Investing in dividend stocks fuels my desire to grow my income. Receiving dividends adds cash to my portfolio, which I can reinvest to increase my passive income—a key step toward covering my daily expenses in the future.

However, my journey hasn’t always been smooth sailing. I faced setbacks when companies I invested in reduced or cut their dividend payouts. A significant example is 3M (NYSE: MMM). This industrial leader ended a remarkable 60-year streak of increasing dividends by reducing its payment earlier this year, prompting me to sell my shares. With part of the funds, I decided to invest in Whirlpool (NYSE: WHR) instead. Let’s explore the reasoning behind this change.

From Dividend King to Cut

3M was once considered a dependable dividend stock, boasting over 50 years of dividend increases and earning it a place among the Dividend Kings. Unfortunately, recent challenges led the company to make tough choices, including a dividend cut.

Legal troubles surrounding certain products cost 3M approximately $18.5 billion to settle. This hefty amount stressed the company’s finances, prompting it to take measures to maintain flexibility in covering its obligations and other financial commitments.

One significant shift was the spinoff of its healthcare unit into Solventum. This move allowed 3M to ease its debt burden but resulted in a significant reduction in cash flow. Consequently, 3M had to reset its dividend, slashing it by nearly 50%.

My initial investment in 3M was largely driven by its reliable dividend, which had steadily increased for many years. Regrettably, its legal issues compromised its ability to maintain this dividend. With the payout drastically reduced, I chose to divest from 3M and Solventum, the latter of which has indicated no plans to reinstate dividends due to outstanding debt.

A New Start with Whirlpool

I invested some of the proceeds from my 3M and Solventum sales into shares of Whirlpool. This well-known appliance maker caught my attention not only because of its dividend but also due to a recent home purchase that necessitated new appliances. Whirlpool manufactures many of the units we were considering.

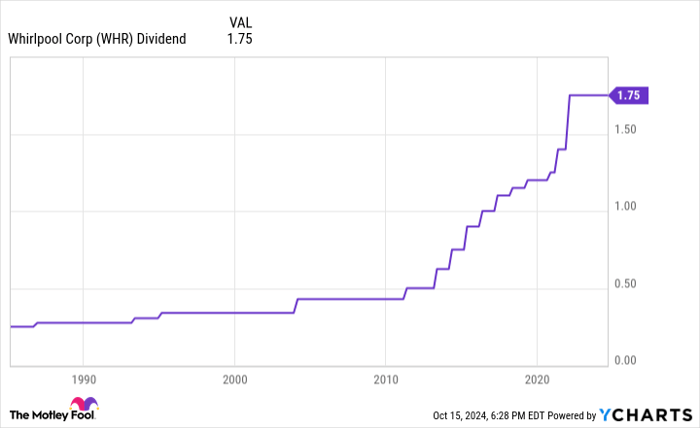

While researching appliances, I deeply examined Whirlpool’s stock. I was impressed to find a dividend yield approaching 7%. This company has a long history, having issued dividends for around 70 years. Though it hasn’t raised its payout consistently every year—last increasing it in 2022—it has never cut its dividends:

WHR Dividend data by YCharts

A strong dividend history, however, does not guarantee future success, as I learned with 3M. Nevertheless, Whirlpool seems well-positioned to uphold its dividend despite prevailing challenges. This year, its dividend obligations will total about $400 million, easily manageable given its estimated free cash flow of around $500 million after capital expenditures. Furthermore, Whirlpool plans to enhance its cash flow by divesting some international operations, potentially saving $300 million to $400 million. The company is also focused on reducing its debt to minimize interest expenses.

With the housing market anticipated to rebound as interest rates decline, Whirlpool expects an increase in sales. Homeowners often replace older appliances to attract buyers. Personally, I dislike the refrigerator in my new home (not a Whirlpool product), which drives us to seek a replacement. This cycle will likely bolster Whirlpool’s sales and profits, solidifying its dividend foundation.

Transitioning to Steady Income

3M’s decision to cut its dividend was disappointing, considering its impressive history. This prompted my transition to Whirlpool, which offers a more lucrative dividend that it should be able to sustain even amidst the current housing market decline. Although increases may be on pause, I am optimistic about Whirlpool’s potential to be a strong income stock for the future, providing consistent cash flow into my portfolio.

Explore a New Investment Opportunity

Have you ever felt you missed out on acquiring successful stocks? There may be another chance now.

Sometimes, our dedicated analysts identify a “Double Down” stock—companies they believe are set for significant growth. If you feel you missed your opportunity before, this could be a perfect moment to invest.

- Amazon: Invested $1,000 in 2010? You’d have $21,285!

- Apple: Invested $1,000 in 2008? You’d have $44,456!

- Netflix: Invested $1,000 in 2004? You’d have $411,959!

Right now, “Double Down” alerts are available for three outstanding companies, and opportunities like this don’t come often.

Discover the 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

Matt DiLallo has positions in Whirlpool. The Motley Fool recommends 3M, Solventum, and Whirlpool. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.