“`html

Microsoft Delivers Strong Q1 Earnings, Fueled by Cloud and Gaming Revenue Growth

Microsoft MSFT posted first-quarter fiscal 2025 earnings of $3.3 per share, exceeding the Zacks Consensus Estimate by 10.4% and marking a 16% year-over-year increase.

Overall revenues reached $65.58 billion, climbing 16% compared to the previous year and surpassing the Zacks Consensus Estimate by 1.82%. When adjusted for constant currency, revenues also saw a 16% growth year over year.

In the commercial sector, increased demand, paired with long-term commitments to Microsoft’s Cloud platform, contributed significantly to these results.

Commercial bookings exceeded expectations, rising 30% (23% in constant currency). This growth was attributed to strong performance in core sales and a rise in the number of contracts exceeding ten million dollars for both Azure and Microsoft 365 (M365). Additionally, there was an increase in the number of contracts valued at over one hundred million dollars for Azure.

The commercial remaining performance obligation climbed 22% (21% in constant currency) to reach $259 billion, with about 40% expected to be recognized in the next year, reflecting a 17% increase year over year. The remaining obligations set to be recognized beyond a year increased by 27%. During this quarter, 98% of sales were from annuity contracts.

Microsoft also benefited from recognizing revenue during the period from its Microsoft 365 commercial, Azure, and on-premises server businesses.

The impact of foreign exchange was negligible on the fiscal first-quarter results, aligning with expectations across total revenues, segment revenues, costs of goods sold, and operating expenses.

Microsoft Cloud revenues totaled $38.9 billion, a notable 22% increase, which aligned well with expectations.

Microsoft Corporation Price, Consensus and EPS Surprise

Microsoft Corporation price-consensus-eps-surprise-chart | Microsoft Corporation Quote

Segment Breakdown

The Productivity & Business Processes segment, which encompasses Office and Dynamics CRM, accounted for 43.2% of total revenues. This segment saw revenues grow by 12% (up 13% in constant currency) to $28.3 billion, surpassing expectations due to strong performance across all business areas.

Microsoft 365 Commercial products and cloud services saw a revenue increase of 13% (up 14% in constant currency). The M365 commercial cloud revenues grew by 15% (up 16% in constant currency), reflecting positive business trends. The exceptional results were partially attributed to an earlier recognition of in-period revenue.

ARPU growth primarily arose from increased uptake of E5 and M365 Copilot. Microsoft reported an 8% increase year over year in paid M365 commercial seats, driven largely by expansion in small and medium business offerings.

Significantly, M365 commercial cloud revenues represented almost 90% of overall M365 commercial products and services.

Revenues from M365 commercial products rose by 2% (3% in constant currency), also benefiting from in-period revenue recognition.

Consumer-focused M365 products generated a 5% revenue increase (6% in constant currency), with an uptick of 10% in consumer subscriptions, bringing the total to 84.4 million. These consumer cloud revenues made up 85% of total M365 consumer offerings.

LinkedIn revenues increased by 10% (up 9% in constant currency), slightly outpacing expectations, with growth noted across all business divisions.

Segment gross margin dollars increased 11% (12% in constant currency), although the gross margin percentage dipped due to the scaling of AI infrastructure. Operating expenses grew by 2%, while operating income increased by 16%.

The Intelligent Cloud segment, which includes server and enterprise products and services, contributed 36.7% of total revenues. This segment achieved revenues of $24.1 billion, marking a 20% increase year over year (21% in constant currency).

Server products and cloud services grew by 23%, attributed to a 33% spike in Azure and other cloud services (34% in constant currency). Healthy consumption trends closely matched expectations, with results benefiting from earlier revenue recognition.

AI services accounted for approximately 12 points growth in Azure, maintaining similar trends from the previous quarter. Demand continues to exceed Microsoft’s available capacity, and non-AI growth trends remained stable as customers transition to the Azure platform, although the non-AI contribution saw a minor sequential decline.

Revenue from the on-premises server business dipped by 1%, influenced by decreased purchasing ahead of the Windows Server 2025 launch. This was slightly offset by the benefits associated with earlier revenue recognition.

Further, revenues from enterprise and partner services were steady, with an unchanged outlook in constant currency.

Gross margin dollars in this segment rose by 15%, while gross margin percentage fell by 3 points, attributed to infrastructure scaling. Operating expenses surged by 8%, with operating income increasing by 18%.

