdings. However, it is essential to proceed with caution and conduct thorough due diligence before making any investment decisions.

Good luck with your investments and trades!