Mondelez in Focus: Signs of Recovery After Recent Decline

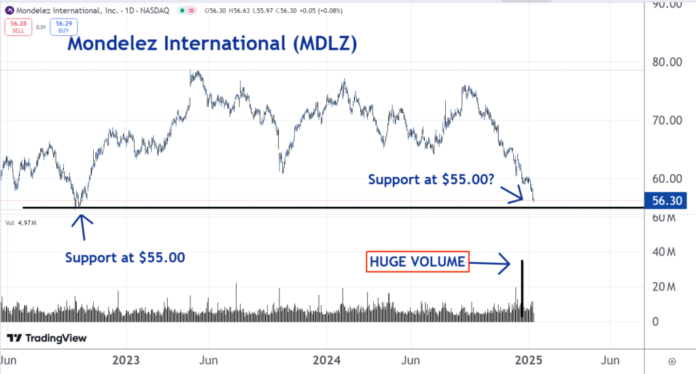

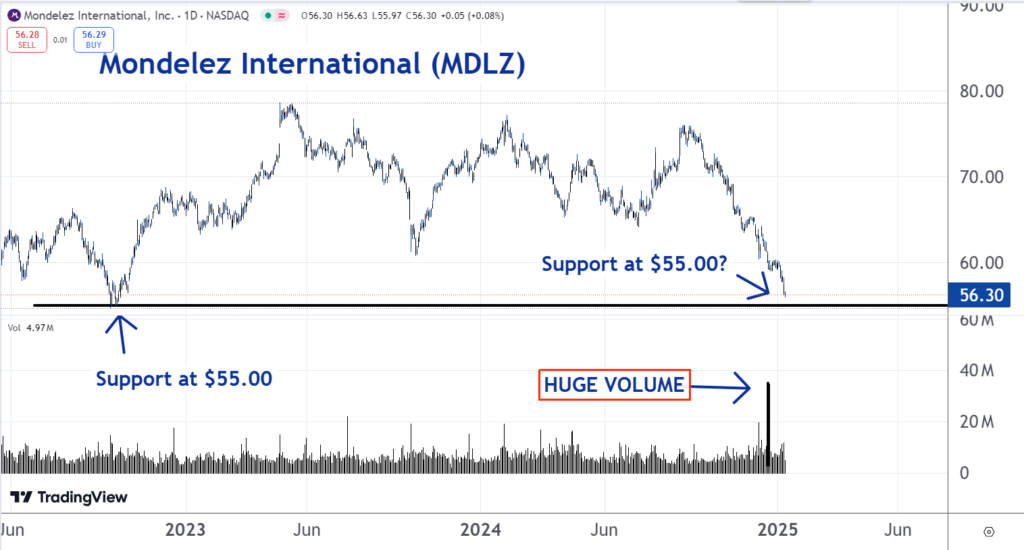

Shares of Mondelez International, Inc. MDLZ are trading flat on Monday, but the stock has experienced a significant downward trend lately.

Potential for a Turnaround

Investors might be nearing the end of the selloff period. There’s a possibility that the stock could begin to recover, which is why it has been designated as our Stock of the Day.

Understanding Oversold Conditions

Currently, Mondelez appears to be oversold. A stock is typically considered oversold when it drops below its usual trading range due to aggressive selling. This situation often attracts buyers who are betting on a price rebound, which could push the stock higher.

Volume Surge and Market Sentiment

Recently, Mondelez observed a significant spike in trading volume. Such surges may hint at capitulation, which can create optimistic market conditions.

Capitulation happens when investors decide to sell their shares after becoming frustrated with a continuous decline. This mass selling results in high trading volumes as they await a price recovery that sometimes never comes.

Market Dynamics Post-Capitulation

If buyers enter the market following a capitulation, they may struggle to find shares available for purchase. This scarcity could force them to pay higher prices, potentially driving the stock into an upward trend.

Support Levels and Historical Context

Additionally, Mondelez is nearing a price point that has previously shown support. Investors often experience ‘seller’s remorse’ after selling at these levels, which can lead many to re-enter the stock when it retraces to those price points.

Looking Ahead: Signs of Stability

With the combination of being oversold, approaching a historical support level, and potential signs of capitulation, there is a likelihood that the selloff for Mondelez may soon be over. The stock could also reverse direction and rise in value.

Read Next:

Image: Shutterstock

Overview Rating:

Speculative

Market News and Data brought to you by Benzinga APIs