The More Personal Computing segment, primarily comprising Windows, Gaming, Devices, and Search, accounted for 20.1% of overall revenues. Revenues increased 15% year over year, reaching $13.18 billion, which included a 15-point boost from the Activision acquisition.

Revenues from Windows OEM and Devices rose by 2% annually, with Windows OEM performing better than expected against a backdrop of a shift towards higher monetizing markets. Conversely, the Devices category faced some challenges within the commercial segment.

Search and news advertising revenue, excluding TAC, climbed by 18% (19% in constant currency), outperforming expectations due to ongoing improvements in execution. Rate expansion and healthy volumes were recorded in both Edge and Bing.

Gaming revenues surged by 43% (44% in constant currency), largely driven by the Activision acquisition, which contributed 43 points. Performance exceeded expectations, driven by robust uptake of both first- and third-party content as well as consoles. Xbox content and services revenues soared by 61%, with a significant impact from Activision.

Overall segment gross margin dollars grew 16%, with a similar proportional growth in constant currency, while gross margin percentage remained stable year over year. Strong performance in Gaming and Search offset slower growth in less profitable sectors.

At a broader company level, Activision’s impact on revenue growth accounted for over 3 points, although it resulted in a 2-point reduction in operating income growth and negatively impacted earnings per share by 5 cents. These effects include adjustments from transitioning Activision content to first-party from third-party and accounted for $911 million from purchase accounting, integration, and related costs.

Operating expenses increased by 49% largely driven by the Activision acquisition, with 51 points reflecting this change. Operating income…

“““html

Microsoft’s Financial Growth Fueled by Azure and AI Innovation

Microsoft’s Q1 finances showcase a significant 4% decrease.

Azure Drives Strong Fiscal Q1 Results

Azure Arc has now attracted over 39,000 customers spanning all industries, including American Tower, CTT, and L’Oreal, marking an impressive year-over-year growth of more than 80%.

Operating data centers in more than 60 regions globally, Microsoft has announced new investments in cloud and AI infrastructure for Brazil, Italy, Mexico, and Sweden. This expansion aligns with anticipated long-term demand.

In the silicon sector, the new Cobalt 100 virtual machines (VMs) are proving effective for companies such as Databricks, Elastic, Siemens, Snowflake, and Synopsys, providing up to 50% better price performance than older models.

Additionally, Microsoft is developing advanced AI infrastructure, innovating across the stack to enhance performance for AI workloads. Offering a wide range of AI accelerators, Microsoft includes the Maia 100 and the latest GPUs from AMD and NVIDIA.

Notably, Microsoft has become the first cloud provider to utilize NVIDIA’s NVDA Blackwell system, integrating GB200 AI servers into its operations.

Its collaboration with OpenAI continues to yield benefits. This partnership is not only creating unique intellectual property but also driving revenue growth. With Azure AI, Microsoft is building a comprehensive app platform that enables customers to create their own copilots and agents.

Usage of Azure OpenAI has more than doubled in the last six months. Digital natives like Grammarly and Harvey and seasoned companies like Bajaj Finance, Hitachi, KT, and LG are transitioning their applications from testing to full production.

A significant case is GE Aerospace, which used Azure OpenAI to develop a digital assistant for its workforce of 52,000 employees. In three months, the assistant facilitated over 500,000 internal inquiries and managed more than 200,000 documents.

During the first quarter, Microsoft added support for OpenAI’s latest model family. Additionally, industry-specific models, particularly for medical imaging, are being tailored for Azure AI.

With GitHub Models, Microsoft now enables direct access to a full catalog of models within the GitHub developer workflow.

As new AI applications emerge on Azure, Microsoft has noted a surge in the use of Azure Cosmos DB and Azure SQL DB Hyperscale. Customers like Air India, Novo Nordisk, Telefonica, Toyota Motor North America, and Uniper are leveraging these capabilities designed specifically for AI applications.

With Microsoft Fabric, the company offers a unified AI-driven platform, aiding clients like Chanel, EY, KPMG, Swiss Air, and Syndigo in organizing their data across various clouds. Currently, Microsoft counts over 16,000 paid Fabric customers, including more than 70% of the Fortune 500.

Surge in Microsoft AI Copilot Usage in Q1

GitHub Copilot is enhancing productivity among developers. This past quarter, the number of Copilot Enterprise customers grew by 55% sequentially, with companies like AMD and Flutter Entertainment customizing Copilot for their specific codebases.

