Monday Market Update: Energy Sector Struggles Amid Mixed Performances

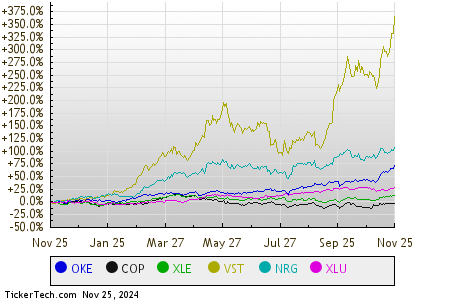

As of midday Monday, the Energy sector is lagging behind others with a 1.6% decline. Notably, large companies like ONEOK Inc (Symbol: OKE) and ConocoPhillips (Symbol: COP) are facing significant losses, with OKE down 6.7% and COP falling 3.9%. The Energy Select Sector SPDR ETF (Symbol: XLE), which tracks the energy sector, has dipped 1.7% today but is still up 16.68% this year. In contrast, ONEOK has gained 61.13% year-to-date, while ConocoPhillips has decreased by 4.82% over the same period. Together, these two stocks comprise roughly 11.8% of XLE’s holdings.

Utilities Sector Sees Small Gains

Following Energy, the Utilities sector is slightly up by 0.1%. Among large stocks in Utilities, Vistra Corp (Symbol: VST) and NRG Energy Inc (Symbol: NRG) are standing out, showing losses of 3.5% and 2.6%, respectively. The Utilities Select Sector SPDR ETF (Symbol: XLU) is flat today but has surged 31.16% year-to-date. Vistra Corp has an impressive year-to-date gain of 307.22%, while NRG Energy Inc is up 83.08%. Combined, VST and NRG account for about 6.2% of the underlying holdings of XLU.

For a visual overview, here’s a comparison of stock price performance from the past twelve months for the mentioned companies:

Sector Performance Snapshot

The following table shows how various sectors within the S&P 500 are performing in afternoon trading on Monday, revealing that eight sectors are making gains while one is declining.

| Sector | % Change |

|---|---|

| Services | +2.0% |

| Consumer Products | +1.7% |

| Materials | +1.6% |

| Technology & Communications | +1.3% |

| Healthcare | +1.2% |

| Financial | +1.1% |

| Industrial | +0.8% |

| Utilities | +0.1% |

| Energy | -1.6% |

![]() 10 ETFs With Stocks That Insiders Are Buying »

10 ETFs With Stocks That Insiders Are Buying »

Also see:

• George Soros Stock Picks

• DRI Options Chain

• Funds Holding SII

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.