Looking Beyond the Numbers

When a stock outperforms by 40% in a year, many investors hit the panic button. But history tells us – the biggest winners often defy these numbers: the rise of Nvidia and Super Micro Computer stand as testaments to this. They saw incredible growth beyond the 40% mark, reaping even greater rewards.

The Ad Powerhouse Behind Meta Platforms

Formerly known as Facebook, Meta Platforms runs a tight ship in the advertising world. Its Family of Apps includes big names like Facebook, Instagram, WhatsApp, Messenger, and Threads. While its Reality Labs division once raised eyebrows with its fancy tech ventures, the tide is turning. With AI on the rise, Mark Zuckerberg’s vision for the future is coming into focus.

Meta’s secret weapon? An AI innovation dubbed Ego, set to revolutionize AR glasses. Imagine the possibilities: from language translation to culinary tutorials, the sky’s the limit. This ambitious project could catapult Meta’s stock to the stars, injecting billions into its sales pipeline.

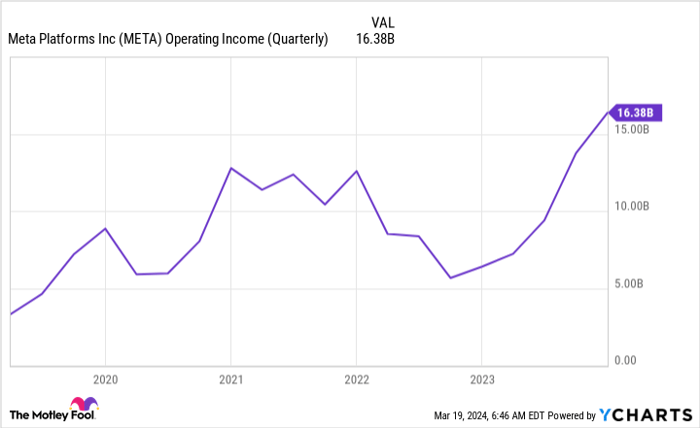

Yet, amidst these groundbreaking pursuits, Meta’s core business remains strong. Record-breaking ad sales of $38.7 billion in Q4 2024 – trouncing expectations by 24% – prove that Meta continues to be a cash cow. With a stellar 54% revenue-to-profit conversion rate, it’s a cash-generating behemoth. Even after Reality Labs chomped $4.6 billion of profits in one gulp, Meta still boasts a formidable $16.4 billion in operating profits.

And let’s not forget about their cash reserves – a cool $65.4 billion in the bank by Q4’s end. With a mere $18.4 billion in long-term debt, Meta’s war chest is well-stocked for future ventures. The recent nod for a dividend underscores their financial prowess, signaling a steady start to what could be a dividend dynasty.

The Numbers Game: A Fair Price for Entry

Meta’s forward P/E ratio sits at 25, signaling fair valuation. For a trailblazer in AI tech, boasting a 25% growth rate, this isn’t a steep price to pay. Compare this to tech giants like Apple and Microsoft, both trading at a premium. Meta seems like a steal in the making.

With Meta dominating the AI landscape and social media arena, the growth story has just begun. Selling now would be short-sighted. Investing in Meta now could well be a ticket to riches three to five years hence.

Should You Seize the Meta Moment?

Before diving into Meta Platforms, heed this advice:

The Motley Fool Stock Advisor team singled out the top 10 stocks deemed to be tomorrow’s winners; Meta Platforms didn’t make the cut. The chosen few could yield massive returns in the near future.

Stock Advisor guides investors with expert advice, paving the way to success through portfolio building, analyst insights, and bi-monthly stock picks. Since 2002, the service has handily outperformed the S&P 500*.

Explore the 10 stocks poised for greatness

*Stock Advisor returns as of March 21, 2024

Randi Zuckerberg, former Facebook director and sister to Meta Platforms CEO Mark Zuckerberg, is a Motley Fool board member. Keithen Drury holds positions in Meta Platforms. The Motley Fool holds and advises on Meta Platforms. The Motley Fool maintains a strict disclosure policy.

The views expressed herein are solely those of the author and not necessarily aligned with Nasdaq, Inc.