The Year-end Rally in December saw the S&P500 (SPY) soar 4.5% and cap off a phenomenal year with a 26.3% gain, marking one of the best years in the past decade. This remarkable performance was largely driven by the Magnificent 7 and the underlying AI rally, as well as expectations surrounding the Fed’s potential shift towards a series of rate cuts in 2024. Throughout the last quarter, interest rates remained unchanged as the Fed kept its target rate range at 5.25% to 5.50%. All eyes will once again be on the Fed in 2024.

Amidst lingering doubts regarding a soft landing, it seems unlikely that there will be any type of recession; at most, it might lead to a technical one. If it does occur, it may be as short-lived as the brief 2022 bear market in stocks, an event that, in my view, was not noteworthy.

Personally, December was an enriching and memorable month as I ventured to South East Asia for the first time, relishing almost four wonderful weeks in Vietnam. Experiences like these are priceless and the ultimate reward to spend dividends on. While I am driven to invest as much as possible in the markets in pursuit of financial independence, I believe it’s crucial not to sacrifice life’s treasures and experiences for mere cash.

December Portfolio Adjustments

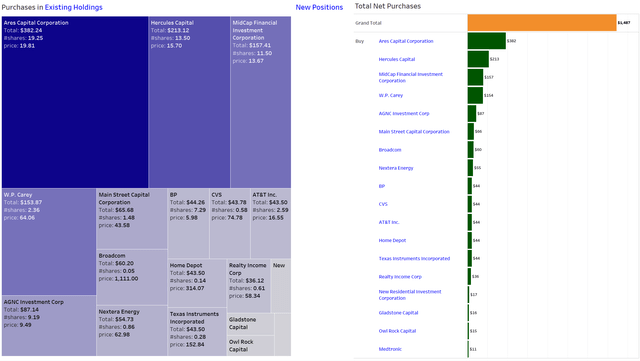

Due to my vacation covering most of December and the time zone differences between Vietnam and the USA, investment activity was notably lower. Nevertheless, I managed a couple of purchases, totaling around $1,500. I directed most of my investments towards BDCs like Hercules Capital (HTGC), MidCap Financial Investment Corporation (MFIC), and the bellwether stock Ares Capital Corporation (ARCC). Although buying opportunities are diminishing, I remain resolute in favoring BDCs even with lower yields.

My most significant December purchases were several small transactions to acquire more shares of Ares Capital, which remains my #1 dividend payer in the entire portfolio and led to a record dividend income in December. I also made several investments in Hercules Capital, MidCap Financial Investment Corporation, and Main Street Capital Corporation (MAIN).

Overall, I managed to add $116 in forward annual dividend income this month, bringing the total 2023 added annual dividend income to a record $1,640, in line with the 2022 figure of $1,680.

All net purchases in December can be found below:

