Midstream Firms Shielded Amid Energy Sector Turbulence

With escalating tensions between Iran and Israel sending shockwaves through the oil-energy sector, investors are turning to companies with stable revenue streams. Midstream energy giants like The Williams Companies Inc., Kinder Morgan Inc., EOG Resources Inc., and ConocoPhillips remain resilient due to their long-term take-or-pay contracts, insulating them from market volatility and geopolitical uncertainty.

Upswing for Upstream Energy Players with Oil Price Surge

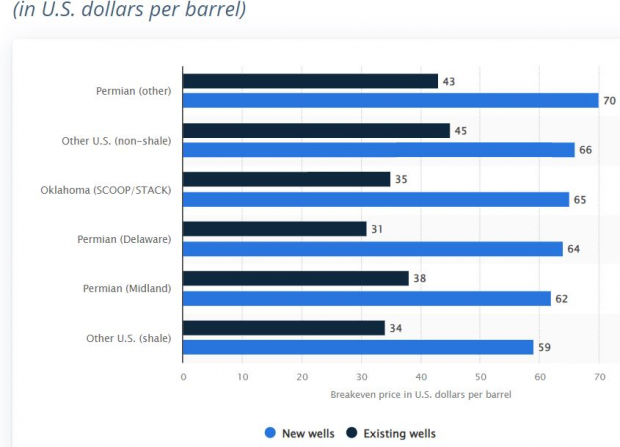

The current uptick in West Texas Intermediate (WTI) crude prices over $70 per barrel is a welcome sight for upstream energy companies. While drilling activities have scaled back, the robust pricing environment ensures profitability for U.S. oil and gas producers. Companies like EOG Resources and ConocoPhillips stand to benefit, leveraging the favorable market conditions to capitalize on strong oil prices and substantial reserves.

Key Players to Watch: WMB, KMI, EOG, COP

WMB: Gas Transport Dominance

The Williams Companies leads natural gas transportation in the U.S., owning a vast network of pipelines crucial for the nation’s energy consumption. With a focus on renewables, WMB is poised for growth in response to the rising demand for clean energy.

KMI: Shaping Natural Gas Infrastructure

Kinder Morgan’s extensive pipeline network plays a critical role in transporting natural gas across North America. With a stable business model and substantial earnings, KMI remains a solid investment option amid market volatility.

EOG: Harnessing Oil Price Surge

EOG Resources positions itself as a leading explorer and producer of oil and gas in the U.S. with strategic reserves across premium resources. Leveraging the favorable oil pricing environment, EOG is geared for continued success in the energy market.

COP: Shale Potential Amidst Rising Oil Prices

ConocoPhillips boasts a strong presence in oil and gas resources globally, particularly in the lucrative Eagle Ford, Bakken, and Permian shale plays. With a focus on shale reserves, COP is well-equipped to ride the wave of escalating oil prices and secure profitable returns.

Insider Tips for Savvy Investors

Amidst market uncertainty, a strategic eye on midstream and upstream energy players could yield significant returns. With a Zacks Rank #3 (Hold), these stocks present promising opportunities for growth in the volatile energy sector landscape.

Investors seeking to capitalize on the energy market upheaval should keep a close watch on companies like WMB, KMI, EOG, and COP, as they navigate the challenges posed by Middle East tensions and leverage the favorable market conditions for sustained profitability.