Major Oversold Consumer Staples Stocks Present Buying Opportunities

Identifying undervalued stocks can be beneficial, especially in the consumer staples sector, which has several oversold companies right now.

The Relative Strength Index (RSI) serves as a momentum indicator, helping traders analyze a stock’s performance by comparing price increases to price decreases. Typically, a stock is deemed oversold when it has an RSI below 30, according to Benzinga Pro.

Below is a list of significant oversold stocks in this sector, with their RSI values hovering at or below the 30-mark.

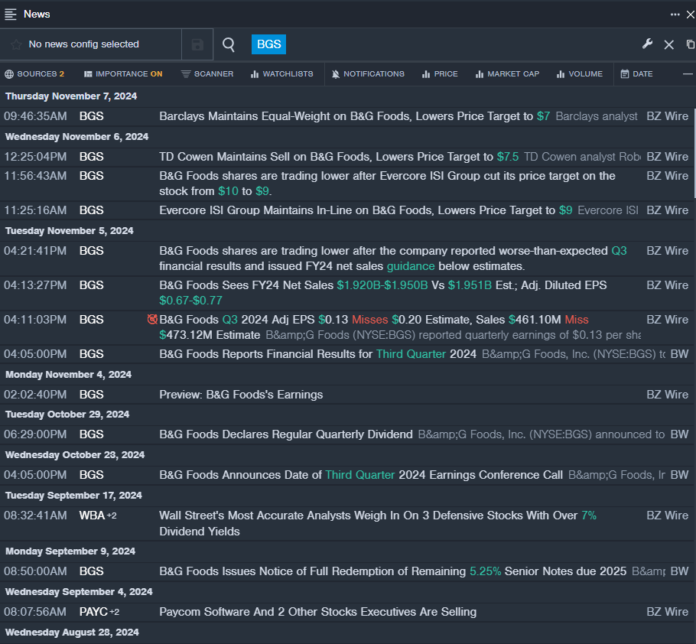

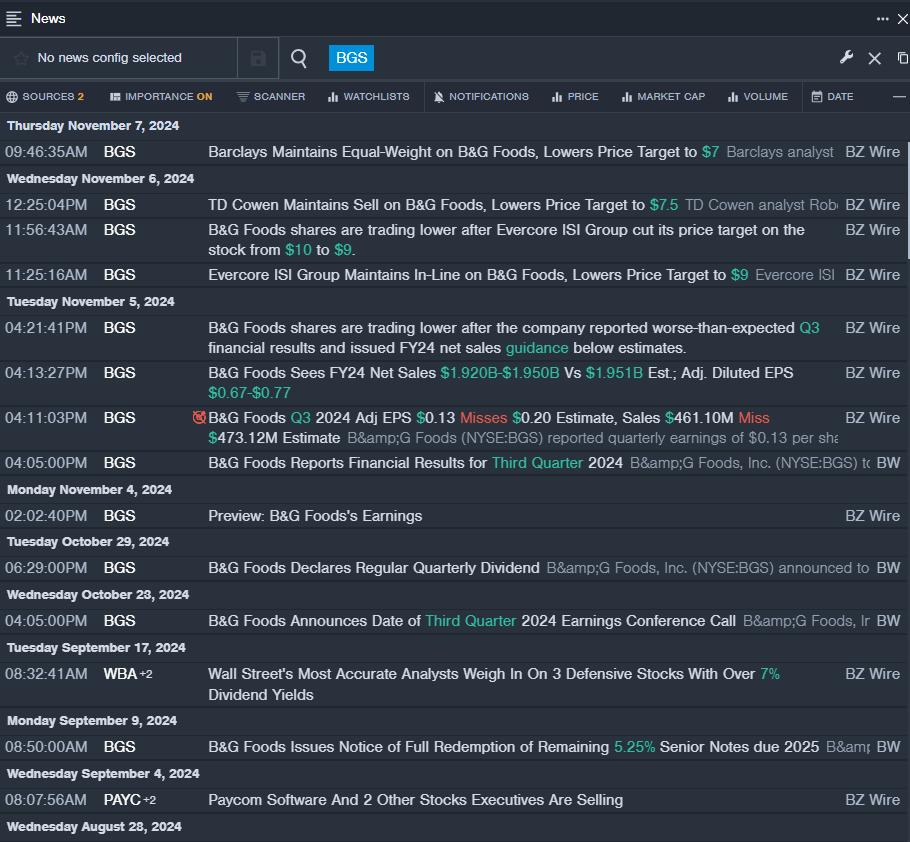

B&G Foods Inc BGS

- On November 5, B&G Foods disclosed third-quarter results that fell short of expectations and provided lower-than-anticipated guidance for FY24 net sales. Casey Keller, the President and CEO, remarked that the results indicated a slower recovery in sales, echoing broader industry trends. He anticipates gradual improvement as consumers acclimate to rising food prices. Over the past month, the stock has seen a decline of around 23%, with a 52-week low recorded at $6.25.

