Lumen Technologies Faces Stock Slide Amid Legacy Business Struggles

Lumen Technologies, Inc. (LUMN) has experienced a significant drop in shares, falling 13.7% in the past month. This contrasts sharply with the S&P 500 composite, which declined by only 4.1%, and the sub-industry’s decline of 8.5%.

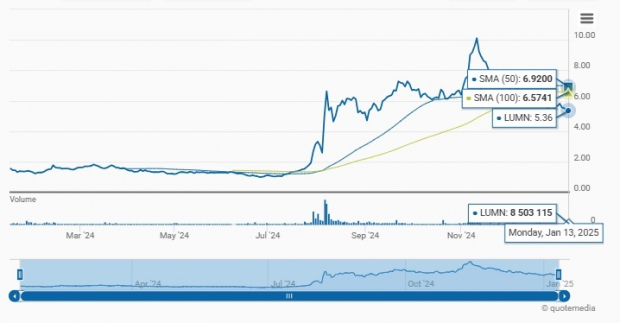

Analyzing Stock Trends

Image Source: Zacks Investment Research

As of yesterday’s trading session, LUMN shares closed at $5.36. This positions the stock at 48.1% below its peak of $10.33 reached on November 11, 2024. Following a remarkable 237% rally over the past year, current questions linger: Is this drop a routine market correction or does it signal deeper issues? It’s imperative to examine both advantages and challenges associated with Lumen’s stock, considering whether this downturn is a cause for caution or a new investment opportunity.

Challenges from Legacy Business Operations

Lumen is grappling with difficulties in its legacy business. In Q3 2024, total revenues fell by 11.5% year-over-year to $3,211 million. This downturn stems from factors such as divestitures, commercial agreements, and the sale of its CDN business. As the company pivots towards newer products such as fiber and cloud solutions, the ongoing decline in legacy operations is expected to continue affecting revenue growth, at least in the short term.

Additionally, rising costs linked to expanding new ventures may negatively impact profit margins. For the current year, Lumen anticipates adjusted EBITDA to be between $3.9 billion and $4 billion, with capital expenditures projected between $3.1 billion and $3.3 billion. Due to current business trends, Lumen expects EBITDA for 2024 at the lower end of this range. Moreover, for 2025, the company predicts EBITDA to fall below 2024 levels, citing ongoing costs for transformation efforts and declines in legacy revenues. A rebound in EBITDA is expected by 2026.

Lumen’s Heavy Debt Burden

LUMN’s financial health is marred by a considerable debt load. By September 30, 2024, Lumen reported $2.64 billion in cash alongside $18.142 billion in long-term debt, a slight decrease from $18.411 billion in June of the same year.

Stable Earnings Forecasts Amidst Market Concerns

Over the last two months, analysts have not changed their earnings estimates for LUMN for 2024 and 2025.

Image Source: Zacks Investment Research

The stock currently trades below both its 50-day and 100-day moving averages, reflecting a generally bearish outlook from analysts and indicating potential underperformance in the near term.

Image Source: Zacks Investment Research

Positive Trends in PCF Solutions

There is rising demand for Lumen’s Private Connectivity Fabric (PCF) solutions, especially as AI technology evolves. The company recently secured $3 billion in new PCF contracts, totaling $8 billion in sales since June 2024. As AI applications expand, many large businesses are urgently seeking robust fiber capacity.

Important partnerships have emerged with technology leaders like Microsoft (MSFT), Amazon (AMZN), Google Cloud, and Meta Platforms (META) to bolster network capabilities for AI initiatives. Additionally, Lumen has increased its free cash flow forecast for 2024 to between $1.2 billion and $1.4 billion, an improvement from an earlier estimate of $1 billion to $1.2 billion, driven by growing demand for PCF sales.

Lumen’s strong network infrastructure and integrated services are prime factors that distinguish it in the competitive cloud market. Currently, over 400 clients utilize Lumen’s Network-as-a-Service (NaaS) solutions, launched earlier in the year with a focus on user privacy and security.

Expansion in the Quantum Fiber Sector

Investment in the Quantum Fiber and enterprise business is yielding promising results. Lumen recently added 43,000 Quantum Fiber subscribers, bringing the total count to 1 million. Additionally, in Q3, Lumen expanded its Fiber broadband-enabled locations by 131,000, totaling 4 million as of September 30, 2024. The company targets reaching 500,000 enabled locations by the end of this year.

Cost Reduction Strategies

Lumen is actively working on improving operational efficiency through a $1 billion cost-saving initiative by 2027. This major effort aims to simplify infrastructure across various network architectures while trimming down its extensive product offerings from thousands of codes to about 300.

Assessing LUMN’s Valuation

LUMN appears significantly undervalued, trading at a price-to-sales ratio of 0.4 compared to the industry average of 9.71.

Image Source: Zacks Investment Research

Investment Strategy for LUMN Stock

Opportunities in the rapidly growing AI sector are promising, but Lumen contends with stiff competition, a high debt burden, and ongoing revenue pressures. Currently trading below the 50-day and 100-day moving averages, analysts maintain their bearish stance on the stock. As such, investing in LUMN now may not be the smartest choice; it holds a Zacks Rank #3 (Hold). Those considering it might find waiting for a more favorable entry point to be a better strategy.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Unlocking Opportunities: Top 5 Stocks for Infrastructure Growth

With trillions in federal funding aimed at revitalizing America’s infrastructure, significant investments will flow into AI data centers, renewable energy, and more.

Discover five companies positioned to benefit the most from this upcoming spending surge.

Download your free guide on how to capitalize on the trillion-dollar infrastructure boom today.

Stay updated with the latest recommendations from Zacks Investment Research. Today, you can also download 7 Best Stocks for the Next 30 Days for free.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Lumen Technologies, Inc. (LUMN): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.