In the bustling arena of afternoon trading, Consumer Products seize the spotlight as the best-performing sector, surging by an impressive 0.8%. Among this realm, two heavyweight contenders, Tesla Inc and Cummins, Inc., shine the brightest, flaunting a commendable 5.9% and 4.5% gain, respectively. The iShares U.S. Consumer Goods ETF mirrors this fervor, soaring by 0.8% today and by an impressive 4.80% year-to-date. Despite a rough year, Tesla Inc remains resilient, down 30.27% year-to-date while Cummins, Inc. proudly stands tall, boasting a 20.59% uptick year-to-date.

Trailing closely behind, the Services sector mirrors the Consumer Products triumph with a parallel 0.8% surge. Noteworthy titans in this realm, Alphabet Inc (GOOGL) and Alphabet Inc (GOOG), command attention with a solid 5.0% and 4.9% climb, respectively. The iShares U.S. Consumer Services ETF embodies this upward momentum, ascending by 0.7% in midday trading and by a remarkable 5.61% year-to-date. The Alphabet Inc giants hold their ground, with GOOGL on a 6.12% rise year-to-date, closely followed by GOOG at a 5.81% increase.

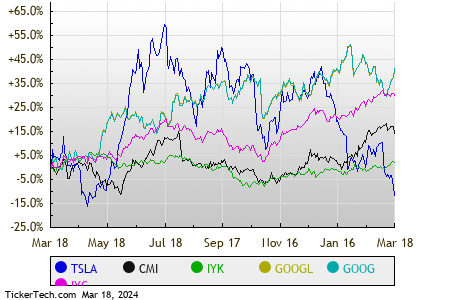

Examining these stocks and ETFs over a twelve-month span unveils a fascinating narrative, depicted in a colorful stock price performance chart that offers a nuanced perspective of their market journey.

Delving deeper into the market terrain, a glimpse at the S&P 500 components across various sectors reveals a striking panorama in afternoon trading on Monday. Evidently, nine sectors revel in an upswing, with not a single sector experiencing a downturn.

| Sector | % Change |

|---|---|

| Consumer Products | +0.8% |

| Services | +0.8% |

| Materials | +0.8% |

| Utilities | +0.7% |

| Technology & Communications | +0.6% |

| Healthcare | +0.5% |

| Industrial | +0.4% |

| Energy | +0.4% |

| Financial | +0.2% |

![]() 10 ETFs With Stocks That Insiders Are Buying »

10 ETFs With Stocks That Insiders Are Buying »

Also see:

Mergers and Acquisitions

DXPE Past Earnings

ESSA Next Dividend Date

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.