Microsoft’s Stock Declines Despite Strong Earnings: The Challenge of Valuation

Microsoft’s (NASDAQ: MSFT) share prices dropped 6% right after its fiscal second-quarter earnings report on January 29. Even though the tech giant posted revenue and earnings that exceeded Wall Street forecasts, investors found it insufficient to justify pushing the share price to new heights.

Valuation Concerns Weigh on Investor Sentiment

The primary concern appears to be valuation. Over recent years, Microsoft has ramped up its capital expenditures to fuel its artificial intelligence (AI) initiatives. This surge in spending elevated the share price to a high price-to-earnings (P/E) ratio of 33, as investors anticipated strong growth. However, the company’s earnings have only grown by 10% year over year for the last three quarters, leading to investor frustration.

Investors may be losing patience as they await meaningful returns on these investments. The stock’s trajectory could remain disappointing as we head into 2025.

AI Investments Are Not Yet Paying Off

Microsoft is well-positioned to capitalize on enterprise interest in AI services. The company’s cloud revenue exceeded $40 billion, with a 21% year-over-year growth. Additionally, AI-related revenue has reached $13 billion on an annualized basis, marking a staggering 175% increase year over year.

Despite this impressive growth in AI revenue, it still barely moves the needle for a company with total revenues of $261 billion across all its products. Furthermore, the modest rise in AI revenue comes at a significant cost, evident in the slowdown of overall earnings growth.

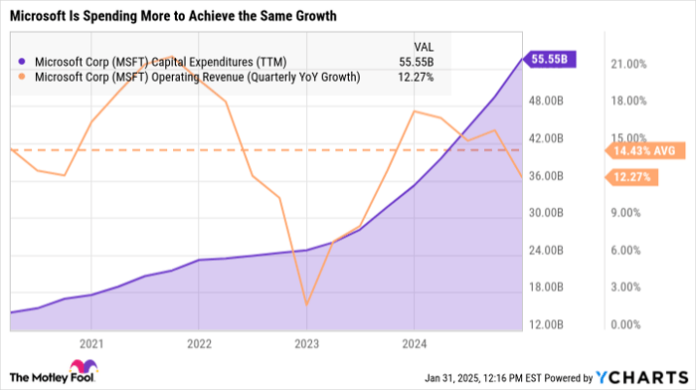

Data by YCharts.

Over the past three years, Microsoft has doubled its data center capacity. Capital expenditures were under $25 billion in calendar year 2022, but they have surged to $55 billion over the last 12 months.

Despite this increased spending, Microsoft’s year-over-year earnings growth has dipped from more than 20% a year ago to just 10%. This slowdown in growth occurs even as the stock commands a higher P/E ratio. Analysts predict earnings to increase at an annualized rate of 13%, which may not suffice to support the stock’s valuation of 33.

Risks of Overvaluation Persist

While Microsoft is investing heavily to meet AI and cloud services demand, this does not automatically make the stock a viable buy. Other tech companies are also investing in AI but are achieving higher earnings growth.

For instance, Meta Platforms experienced a Q4 earnings growth of 50% year-over-year, with analysts projecting a 17% annual growth rate for the coming years. Meta’s stock trades at 29 times earnings, slightly cheaper than Microsoft’s valuation.

Although demand for AI remains robust, it has yet to significantly boost Microsoft’s overall growth rate. Without a boost in either revenue or earnings growth, investors may not see the stock reach new highs soon. There may even be further declines if the stock corrects to a lower P/E ratio.

Is Now the Right Time to Invest $1,000 in Microsoft?

Before making an investment in Microsoft, some considerations are worth noting:

The Motley Fool Stock Advisor analyst team has identified their top 10 best stocks to invest in now, and Microsoft is notably absent from this list. These selected stocks are believed to offer significant returns in the foreseeable future.

Reflect back to April 15, 2005, when Nvidia was recommended… if you invested $1,000 at that time, it would be worth $714,954 today!*

Stock Advisor equips investors with a streamlined plan for success, which includes portfolio-building guidance, regular updates from analysts, and two new stock picks each month. Since 2002, the Stock Advisor service has more than quadrupled the returns of the S&P 500.*

Learn more »

*Stock Advisor returns as of February 3, 2025

Randi Zuckerberg, a former director at Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board. John Ballard has no positions in any of the stocks mentioned. The Motley Fool has positions in and recommends both Meta Platforms and Microsoft. They also recommend long January 2026 $395 calls and short January 2026 $405 calls on Microsoft. For more details, please see The Motley Fool’s disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.