Microsoft is pushing forward the next stage of AI code generation, making GitHub Copilot an integral part of the developer workflow. GitHub Copilot Workspace allows developers to transition from specifications to planning and coding in natural language.

Copilot Autofix, an AI agent, helps developers at firms such as Asurion and Otto Group resolve coding vulnerabilities more than three times faster than their individual efforts.

Further expanding GitHub’s open platform ethos, Microsoft continues to make more models accessible through GitHub Copilot.

Aiming to reach new developer communities, Microsoft introduced GitHub Spark, which empowers users to create applications using natural language.

Generative AI has also been integrated into Power Platform, facilitating cost cuts and faster development through low-code/no-code tools. Almost 600,000 organizations have utilized AI features in Power Platform, reflecting a fourfold increase year over year.

Citizen developers at ZF exemplify this trend, creating applications simply by articulating their needs in natural language.

Microsoft also launched new features to enhance AI-driven workflows in Power Automate during the first fiscal quarter.

Last month, the latest wave of Microsoft 365 Copilot innovations was introduced, combining web, work, and Pages into a new design system aimed at optimizing productivity for knowledge workers. The Pages feature, crafted for the AI era, assists users in ideation and collaboration. Additionally, Microsoft 365 Copilot has doubled in response speed and enhanced response quality nearly threefold, leading to a surge in daily usage.

Many industries are witnessing increased adoption of Microsoft 365 Copilot, which is delivering tangible business benefits. For instance, Vodafone VOD is set to implement Microsoft 365 Copilot for 68,000 employees after a trial revealed an average time savings of three hours per employee per week. Similarly, UBS UBS plans to deploy 50,000 seats in what is Microsoft’s largest financial services deal to date.

Enterprise customers are consistently returning for additional seat purchases. Presently, nearly 70% of the Fortune 500 are utilizing Microsoft 365 Copilot, with adoption rates surpassing those of any other new suite within Microsoft 365.

The Copilot serves as the user interface for AI, supporting an end-to-end system for business transformation. Through Copilot Studio, organizations can connect Microsoft 365 Copilot to autonomous agents, enabling efficient delegation for exceptions.

Over 100,000 organizations, like Nsure, Standard Bank, Thomson Reuters, Virgin Money, and Zurich Insurance, have engaged with Copilot Studio to date, achieving a growth of over 2X quarter over quarter.

Microsoft is witnessing a transformative shift in the business applications market as clients transition from legacy applications to AI-first processes. Dynamics 365 is gaining market share as organizations such as Everon, HEINEKEN, and Lexmark opt for these applications over competitors.

Monthly active users within the Copilot across CRM and ERP portfolios soared more than 60% from the previous quarter.

Dynamics 365 Contact Center is attracting customers like Currys, Le Creuset, and RXO, integrating generative AI across customer engagement channels.

Microsoft Teams continues to receive high usage, with nearly 75% of enterprise customers opting for Premium, Phone, or Rooms features.

The latest generation of Copilot+ PCs is gaining traction, now supported by AMD, Intel, and Qualcomm.

Operating Results

Gross profit increased by 13.1% year over year to $45.48 billion. However, the gross margin declined by 180 basis points (bps) to 69.4% compared to last year. This decrease reflects a reduction in the gross margin for Microsoft Cloud, along with the financial impacts of purchase accounting adjustments and costs associated with the integration from the Activision acquisition.

Microsoft Cloud’s growth is indicative of its ongoing success amid a rapidly changing market landscape.

“`

Microsoft Reports Mixed Financial Results Amid AI Investments

Gross Margin and Operating Expenses

Microsoft’s gross margin percentage slipped 2 points year-over-year to 71%. This decline was slightly better than anticipated, thanks in part to improvements in Azure. Nonetheless, the decrease is part of the ongoing efforts to expand Microsoft’s AI infrastructure.

Operating expenses increased by 12.1% year-over-year, reaching $14.9 billion. This growth was lower than expected, thanks to a focus on cost efficiencies and prioritization efforts. Notably, 9 points of this expense growth came from the Activision acquisition.

Microsoft’s operating income rose by 14%. The operating margins were reported at 47%, a decrease of 1 point from the previous year. However, when excluding the impact of the Activision acquisition, operating margins actually increased by 1 point. This positive trend is supported by enhanced operational efficiencies fueled by investments in AI.

