The Rise of MFC Stock

Manulife Financial Corporation (MFC) has witnessed an impressive surge in its stock price, closing near its 52-week high at $28.87. The company’s success is attributed to its robust Asia business, expanding Wealth and Asset Management division, and solid capital position, propelling it towards a trajectory of growth and prosperity.

Outperformance on Multiple Fronts

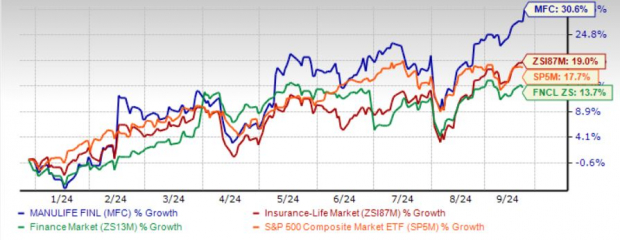

Shares of MFC have surged by 30.6% year to date, outpacing not only the industry’s 19% increase but also the Finance sector’s rise of 13.7% and the S&P 500 composite’s growth rate of 17.7%. These remarkable figures are a testament to Manulife’s stellar performance in the market.

The Foundation of Success: Return on Equity

Manulife’s impressive return on equity (ROE) of 16.2% for the trailing 12 months surpasses the industry average of 15.5%, underscoring the company’s efficient utilization of shareholders’ funds. With a projected ROE exceeding 18% by 2027, Manulife’s commitment to maximizing returns remains unwavering.

Optimistic Growth Prospects

Forecasts indicate a positive trajectory for MFC, with estimated earnings per share growth rates of 5.8% and 5.2% for 2024 and 2025, respectively. The long-term growth rate pegged at 10% underscores Manulife’s commitment to sustained prosperity, with a core earnings growth target of 10-12% over the medium term.

The Driving Forces Behind MFC’s Success

Manulife’s thriving Asia business stands as a cornerstone of its earnings success, driven by robust volume growth and lucrative margins in a rapidly evolving market. Moreover, strategic investments in high-return segments across North America showcase Manulife’s commitment to diversification and long-term value creation.

As the digital revolution sweeps through industries, MFC’s initiatives in digitalization and automation position the company for enhanced efficiency and profitability. By investing in cutting-edge technologies like GenAI and advanced analytics, Manulife is paving the way for a more streamlined and cost-effective operational landscape.

Challenges and Considerations

While MFC boasts a promising outlook, challenges persist, such as the impact of international operations on profitability due to foreign exchange exposure and hedging costs. Efforts to streamline operations and enhance leverage ratios are ongoing, highlighting the company’s commitment to addressing these challenges head-on.

Valuation and Investment Considerations

Currently trading at a price-to-earnings multiple of 10.23, higher than the industry average of 8.40, MFC’s premium valuation warrants caution for new investors seeking an entry point. While shares of other insurers like Sun Life Financial and Aflac Incorporated also command premiums, MFC’s growth potential remains an attractive proposition for investors.

Concluding Thoughts on MFC

Manulife Financial Corporation’s steadfast focus on growth, enhanced shareholder value, and expanding return on equity positions it as a resilient player in the market. While new investors may benefit from waiting for a more favorable entry point, current shareholders are advised to hold onto their positions, given the company’s promising growth trajectory and commitment to sustainable value creation.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.