Utilities and Consumer Products Struggle in Midweek Trading

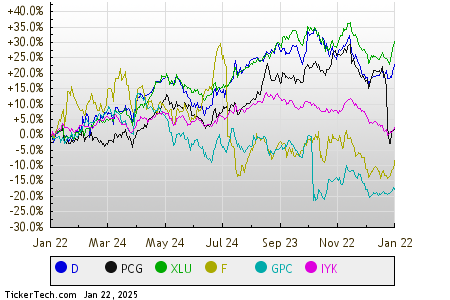

As the midday trading session unfolds on Wednesday, the Utilities sector is notably underperforming, suffering a 1.9% decline. Major players in this sector, like Dominion Energy Inc (Symbol: D) and PG&E Corp (Symbol: PCG), report losses of 4.5% and 4.0%, respectively. The Utilities Select Sector SPDR ETF (Symbol: XLU), an ETF that tracks this sector, is down 1.7% today but has gained 3.98% year-to-date. In contrast, Dominion Energy is down 0.88% year-to-date, while PG&E Corp has plummeted 17.62% in the same period. Together, D and PCG represent about 6.8% of XLU’s total holdings.

Consumer Products Sector Also Faces Challenges

Next in line for poor performance is the Consumer Products sector, which shows a modest 0.9% decrease. Among key stocks, Ford Motor Co. (Symbol: F) and Genuine Parts Co. (Symbol: GPC) have experienced declines of 3.3% and 2.8%, respectively. The iShares U.S. Consumer Goods ETF (IYK), which tracks this sector closely, is down just 0.1% during midday trading and has a slight drop of 0.90% year-to-date. In contrast, Ford Motor Co. is up 1.87% and Genuine Parts Co. is barely up at 0.01% year-to-date.

For a clearer comparison, a trailing twelve-month stock price performance chart illustrates the discrepancies between these stocks and ETFs. Each symbol is color-coded for easy identification, as shown in the graph below:

Current S&P 500 Sector Performance Overview

Here’s a look at the performance of various sectors within the S&P 500 as of Wednesday afternoon. Notably, two sectors are rising while five are declining.

| Sector | % Change |

|---|---|

| Technology & Communications | +1.3% |

| Healthcare | +0.2% |

| Services | -0.0% |

| Industrial | 0.0% |

| Materials | -0.4% |

| Financial | -0.7% |

| Energy | -0.8% |

| Consumer Products | -0.9% |

| Utilities | -1.9% |

![]() 25 Dividend Giants Widely Held By ETFs »

25 Dividend Giants Widely Held By ETFs »

Additional Resources:

• Preferred Stock Investing

• OCCF Insider Buying

• FDTS Dividend History

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.