Micron Technology Faces Short-Term Struggles but Long-Term Prospects Shine Bright

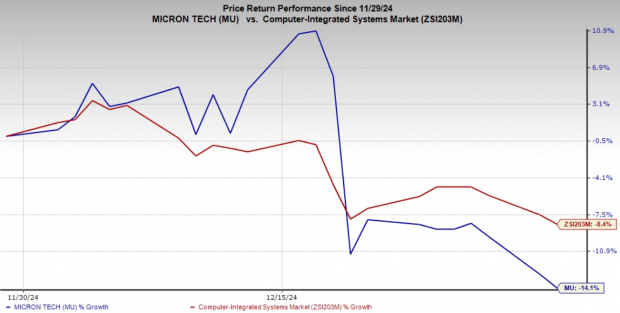

Micron Technology, Inc. MU experienced a tough end to 2024, witnessing a 14.1% drop in its stock during December alone. This steep decline was primarily driven by second-quarter fiscal 2025 projections that did not meet Wall Street’s expectations.

Image Source: Zacks Investment Research

Micron anticipates revenues of $7.9 billion (+/- $200 million) and earnings per share (EPS) of $1.23 (+/- 10 cents). These figures are well below analyst predictions of $8.96 billion and $1.95, respectively. This disappointing outlook has overshadowed the company’s strong first-quarter results, where it saw an 84.3% year-over-year revenue increase and a net income jump of $2.04 billion, recovering from a prior year loss of $1.05 billion.

Since the earnings announcement on Dec. 18, which hinted at challenges in the upcoming quarter, the stock has slipped 15.5%, closing at $89.87 on Jan. 3, 2025. As it hovers near its 52-week low of $79.15, investors are left questioning whether now is the right time to buy the dip or wait for more clarity.

Micron’s Long-Term Growth Potential

Although the near-term guidance lacks enthusiasm, Micron’s long-term outlook is strong. If the company meets its second-quarter goals, it would still indicate a remarkable 36% revenue growth year-over-year and a substantial increase in earnings. Micron’s strong foothold in the memory and storage chip market—integral for artificial intelligence (AI) operations—positions it to benefit from anticipated rises in AI-related spending in the years ahead.

Image Source: Zacks Investment Research

As AI applications expand, the demand for Micron’s high-bandwidth memory (HBM) and dynamic random-access memory (DRAM) is expected to grow, largely due to new graphics processing units (GPUs) from Nvidia Corporation NVDA and Advanced Micro Devices AMD.

Micron has collaborated with Advanced Micro Devices to deliver chipset and logic solutions, including memory and storage components. Additionally, through its partnership with NVIDIA, Micron supplies memory for NVIDIA’s AI chips, specifically its HBM chips used in GPUs.

Working alongside partners like Cadence Design Systems, Inc. CDNS and Synopsys further enhances Micron’s market position. By collaborating with these companies, Micron ensures its memory verification IP (Internet Protocol) remains effective.

Favorable Industry Trends for Micron

Micron stands at the forefront of the semiconductor industry by capitalizing on high-demand areas like AI, automotive, and industrial IoT. The surge in AI applications has led to a heightened need for advanced memory solutions such as DRAM and NAND. Micron’s investments in innovative DRAM and 3D NAND technologies solidify its competitive edge and readiness for these trends.

Notably, Micron’s diversification strategy helps mitigate risks. By reducing its dependence on consumer electronics—often vulnerable to market fluctuations—and concentrating on more stable sectors like automotive and data centers, the company positions itself to handle revenue volatility more effectively.

Micron Stock Seen as an Undervalued Opportunity

Currently, Micron’s forward 12-month price-to-earnings (P/E) ratio stands at 10.85, close to its lowest in a year and considerably lower than the Zacks Computer-Integrated Systems industry average of 18.88. Likewise, its forward 12-month price-to-sales ratio of 2.56 compares favorably against the industry rate of 3.15. This valuation gap provides a noteworthy opportunity for investors as Micron’s revenue and profitability metrics point to ongoing growth.

Image Source: Zacks Investment Research

Ongoing Risks for Micron

Despite its strengths, Micron faces several near-term challenges that could impact its growth trajectory. A significant concern is the potential for oversupply in the HBM sector. As these chips play a crucial role in Micron’s revenue, any mismatch between supply and demand might lead to falling average selling prices (ASPs), directly affecting profits as competition grows.

Another risk is Micron’s reliance on AI-driven demand. While the ongoing AI boom presents unique growth opportunities, any deceleration in adoption or shifts in technology trends could adversely affect the demand for its memory products.

Conclusion: A Hold on MU Stock for Now

The downturn in Micron’s stock in December reflects temporary challenges, yet its long-term growth narrative remains appealing. With a solid position in AI and data center markets, strong recovery potential, and attractive valuations, holding onto Micron stock seems to be the most prudent course for investors navigating short-term uncertainties. Currently, Micron is rated as Zacks Rank #3 (Hold).

Zacks’ Research Chief Identifies “Stock Most Likely to Double”

Our expert team has just revealed five stocks with the highest potential for gaining over 100% in the coming months. Among these, Sheraz Mian, our Director of Research, specifically highlights a single stock that is forecasted to see the largest increase.

This top pick comes from one of the most innovative financial firms, boasting a rapidly growing customer base of over 50 million and a diverse array of advanced solutions poised for substantial growth. While not every elite stock is guaranteed success, this one could significantly outpace earlier Zacks success stories like Nano-X Imaging, which soared by +129.6% in just over nine months.

Free: Discover Our Top Stock and Four Other Contenders.

Interested in the latest recommendations from Zacks Investment Research? Download the 7 Best Stocks for the Next 30 Days for free.

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

Micron Technology, Inc. (MU): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.