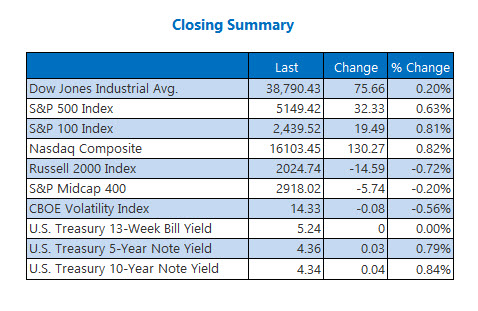

After a tumultuous journey, Wall Street found a glimmer of hope on Monday, riding on the coattails of Nvidia (NVDA) and Alphabet (GOOGL) as they surged ahead. Anticipation set the stage for the upcoming Federal Open Market Committee’s (FOMC) meeting, with the promise of the central bank’s interest rate decision looming on Wednesday. In this climate of expectancy, the Dow triumphed with a 75-point gain, while the S&P 500 and Nasdaq shattered their three-day losing streaks.

For more insights into today’s market performance, delve deeper:

5 Key Highlights for Today

- Following recent incidents, United Airlines (UAL) CEO Scott Kirby announced a review of the company’s safety training for employees (MarketWatch).

- The National Association of Home Builders/Wells Fargo Housing Market Index revealed a surge in homebuilder sentiment to 51 in March, marking its highest level since July (CNBC).

- HashiCorp stock experienced a boost due to a potential sale push.

- The chip industry is gearing up to enhance its advanced packaging capacity.

- Morgan Stanley’s latest assessment tags PepsiCo stock as “undervalued.”

No significant earnings reports made waves today.

Oil Upsurge Amid Russia-Ukraine Conflict

Fueling the market fervor, oil prices soared to their zenith in over four months on Monday. The surge was sparked by reports of Ukraine’s relentless attacks on Russia’s energy infrastructure, potentially jeopardizing its refining capabilities. For April, West Texas Intermediate (WTI) leaped by $1.68, or 1.8%, settling at $ per barrel by day’s end.

In tandem with the oil momentum, gold prices also ascended, under the watchful eye of traders monitoring the Federal Reserve’s interest rate resolution. April’s gold prices climbed by $2.80, or 0.1%, settling at $2,164.30 per ounce.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.