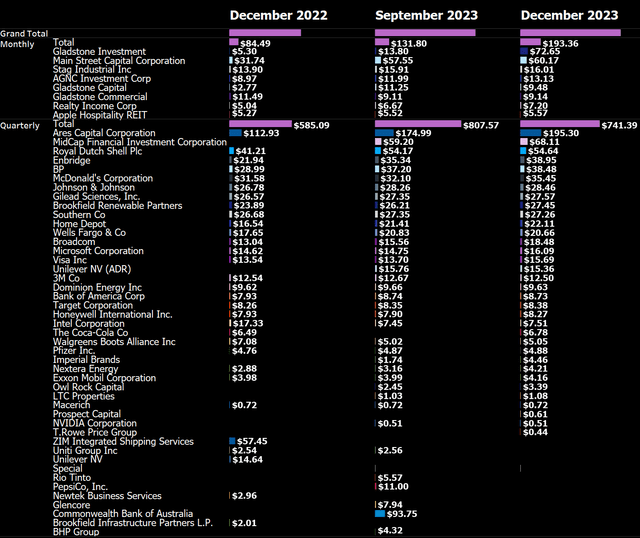

December 2023 Dividend Income

The dividend income hit a new high of $935, marking a 35% year-over-year growth and remaining flat sequentially. Excluding special dividends, the biggest income driver is Ares Capital, with dividends quickly approaching the next big milestone of $200. Dividend income from MFIC is also rising rapidly, approaching $70. Net dividends from monthly payers have comfortably surpassed $100 thanks to supplemental dividends from Main Street Capital and Gladstone Investment. The dividend income from my top-3 payers in December continues to grow, pushing the 2023 average to a staggering $270, compared to just around $118 in 2022.

2024 Dividend Growth Projections for Investment Portfolio

As the markets continue to evolve, there’s a prevailing sense of anticipation for what lies ahead. The landscape is shifting, investment strategies are adapting, and amidst all this, a unique story unfolds – one of resolute growth, deliberate decision-making, and unwavering dedication. In the realm of dividends, one investor’s journey stands out, marked by a steadfast pursuit of financial prosperity.

Embracing Growth Opportunities

The year 2024 holds the promise of substantial growth, with projections pointing to an increase of at least 18% compared to the 2023 average. However, fueled by an unwavering commitment to acquisitive drive, this growth trajectory may surge to a staggering 25% to 30%. As the investor continues to augment their portfolio with astute purchases, the potential for exponential growth becomes increasingly tangible.

Visualizing the Financial Trajectory

Visual representations provide a compelling narrative of the investor’s journey, serving as a tangible testament to their commitment. Charts showcasing the development of net dividend income over time, from 2015 to 2023, vividly illustrate the upward trajectory. Moments frozen in time chronicling the growth of dividend income and the average annual dividend for each year offer poignant insights into the investor’s perseverance and foresight.

A profound visual narrative emerges through a depiction of individual dividend payments, meticulously arranged to allow for comprehensive analysis. This nuanced approach provides a deeper understanding of the distribution of dividend payments over time, underscoring the overarching growth of dividend income.

Zooming in on December, the visual depiction lends clarity to the impact of key investments. Notably, the prominence of certain assets, such as Ares Capital Corporation, serves as a vivid testament to the substantial influx of dividend income, fueled by steadfast monthly investments – a practice poised to continue unabated.

Strategic Milestones and Reflections

Framed within the narrative of gifted working time, the investor’s journey is imbued with anecdotes of diligence and ambition. From the modest 2018 figure to the targeted 2023 annual net dividends, each milestone speaks to a narrative of incremental advancement and calculated projections.

- 2018: 121 hours GWT, $3,000 in annual net dividends

- 2019: 142 hours GWT, $3,600 in annual net dividends

- 2020: 152 hours GWT, $3,800 in annual net dividends

- 2021: 180 hours GWT, $5,050 in annual net dividends

- 2022: 229 hours GWT, $6,400 in annual net dividends

- 2023: Targeting at least 216 hours GWT, $7,000 in annual net dividends

Amidst strategic recalibrations and the enduring pursuit of growth, 2023 delivered a staggering $8,808 in dividend income, marking a resounding 37% increase. A testament to foresight and unwavering dedication, this milestone underscores the investor’s prudent decision-making and the resilience of their portfolio against market fluctuations.

Looking Ahead with Foresight and Pragmatism

As the investor charts their trajectory into 2024, reflections on historical data culminate in strategic projections for the future. Striking a balance between aspiration and pragmatism, the aim is to surpass the coveted $10,000 dividend income milestone, underpinned by judicious financial acumen and a proactive approach to investment decisions.

- 2018: Disappointing

- 2019: Phenomenal, benefiting from a low baseline in the prior year

- 2020: Fairly disappointing

- 2021: Phenomenal

- 2022: Much better than expected fueled by the very weak euro

- 2023: Targeted a very conservative low single-digit growth rate which was significantly outperformed with dividend growth reaching 37%

- 2024: Projections for 2024 incline towards a low double-digit growth rate, grounded in a realistic assessment of prevailing market dynamics and investment landscapes.

