Microsoft Faces Challenges Despite AI Boosts

Artificial intelligence (AI) has revived interest in many businesses, empowering tech companies to improve their products and discover new growth avenues. Investors are eager to invest in stocks that capitalize on these trends, and tech leader Microsoft (NASDAQ: MSFT) stands out in this regard.

Recently, Microsoft’s growth has surged due to its AI-enhanced offerings, leading to stronger sales and profits. The company now boasts a market cap of $3.1 trillion, suggesting that its investments in AI are currently paying off.

However, a closer look at its latest earnings report reveals a concerning trend that investors should monitor. If this pattern persists, it may spell trouble for the tech giant’s stock in the near future.

Profit Growth Slowing

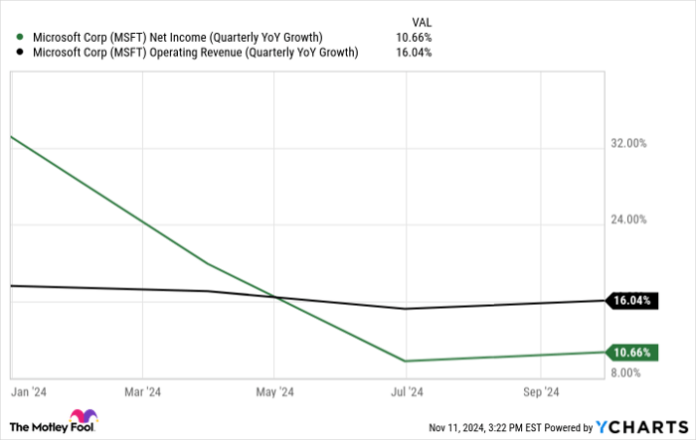

Many companies in the AI sector face the challenge of high spending to expand their AI initiatives, which can cloud their financial outcomes. For Microsoft’s most recent quarter, ending on September 30, profit growth was about 11%. This is slower than previous periods and lags behind the company’s revenue growth.

MSFT net income (quarterly YoY growth), data by YCharts; YOY = year over year.

There are hints that Microsoft’s AI performance might not meet expectations. Salesforce CEO Marc Benioff even likened Microsoft’s AI tool Copilot to the infamous Clippy assistant from the 1990s, known more for interference than assistance.

A recent CNBC survey noted that nearly half of the companies using Copilot are uncertain about expanding its use or are still in the testing phase. This suggests that Copilot may not have been the game-changing product many hoped for.

Potential Valuation Risks

At present, Microsoft’s stock trades at about 35 times its trailing earnings. This figure appears reasonable compared to the average in the Technology Select Sector SPDR Fund, which is nearly 42 times. Nonetheless, inflated valuations of tech stocks due to strong earnings this year raise concerns about a potential market correction should growth stall. Microsoft could be impacted by this trend.

Research firm Gartner has warned that many companies might abandon unproven AI projects, predicting that 30% of generative AI initiatives could be discarded by next year. As a potential recession looms and businesses reevaluate expenditures, investments in AI may become easy targets for cuts.

This could create significant challenges for Microsoft moving forward, potentially leading to a further decline in earnings growth. Investor sentiment appears cautious, as evidenced by Microsoft’s year-to-date gains of only 11%—a stark contrast to the strong 26% rise of the S&P 500 this year.

Is Microsoft a Smart Buy?

For those considering a long-term investment, Microsoft still presents a robust option. The company’s diverse segments, including gaming and cloud services, position it well for continued growth beyond AI ventures.

Nonetheless, given its current high valuation and the accompanying growth expectations, potential buyers should be ready for a possible market correction soon. The stock lacks significant margin for safety at this time.

Don’t Miss This Second Chance at a Potentially Lucrative Opportunity

Have you ever felt like you missed out on investing in top-performing stocks? If so, you might be interested in this.

Occasionally, our expert analysts recommend a “Double Down” stock—companies they believe are on the verge of significant growth. If you thought you’d missed your chance to invest, now could be the ideal time before it’s too late. Here are some numbers to consider:

- Amazon: If you invested $1,000 when we doubled down in 2010, you’d have $23,529!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $42,465!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $441,949!*

Currently, we are issuing “Double Down” alerts for three remarkable companies—opportunities that may not arise again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 11, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.