Micron Technology: Evaluating Potential Amid Market Dynamics

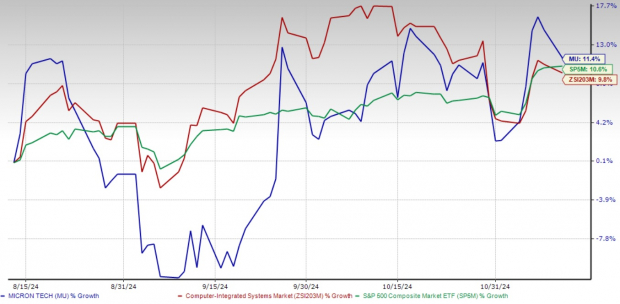

Micron Technology, Inc. (MU) has demonstrated remarkable resilience in the semiconductor industry despite challenging market conditions. The Boise, ID-based memory chip manufacturer has seen an 11.4% rise in stock price over the last three months, surpassing gains of 9.8% in the Zacks Computer – Integrated System industry and 10.6% in the S&P 500. This strong performance raises questions for investors about whether now is the right time to buy, sell, or hold Micron shares.

Recent Stock Performance Analysis

Image Source: Zacks Investment Research

Key Trends Favor Micron’s Growth

Micron is well-positioned to capitalize on key trends in memory and storage solutions, particularly DRAM and NAND. The increasing demand for high-performance memory, driven by artificial intelligence (AI) applications, benefits the company’s cutting-edge DRAM and 3D NAND technologies. These investments strengthen Micron’s competitive advantage and hint at a promising profitability outlook moving forward.

Additionally, Micron’s expansion into high-growth areas such as automotive, industrial IoT, and data centers supports its diversification strategy. By reducing reliance on consumer electronics—often subject to volatile demand—Micron aims to maintain more stable revenue streams and ensure a vital role in the evolving semiconductor landscape.

Strong Product Portfolio and Strategic Collaborations

Micron’s extensive product range, covering DRAM and NAND chips for PCs, servers, and mobile devices, reinforces its market position and enables successful engagements with key customers. Currently, its GDDR7 graphics memory is being tested by Advanced Micro Devices (AMD) and Cadence Design Systems (CDNS). AMD plans to leverage this memory for enhanced gaming performance, while Cadence tests it for its GDDR7 PHY IP—illustrating Micron’s relevance in cutting-edge technology.

Moreover, Micron’s high-bandwidth memory (HBM3E) is set to power NVIDIA (NVDA) upcoming AI chip, the H200, which aims to succeed the popular H100 chip. With substantial orders already secured and a sold-out HBM supply for 2024, these partnerships emphasize Micron’s critical role in the tech ecosystem and its potential for future growth.

Financial Resilience and Promising Growth Prospects

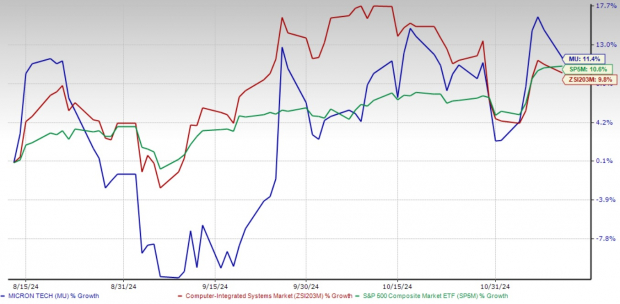

Micron has made a strong financial comeback after experiencing significant hurdles in late 2022 and early 2023. Over the past four quarters, the company has consistently outperformed the Zacks Consensus Estimate for earnings, boasting an average surprise of 72.7%. This recovery not only highlights Micron’s adaptability but also outlines its ability to grow despite challenges.

Performance Metrics: Price Trends and Earnings Surprises

Micron Technology, Inc. price-consensus-eps-surprise-chart | Micron Technology, Inc. Quote

Looking ahead to fiscal years 2025 and 2026, the outlook remains positive. Micron’s substantial investments in memory technologies, coupled with a focus on expanding into high-growth markets, provide a robust foundation for sustained long-term performance.

Image Source: Zacks Investment Research

Potential Challenges Ahead for Micron

Despite the encouraging outlook, Micron faces daunting challenges that may affect its progress. A primary concern is the risk of oversupply in the high-bandwidth memory (HBM) segment, crucial for the company’s revenues amid high demand driven by AI and data center needs. Fiscal 2024 saw substantial contributions from HBM, and the expectation is billions in revenues from this segment in 2025.

However, should an oversupply of HBM chips occur, average selling prices (ASPs) could decline, impacting profit margins significantly. Given that Micron’s growth is heavily reliant on supportive AI-driven memory demand, a drop in ASPs could disrupt future earnings and introduce uncertainty into growth projections.

Conclusion: A Cautious Approach Toward MU Stock

Micron’s favorable market presence, extensive product lineup, and strategic partnerships underscore its considerable growth potential. Nevertheless, short-term risks, particularly concerning the potential for HBM oversupply and pricing pressures, warrant careful consideration.

Balancing its robust fundamentals against these potential challenges suggests that maintaining a hold on Micron stock is a prudent decision for the moment. As market conditions evolve, investors should keep a close eye on developments within the memory sector, ready to reassess their positions on this Zacks Rank #3 (Hold) stock.

Top 5 Stocks with Doubling Potential

Each of these stocks has been selected by a Zacks expert as having the potential to achieve +100% growth or more by 2024. While not every pick will succeed, previous recommendations have delivered remarkable gains, including +143.0%, +175.9%, +498.3%, and +673.0%.

Most stocks featured in this report are currently flying under Wall Street’s radar, offering an excellent opportunity to invest early.

Explore these 5 potential home runs >>

For the latest recommendations from Zacks Investment Research, download the report on 5 Stocks Set to Double today.

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.