Operating income in the Productivity & Business Process segment rose 15.5% to $16.51 billion, while Intelligent Cloud operating income increased 17.9% to $10.5 billion. In contrast, More Personal Computing saw a decline in operating income, which fell 4.3% to $3.53 billion.

Financial Position and Cash Flow

As of September 30, 2024, Microsoft held a total of $78.42 billion in cash, cash equivalents, and short-term investments, up from $75.54 billion on June 30, 2024. On the liabilities side, long-term debt—including the current portion—stood at $42.86 billion, a decrease from $44.9 billion previously.

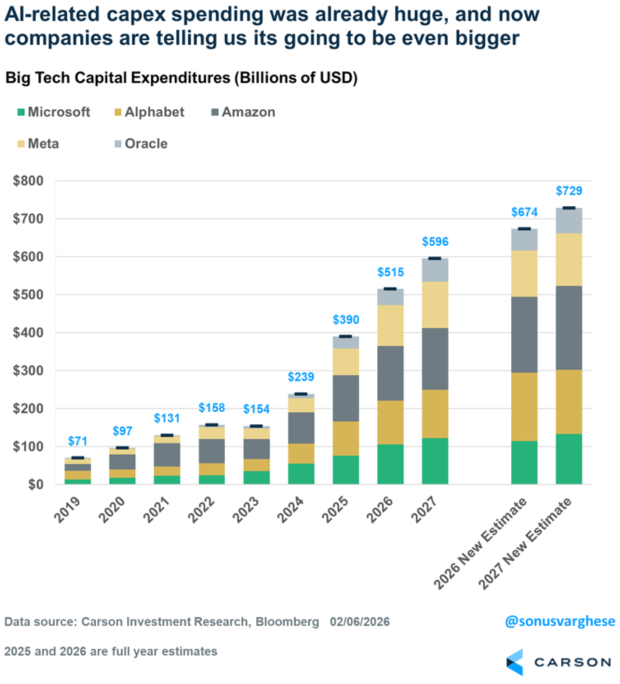

Cash flow from operations amounted to $34.2 billion, reflecting a 12% increase driven by solid cloud billings and collections. However, this was partly offset by higher payments to suppliers, employees, and on taxes. Free cash flow fell by 7% year-over-year to $19.3 billion, attributed to increased capital expenditures aimed at bolstering the cloud and AI divisions.

During the first quarter of fiscal year 2025, Microsoft returned $9 billion to shareholders in dividends and share repurchases.

Future Outlook

For the fiscal second quarter, Microsoft projects revenue costs between $21.9 billion and $22.1 billion, with operating expenses expected to rise to between $16.4 billion and $16.5 billion. Other income and expenses are anticipated to approximate $(1.5) billion.

In the Productivity and Business Processes segment, revenue growth is expected to fall between $28.7 billion and $29 billion. Microsoft anticipates a roughly 14% growth in Office 365 Commercial revenue at constant currency, although revenue from Office Commercial products is projected to decline in the low single digits.

In Office consumer products and cloud services, mid-single-digit growth is expected. LinkedIn’s revenue growth is projected at nearly 10%, while Dynamics should see mid-to-high teen growth rates.

For the Intelligent Cloud segment, revenues are expected between $25.55 billion and $25.85 billion. In Azure, Microsoft projects growth in revenue at constant currency between 31% and 32%. Revenues from Enterprise Services are expected to grow in low single digits, while Server product revenues are anticipated to decline in the low-to-mid single digits.

For More Personal Computing, the company forecasts revenue between $13.85 billion and $14.25 billion, with Windows OEM revenues growing in low to mid single digits. Meanwhile, in the Gaming sector, Microsoft expects revenues to drop in high single digits and anticipates that Xbox content and services revenue will remain flat year-over-year.

Top Stock Picks for 2024

Zacks Investment Research has identified 5 stocks that experts suggest could potentially double in value over the next year. With historical recommendations yielding as much as +673.0%, these selections may be worth considering for investors looking for growth opportunities.

Discover these stocks that are flying under Wall Street’s radar and get a chance to invest early.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Vodafone Group PLC (VOD): Free Stock Analysis Report

UBS Group AG (UBS): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

For more details on this article and stock recommendations from Zacks.com, click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.