What’s propelling the ongoing bull market to new heights? One factor shines brighter than the rest: artificial intelligence (AI). Without the relentless surge in AI integration, the stock market wouldn’t have seen such remarkable growth. Among the top performers dubbed the “Magnificent Seven,” AI plays a crucial role. However, not every behemoth reaping the rewards of the AI wave belongs to this elite group. Enter a $496 billion AI giant, hidden in plain sight, Walmart.

Diving Deeper into the AI Realm

Surprised to hear Walmart in this context? The retail colossus, Walmart (NYSE: WMT), has delved into AI ventures for years. Preceding the AI revolution sparked by OpenAI’s ChatGPT system, Walmart had already weaved AI intricately into its operations. Leveraging AI for supply chain management and predictive analytics, Walmart streamlined operations and enhanced efficiencies.

Recently, Walmart embraced generative AI, enhancing user experience through its online search functionalities. By deploying natural language understanding AI in customer service chatbots, Walmart has reduced millions of customer inquiries to its workforce. Not stopping there, Walmart’s proprietary AI route optimization tech is now available for commercial adoption, highlighting the company’s AI prowess.

A Magnificent Player on Multiple Fronts

While not part of the illustrious Magnificent Seven, Walmart boasts impressive achievements beyond the AI realm. With a staggering $648 billion in revenue last year, Walmart outshines even the most prominent tech giants. Though its profit margins may not rival those of esteemed growth stocks, Walmart still surpassed Tesla’s profits in 2023.

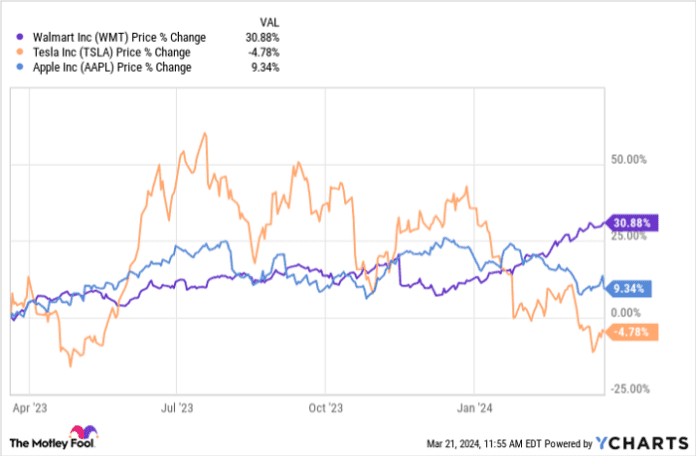

The retailer’s stock has seen a dramatic surge of over 30% in the past year, outpacing Tesla and Apple. Notably, Walmart’s valuation appears promising relative to other industry giants, trading at a lower forward earnings multiple of 26x.

Is Walmart’s Stock a Treasure Trove for Investors?

While Walmart’s valuation may deter short-term speculators, long-term investors can find solace in its enduring business model. With robust financial foundations and a firm commitment to AI integration, Walmart’s growth potential remains steady. Despite not being among the latest Stock Advisor picks, Walmart is a reliable choice for long-term investors.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Keith Speights has positions in Amazon, Apple, and Microsoft. The Motley Fool has positions in and recommends Amazon, Apple, Microsoft, Nvidia, Tesla, and Walmart. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.