MercadoLibre Prepares for an Anticipated Q4 2024 Earnings Report

MELI set to unveil its financial performance on February 20, projecting significant revenue and earnings growth.

MercadoLibre MELI is set to announce its fourth-quarter 2024 results on February 20.

For the fourth quarter, the Zacks Consensus Estimate sets revenues at $5.84 billion, indicating a 37.11% increase from the same period last year.

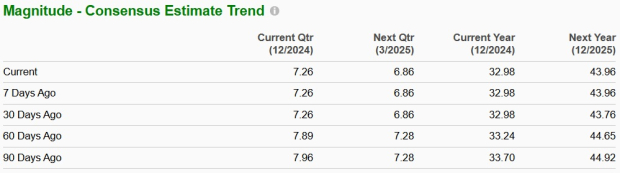

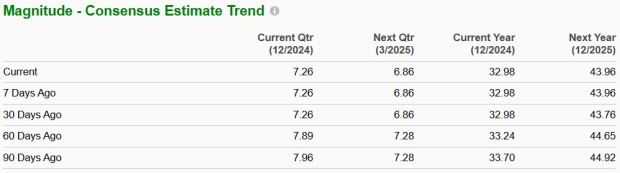

The consensus for earnings per share (EPS) stands at $7.26, suggesting a remarkable 123.8% increase year-over-year. This estimate has remained consistent over the past 30 days.

Image Source: Zacks Investment Research

Explore the latest EPS estimates and surprises on the Zacks Earnings Calendar.

Earnings Performance Overview

MercadoLibre has shown a mixed earnings performance in recent quarters. In the last reported quarter, the company experienced a negative earnings surprise of 30.52%. Out of the previous four quarters, earnings have surpassed the Zacks Consensus Estimate twice and fallen short on two occasions, averaging a negative surprise of 14.86%.

MercadoLibre, Inc. Price and EPS Performance

MercadoLibre, Inc. price-eps performance | MercadoLibre, Inc. Quote

Earnings Predictions for MELI

Currently, our forecast model does not strongly indicate an earnings beat for MercadoLibre this quarter. Merging a positive Earnings ESP with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) enhances the likelihood of an earnings surprise, which does not apply here. Presently, MercadoLibre holds an Earnings ESP of 0.00% and a Zacks Rank of #3.

Factors Impacting MercadoLibre’s Q4 Outlook

Fourth-quarter results may benefit from MercadoLibre’s improved logistics infrastructure, including six newly established fulfillment centers in Brazil and Mexico. While these investments could pressure margins initially, they are expected to support long-term growth. The Zacks Consensus Estimate for commerce revenues is set at $3.47 billion.

The fintech branch, especially Mercado Pago, is anticipated to maintain its upward momentum, following a robust third quarter characterized by a 166% year-over-year growth in credit card total payment volume (TPV). However, the rapid expansion of the credit portfolio and a shift towards credit products may pressure net interest margin (NIM) spreads in the short run. Again, the consensus for commerce revenues is estimated at $3.47 billion.

The recent overhaul of the loyalty program, MELI+, launched with two tiers (Essential and Total), is expected to enhance user engagement and retention, although its margin impact remains a critical factor as the company seeks a balance between growth and profitability. The advertising section also exhibits potential, reaching 2% of gross merchandise volume (GMV) in the third quarter; however, year-over-year comparisons may prove challenging. The core e-commerce operations likely sustained significant growth, bolstered by a stronger brand presence and enhanced customer experience.

Macroeconomic conditions in key markets, particularly Brazil’s interest environment and Argentina’s economic landscape, warrant close attention. While the company has shown resilience, these external factors might influence consumer behavior and overall credit performance.

Given the mixed indicators and the recent stock performance, a cautious investment strategy may prove wise, despite MercadoLibre’s strong market position. While long-term growth remains promising, near-term volatility and margin challenges suggest either waiting for a more opportune entry or maintaining current holdings rather than increasing exposure now.

Key Metrics for Q4 Estimates

The Zacks Consensus Estimate predicts gross merchandise volume at $14.7 billion.

The total payments volume consensus mark stands at $59.79 billion.

Estimates for the number of items sold and shipped are at 505 million and 453 million, respectively.

MELI Stock Performance & Valuation

Over the past year, MercadoLibre shares have climbed 19.3%, although this lags behind the Zacks Retail-Wholesale sector and the S&P 500 index, which reported returns of 31.2% and 23.3%, respectively.

Competing with Amazon AMZN, Walmart WMT, and AliExpress (owned by Alibaba BABA), MercadoLibre faces stiff competition. Year-to-date, shares of AMZN, WMT, and BABA have risen by 34.9%, 83.2%, and 68.8%, respectively.

1-Year Stock Performance

Image Source: Zacks Investment Research

Let’s evaluate the investment value of MercadoLibre at present.

Currently, MELI is trading at a premium, with a trailing 12-month price-to-sales (P/S) ratio of 4.11 compared to the Zacks Internet – Commerce industry average of 1.91, highlighting a higher-than-normal valuation.

MELI’s Valuation: Price-to-Sales Ratio Analysis

Image Source: Zacks Investment Research

Investment Considerations

MercadoLibre continues to signify a compelling long-term story in the Latin American e-commerce and fintech arena. However, it may be prudent for investors to hold their current positions or seek a better entry point before the fourth-quarter 2024 results. While strategic initiatives in logistics, credit portfolio expansion, and refined loyalty programs highlight strong growth potential, short-term margin pressures and macroeconomic challenges in critical markets necessitate caution. Although the recent rise in credit card use and fulfillment center enhancements point to promising growth, they may pressure profitability in the interim. Current valuations suggest limited upside until these strategies lead to more substantial returns.

Final Thoughts

MercadoLibre maintains its top position in Latin American e-commerce and fintech. Still, investors might want to consider holding their investments or waiting for a more favorable entry point ahead of the fourth-quarter 2024 results. Despite strong operational trends, short-term margin pressures due to strategic investments and uncertainties in key markets imply a cautious stance until clearer profitability signals emerge from these initiatives.

Just Released: Zacks Top 10 Stocks for 2025

Don’t miss the chance to get in early on our 10 top stocks for 2025. Selected by Zacks Director of Research Sheraz Mian, this portfolio has delivered remarkable returns. Since its launch in 2012 through November 2024, the Zacks Top 10 Stocks have surged by 2,112.6%, significantly outperforming the S&P 500’s +475.6%. Sheraz has meticulously chosen the best 10 stocks to buy and hold in 2025. Be among the first to discover these newly-released stocks with great potential.

See New Top 10 Stocks >>

Curious about the latest recommendations from Zacks Investment Research? You can download the 7 Best Stocks for the Next 30 Days for free.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Walmart Inc. (WMT): Free Stock Analysis Report

MercadoLibre, Inc. (MELI): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

Read this article on Zacks.com here.

Zacks Investment Research

The views and opinions expressed herein belong to the author and do not necessarily represent those of Nasdaq, Inc.