- RSI Value: 26.16

- BGS Price Action: Shares of B&G Foods declined by 3.2%, closing at $6.29 on Wednesday.

- Benzinga Pro’s real-time newsfeed provided the latest updates on BGS.

Coca-Cola Co KO

- On October 23, Coca-Cola announced a 1% year-on-year sales decline for the third quarter, totaling $11.9 billion, though it surpassed the analyst consensus of $11.59 billion. The company revised its 2024 organic revenue growth forecast to about 10%, an increase from previous guidance (9%-10%). Despite this, its stock has dropped roughly 10% in the last month, with a 52-week low of $56.70.

- RSI Value: 21.53

- KO Price Action: Coca-Cola’s shares dipped by 0.3%, closing at $63.00 on Wednesday.

- Benzinga Pro’s charting tool helped track the trends in KO stock.

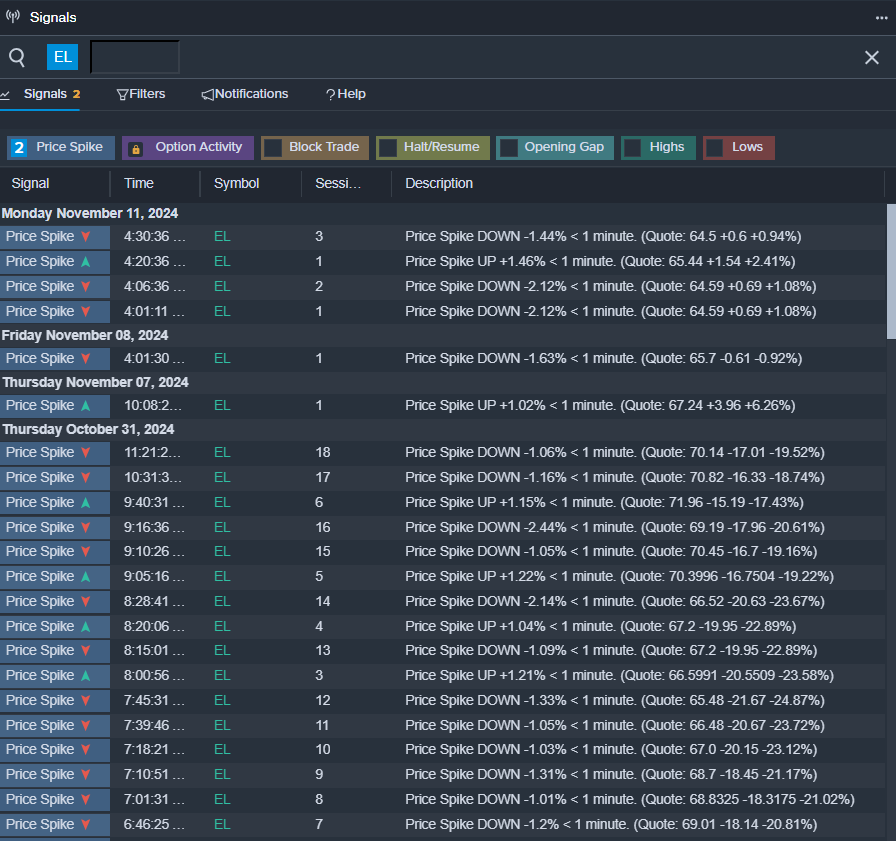

Estee Lauder Companies Inc EL

- On October 31, Estee Lauder revealed first-quarter adjusted earnings per share of 14 cents, surpassing the analyst expectations of 9 cents. However, its quarterly revenues of $3.36 billion fell short of the consensus estimate of $3.371 billion, representing a 4% decline. CEO Fabrizio Freda noted the challenges in forecasting market recovery, especially in China and Asia travel retail. The stock has dropped about 33% in the last month, reaching a 52-week low of $62.29.

- RSI Value: 22.66

- EL Price Action: Estee Lauder’s shares increased slightly by 0.2%, closing at $62.86 on Wednesday.

- Benzinga Pro’s signals feature indicated a potential breakout for EL shares.

Read More:

Market News and Data brought to you by Benzinga APIs