Discovering the World of Convertibles

Let’s delve into the world of convertibles for a moment—a realm where we’re not discussing sleek cars with retractable tops, but rather convertible bonds.

It may not be as dazzling as driving a convertible down the coast, but hidden within the world of convertible bonds lies a captivating element few can resist: extraordinary dividend yields. We’re not talking about the standard “high” yields of 3% or 4% on regular stocks or the 6% to 7% payouts on corporate bonds. No, we’re talking about yields that soar to dazzling heights—like those at 12%.

Exploring the Allure of Convertibles

The concept of receiving $100 per month for every $10,000 invested is anything but mundane. The allure of financial freedom that such significant income streams offer easily eclipses the fleeting joys of owning a convertible car. Speaking from personal experience, having owned two convertibles in my lifetime, neither provided the exhilaration one might expect.

So, what precisely is a convertible bond? Put simply, these are debts issued by companies that, under certain conditions, allow the creditor to convert that debt into equity. In essence, we can lend money to a company and, if the company prospers, opt to transform our debt into shares.

The advantages of this setup are often underestimated. By initially lending money to a company, you can mitigate the risk of financial loss. Then, as the risks diminish and opportunities expand, you can transition to a more substantial stake by outright owning stock based on the convertible bond’s guidelines.

Major corporations frequently utilize convertible bonds as a means to raise funds when they hold strong confidence in their ability to surpass market expectations. This strategy is commonly employed when companies are on the brink of expansion or seeking to outpace competitors without tangible proof to satisfy traditional banks.

In today’s financial landscape, companies are increasingly gravitating towards convertible bonds, resulting in a notable surge in issuances since 2022.

The Rise of Convertibles in a Changing Economy

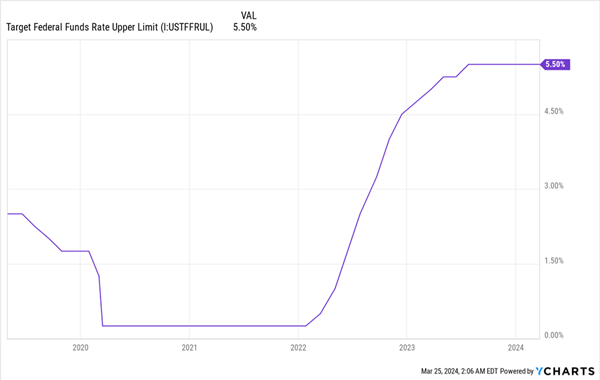

Amid skyrocketing interest rates, companies are seeking alternatives to the exorbitant rates demanded by the bond market. This shift has propelled many established, highly-rated firms to consider convertibles over the conventional corporate bonds they often issued during the low-interest-rate era of the 2010s. Notable companies such as PG&E Corp. (PCG) and Uber Technologies (UBER) have recently transitioned to convertibles, as reported by the Financial Times, reaping cost savings in the process.

The prime approach to capitalize on this trend is through high-yielding closed-end funds (CEFs) specializing in convertible bonds. These funds’ robust dividends are sustained by the equity upside and relative stability of convertible-bond prices. Moreover, the influx of new issuances provides CEF managers with a plethora of options to enrich their portfolios through prudent convertible selections.

Top 3 Convertible-Bond CEF Recommendations

Commencing with Virtus Equity & Convertible Income Fund (NIE), boasting a 9% yield and trading at an 11% discount to its net asset value (NAV), this fund stands out. Despite the deep discount, NIE has not only maintained its generous payouts since the Great Recession but has recently bolstered its regular quarterly dividends and issued substantial special dividends in recent years.

The Sturdy Income of NIE

Shifting our focus to the Advent Convertible and Income Fund (AVK), investors seeking increased income without a significant rise in dividend-risk will find this fund appealing. With an impressive 11.8% yield and a 5% discount, AVK offers a balanced option, given its convertible focus and steady dividend growth over the past decade.

The Dual Strength of AVK

And for those eyeing even grander yields, the Virtus Convertible & Income Fund (NCV) delivers a remarkable 12.4% payout, potentially enabling a six-figure income with an investment of about $807,000. Despite its hefty yield, NCV currently offers a 12.4% discount, heightening the allure of its income stream even further.

However, prudence is essential, as risks abound. NCV’s dividend downturn in recent years is notable, attributed to substantial investments in corporate bonds during the low-interest-rate period of the early 2010s. As interest rates rise, the possibility of a prolonged dividend decrease remains a concern.

While NCV may lag behind our other two recommended funds in the near term, the tide may shift in its favor as economic conditions evolve.

Investors Reap Rewards as NIE Outperforms NCV and AVK in the Convertible-Bond Market

Understanding Total NAV Returns in the Convertible-Bond Funds Landscape

Observing the total NAV returns of three convertible-bond funds provides a glimpse into the gains and dividends inherent in their underlying portfolios. It essentially serves as a litmus test for the effectiveness of a CEF’s management.

In the visualization, NIE (in purple) is seizing the opportunities presented by the post-2022 market scenario, with NCV (in blue) playing catch-up and AVK (in orange) falling in the middle of the pack. It’s clear that NIE has emerged as the superior choice among the trio.

NIE’s strategic focus on melding convertible bonds with equities, distinguishing itself from AVK and NCV that blend convertibles with corporate bonds, has enabled it to capitalize on the upswings in both the convertible and stock markets. This unique approach has proven successful in bolstering its portfolio performance, offering investors substantial returns that offset its comparatively lower yield, a trend observed over an extended period.

Insights into the Long-Term Prospects

Will NIE’s portfolio trajectory sustain its current momentum? While the affirmative echoes loudly for the short term, the long-term outlook hinges on the Federal Reserve’s stance on interest rate adjustments in 2024, particularly with market reactions in the bond sphere looming large.

The landscape of interest rates remains a critical compass point that demands incessant attention, guiding the selection of CEFs for discerning investors.

Amidst the impending likelihood of rate reductions, albeit potentially less drastic than anticipated in 2024, a curated selection of 4 CEFs has surfaced as stalwarts that stand to benefit irrespective of the interest rate tides in the near future.

Should interest rates persist at elevated levels, these 4 income vehicles enjoy a prolonged window to acquire their specialized assets encompassing stocks, bonds, and real estate investment trusts (REITs) at discounted valuations.

In a scenario of steep rate declines, these very assets are primed for an upsurge, given their tendency to exhibit an inverse relationship with interest rates.

What’s more? By seizing the moment and initiating investments now, investors lock in a cumulative 10.2% yield, translating to $10,200 in annual dividends for every $100,000 invested!

Click here to delve into my CEF-picking strategy and gain exclusive access to a free Special Report disclosing the identities of these 4 “rate-resistant” CEFs, each yielding a lucrative 10.2%.

Also explore:

• Warren Buffett Dividend Stocks

• Dividend Growth Stocks: 25 Aristocrats

• Future Dividend Aristocrats: Close Contenders

The perspectives articulated here represent the author’s viewpoints and do not necessarily align with those of Nasdaq, Inc.