January Dividend Income and Portfolio Update

As we kick off 2024, let’s take a closer look at the dividend race and upcoming January dividends, shedding light on the current state of dividend income and the ever-evolving portfolio landscape.

YTD Dividend Race

The YTD Dividend Race chart provides a daily snapshot of the dividend income development, revealing patterns such as mid-month and end-of-month concentration. This detailed breakdown offers a glimpse into substantial income upswings as the year progresses.

Gifted Working Time

Expressed in GWT, it unearths intriguing facts, showing more than 1,251 hours or 156 days of active work substituted with passive income since embarking on the dividend journey. This amounts to over 31 weeks of vacation funded by dividends, equivalent to half a year in total.

- Around 315 hours, or 39.3 days, of active work have been replaced with passive income in 2023, symbolizing significant progress and extra monthly salaries equivalent to eight full-time working weeks funded with dividends.

- The accumulated total at the end of the current reporting month (December) is highlighted in pink.

This visualization delves into the overarching impact of dividend income on the percentage of active work supplanted by passive income, charting year-to-date progress and the cumulative total at month-end.

Upcoming January Dividends

January boasts a flurry of concentrated dividend payments around the 15th and month-end, backed by a robust lineup of dividend-yielding companies including W. P. Carey (WPC), Altria (MO), Cisco Systems (CSCO), and JPMorgan, among others. The stage is set for a record-breaking dividend performance in January.

With dividends from stalwarts such as Toronto-Dominion Bank and Bank of Nova Scotia, along with ongoing investments in Rithm Capital (RITM) and Annaly Capital (NLY), January promises to be a significant month.

An excerpt from the Dividend Calendar underscores the anticipated dividend payments in January.

December Dividend Portfolio Composition

The end of December reveals the composition of the dividend portfolio, highlighting the market value percentages and values of various companies in the portfolio.

| Company Name | Ticker | % Market Value | Market Value (€) |

| Apple Inc. | (AAPL) | 11.18% | 25,098 |

| Visa Inc | (V) | 4.27% | 9,592 |

The Dividend Power Players: Top Stocks of 2023 Unveiled

Behold, the dividend kings and queens of 2023! These steadfast darlings of the stock market have been churning out reliable returns for investors and continue to hold their ground amid the shifting tides of the market.

The Top Performers

The leaderboard of dividend stocks reads like a who’s who of the stalwart companies that have weathered the storm and emerged victorious. The top positions are occupied by the likes of Procter & Gamble Co (PG), BP1 (BP), and Philip Morris International Inc. (PM). These powerhouses have demonstrated resilience and stability, offering investors a reliable source of income with dividend yields ranging from 0.78% to 0.68%.

Steadfast Stability

These dividend giants have stood the test of time, acting as beacons of stability amid the choppy seas of the stock market. Companies such as Realty Income Corp (O), Honeywell International Inc. (HON), and Starwood Property Trust, Inc. (STWD) have consistently delivered dividends, underscoring their unwavering reliability as long-term investment prospects.

Resilient Rookies

While some may view dividend stocks as slow and steady, the newcomers to the dividend game are making their mark. These rising stars, including NextEra Energy (NEE), Exxon Mobil Corporation (XOM), and Vonovia, have shown promising dividend yields, proving that they are worthy contenders for investors seeking stable returns.

Guiding Lights in Turbulent Times

As the market experiences turbulence, dividends provide a calming reassurance to investors. Amid economic uncertainties and market fluctuations, the consistent income stream provided by these dividend stocks acts as a guiding light, offering financial fortitude and a sense of security to shareholders.

Heeding the Cautionary Note

It is important to note that some of the mentioned securities may not trade on major U.S. exchanges, necessitating a cautious approach. Investors are advised to consider the associated risks before diving into these stocks, as they may not align with the risk tolerance of all shareholders.