MGP Ingredients Reports Q3 Results: Earnings Beat, Sales Decline

MGP Ingredients, Inc. MGPI announced its third-quarter results for 2024, where revenues matched the Zacks Consensus Estimate, while earnings exceeded expectations. Notably, both sales and earnings have decreased from the same period last year.

In response to declining trends in the American whiskey market and elevated barrel inventories, the company is adjusting its strategy. For 2025, MGP plans to reduce net aging whiskey stocks, decrease whiskey production, and optimize costs to tackle declining production volumes, which are projected to impact sales and profitability in its Distilling Solutions segment significantly.

Despite the challenges faced, investments in the brand portfolio are expected to enhance organic growth and improve the long-term competitive position in the brown goods sector. Strength in the Ingredient Solutions segment is also anticipated in 2025, despite current transitional challenges.

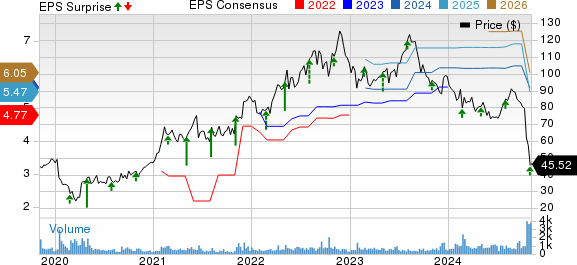

MGP Ingredients, Inc. Price, Consensus, and EPS Surprise

MGP Ingredients, Inc. price-consensus-eps-surprise-chart | MGP Ingredients, Inc. Quote

Quarterly Highlights for MGP Ingredients

In this quarter, MGPI reported adjusted earnings of $1.29 per share, surpassing the Zacks Consensus Estimate of $1.27, although it represents a decrease from $1.34 in the same quarter last year.

Check the latest EPS estimates and surprises on Zacks Earnings Calendar.

Total sales reached $161.5 million, down 23.7% from the prior year. When excluding the Atchison distillery’s impact, total sales declined 14%, reflecting decreased revenue across all three operating segments.

The gross profit amounted to $65.8 million, a decrease of 10.4% year over year. However, the adjusted gross margin rose 30 basis points (bps) to 40.8%, mainly due to robust margin growth in the Branded Spirits segment.

Advertising and promotion expenditures increased by 1.5% to $9.6 million, while corporate selling, general, and administrative (SG&A) expenses decreased by 20.2% to $17.2 million.

Adjusted EBITDA was reported at $45.7 million, down 8.8%, but the adjusted EBITDA margin improved by 460 bps to 28.3% year over year.

Segment Performance Overview

In the Distilling Solutions segment, sales plummeted by 36% year over year to $71.9 million. Excluding the Atchison distillery’s impact, sales in this segment fell by 18%, primarily affected by a 22% drop in brown goods sales, which included declines in both aged and new distillates. Gross profit in this segment decreased 14% to $28.6 million.

Meanwhile, the Branded Spirits segment experienced a 6% drop in sales, totaling $62.6 million, linked to declines in the mid and value-priced portfolio. However, premium sales increased by 1% as the company undertook targeted initiatives in the American whiskey and tequila markets. Gross profit for this segment increased by 12% to $32.4 million.

The Ingredient Solutions segment saw a decrease of 18% in sales, reaching $26.9 million, primarily due to foreign currency fluctuations impacting specialty protein sales, combined with reduced sales volumes of commodity wheat starches amid tough domestic competition.

Gross profit in this segment saw a significant drop, down 57.5% to $4.7 million. When excluding the effects related to the Atchison distillery, gross profit in this segment reduced to $4.7 million from $9.4 million in the third quarter of 2023.

Image Source: Zacks Investment Research

Financial Overview of MGP Ingredients

At the end of the reported quarter, MGP had cash and cash equivalents of $20.8 million, long-term debt (excluding current maturities) of $87.8 million, and total equity amounting to $912.9 million.

Looking Ahead: MGP’s 2024 Forecast

The company anticipates 2024 sales to fall between $695 million and $705 million following the closure of the Atchison distillery in December 2023, compared to total sales of $836.5 million in 2023. Adjusted EBITDA is expected to range from $196 million to $200 million, which includes share-based compensation expenses.

MGPI projects adjusted earnings between $5.55 and $5.65 per share, down from adjusted earnings of $5.90 per share in 2023. Total capital expenditures are estimated at $78 million for the full year.

Over the last three months, MGPI’s stock has decreased by 44.8%, while the overall industry has seen a slight decline of 0.5%.

Stock Recommendations

We highlight three higher-ranked stocks in the broader consumer staples sector: BRF Brasil Foods SA BRFS, Vital Farms Inc. VITL, and Ingredion Incorporated INGR.

BRF Brasil Foods, previously known as Perdigao S.A., is a food company from Brazil, currently holding a Zacks Rank #1 (Strong Buy). The company has exhibited a trailing four-quarter average earnings surprise of 73.8%. The Zacks Consensus Estimate predicts a growth of 256.7% and 14.7% for current financial-year earnings and sales, respectively, compared to the previous year.

Vital Farms specializes in pasture-raised food products and also carries a Zacks Rank of 1. The earnings and sales estimates for the current financial year indicate growth of 88.1% and 27%, respectively, compared to last year. VITL has a trailing four-quarter earnings surprise of 82.5%.

Ingredion is an ingredients solutions provider known for nature-based sweeteners, starches, and nutritional ingredients, currently rated as Zacks Rank #2 (Buy). INGR shows a trailing four-quarter average earnings surprise of 11%, with earnings growth projected at 6.7% from the previous year.

Exclusive Stock Recommendation Featured

Zacks Investment Research offers insights from five experts who have chosen a standout stock, expected to experience significant growth in the coming months. This company is catering to millennial and Gen Z demographics, achieving nearly $1 billion in revenue last quarter. With the recent drop in share price, now is seen as an optimal time to invest.

Of course, while not every pick outperforms, past recommendations like Nano-X Imaging, which increased by 129.6% in just nine months, affirm confidence in their strategy.

Free Stock Analysis Reports:

BRF S.A. (BRFS): Free Stock Analysis Report

Ingredion Incorporated (INGR): Free Stock Analysis Report

MGP Ingredients, Inc. (MGPI): Free Stock Analysis Report

Vital Farms, Inc. (VITL): Free Stock Analysis Report

For more on this article, visit Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.