Monday.com: A Rising Star in Work Management Software

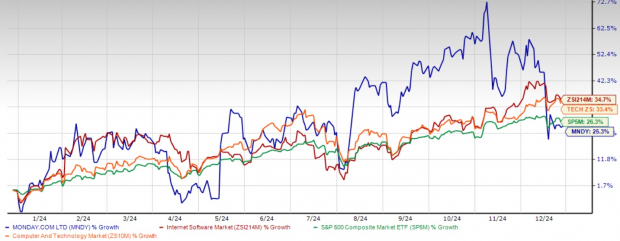

In 2024, Monday.com (MNDY) has distinguished itself in the work management software market, achieving a notable 25.3% increase in stock price. As we approach 2025, indicators point toward continued growth, making the stock an appealing choice for investors.

Reviewing 1-Year Performance

Image Source: Zacks Investment Research

Solid Financial Performance

Recently, Monday.com crossed a significant threshold, earning over $1 billion in annual recurring revenues (ARR). This milestone is particularly remarkable, achieved just eight years after the company reached $1 million in ARR. In the third quarter of 2024, the company reported a 33% year-over-year revenue increase, totaling $251 million. Remarkably, the gross margin stands at 90%, with a 13% non-GAAP operating margin indicating solid profitability.

The Zacks Consensus Estimate forecasts 2025 revenues at $1.21 billion, reflecting a year-over-year growth of 25.62%. Furthermore, earnings are expected to grow to $3.57 per share, which is an 11.72% increase compared to the previous year.

Image Source: Zacks Investment Research

For the latest earnings estimates and surprises, refer to the Zacks Earnings Calendar.

Expanding Market Landscape

Currently, the total addressable market exceeds $100 billion and is growing at an annual rate of 14% across various segments, including work management, CRM, service management, and software development. Monday.com is strategically positioned to capture a larger market share. The enterprise customer base is flourishing, with a 40% increase in customers generating over $50,000 in ARR, bringing the total to 2,907. Even more impressive is the 44% growth in customers with over $100,000 in ARR, totaling 1,080 clients.

Commitment to Innovation

Monday.com’s dedication to innovation is reflected in its expanding product lineup. The company’s AI initiatives have witnessed a remarkable 250% increase in adoption quarter-over-quarter. Additionally, the planned launch of monday service by the end of 2024 is anticipated to create new growth opportunities, especially based on promising results from its beta phase. The rollout of mondayDB 2.0 to enterprise clients showcases the platform’s scalability, capable of supporting boards with up to 100,000 items and dashboards featuring 500,000 items.

High Retention and Enterprise Achievements

The appeal of the platform is highlighted by the expansion of its second-largest customer, which has increased from 25,000 to 60,000 seats, illustrating the software’s scalability. The net dollar retention rate stands at 111% overall, with an impressive 115% for customers exceeding $100,000 in ARR, reflecting strong user satisfaction and increased usage among existing clients.

Looking Ahead: Growth Drivers for 2025

Despite facing competition from tech leaders like Asana (ASAN), Microsoft (MSFT), through Microsoft Teams and Planner, and Atlassian (TEAM), with Jira and Confluence, various factors suggest that Monday.com is set for success in 2025. The pricing optimization strategy, intended to be fully implemented by July 2025, is projected to yield around $80 million in additional revenue through 2026. The growing partner network, now consists of 254 active channel partners and 738 new referral partners, adds strength to its market reach. With ongoing investment in R&D and product innovation, particularly in AI, the company is well-placed to maintain its competitive advantage. Moreover, its strong balance sheet, featuring $1.34 billion in cash and cash equivalents, will support strategic growth and innovation efforts.

Currently, its three-year forward price-to-sales ratio is 9.37, significantly above the industry average of 3.01, showcasing market confidence in MNDY’s growth prospects.

MNDY’s Price-to-Sales Ratio Indicates High Valuation

Image Source: Zacks Investment Research

Why Invest in Monday.com for 2025

For prospective investors eyeing 2025, Monday.com stands out as an attractive option. Its robust financial performance, ongoing product innovation, and growing enterprise customer base lay a solid foundation for sustained expansion. The company has shown that it can scale effectively while remaining profitable, backed by a compelling product lineup and high customer retention rates.

With substantial cash reserves, impressive gross margins, and expanding market possibilities, Monday.com is poised for continued growth. As the global shift towards digital transformation accelerates, the company’s comprehensive work operating system is well-positioned to seize a larger share of the burgeoning market. For those looking to invest in the thriving work management software sector, Monday.com presents a promising investment opportunity for 2025. The stock currently holds a Zacks Rank #1 (Strong Buy). You can view the full list of today’s Zacks #1 Rank stocks here.

Only $1 to Access All Zacks’ Recommendations

No, we aren’t joking.

In a previous offer, we surprised our members by providing 30-day access to all our stock picks for just $1. There’s no obligation to spend further.

While many have taken advantage of this deal, some hesitated, suspecting a catch. Our aim is clear: we want you to experience our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, which achieved double- and triple-digit gains on 228 positions in 2023 alone.

See Stocks Now >>

Want the latest recommendations from Zacks Investment Research? Download 5 Stocks Set to Double today. Click to access this free report.

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Atlassian Corporation PLC (TEAM) : Free Stock Analysis Report

Asana, Inc. (ASAN) : Free Stock Analysis Report

Monday.com Ltd. (MNDY) : Free Stock Analysis Report

Click here to read this article on Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.