Stocks related to artificial intelligence (AI) have soared over the past few years. For instance, Nvidia (NASDAQ: NVDA) has surged more than 1,000% and now ranks among the world’s largest companies by market capitalization. Big tech firms are riding the AI wave, contributing to impressive gains in 2024. The crucial question is: will this momentum carry into 2025?

Importantly, identifying a stock as an “AI stock” is less important than its valuation, growth potential, and risks associated with buying shares now. Stocks like C3.ai (NYSE: AI), Nvidia, and Amazon (NASDAQ: AMZN) illustrate the diverse options available in the AI sector. Rather than asking if 2025 is a good year to invest in “AI stocks,” focus on each company individually to make informed investment choices.

Stay Informed with Breakfast News! Get important market updates in your inbox every morning. Sign Up For Free »

High-Risk AI Investment: C3.ai

C3.ai, a popular AI stock with the ticker “AI,” has experienced significant price fluctuations recently. Ending 2022 at about $10 per share, its current price hovers around $30. Investors are optimistic about the company’s ability to implement AI solutions across industries, paving the way for potentially profitable software contracts.

However, this optimism comes with considerable risk. Over the past three years, C3.ai’s revenue grew by 49%, fueled by increasing AI investments, resulting in $347 million in revenue over the last year. Despite this growth, the company incurred a net loss of $274 million in the same period, marking a nearly 100% negative profit margin.

While demand may rise with the ongoing AI boom, expecting C3.ai to quickly turn a profit would be overly optimistic. The company has yet to show profitability and is unlikely to do so for several years. Since a stock’s value hinges on future profits, C3.ai presents high risks that could lead to disappointing outcomes for investors in 2025.

Medium-Risk AI Investment: Nvidia

Nvidia is a semiconductor giant with medium risk. The company’s products are in high demand as customers aggressively invest in this emerging market. Over the past three years, Nvidia’s revenues have soared by 320%, with its data center segment increasing by 112% year over year to $30.8 billion last quarter.

Given the plans to invest in data centers, Nvidia’s income is likely to grow again in 2025. However, this does not guarantee massive returns. Currently, Nvidia’s price-to-earnings (P/E) ratio stands at 52.4, with profit margins at an all-time high. History shows that Nvidia has faced cyclical downturns due to fluctuating demand for its chips.

It’s possible that 2025 could witness another cyclical peak for Nvidia’s product demand. While its history of innovation is a positive sign, the high P/E ratio and cyclical nature of the industry contribute to Nvidia’s medium-risk status for investors heading into 2025.

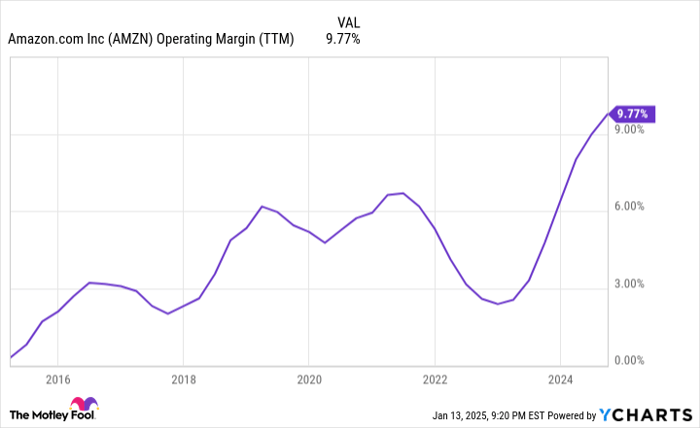

AMZN Operating Margin (TTM) data by YCharts

Low-Risk AI Investment: Amazon

Amazon, a tech leader benefiting from rising AI spending, stands out as a low-risk stock. It operates in a less cyclical industry, has improving margins, and could see revenue growth accelerate in 2025. This tech titan leads in both e-commerce and cloud computing.

The cloud computing sector has consistently expanded, driven by increasing IT workloads and a shift from traditional on-premise services. Since launching in 2006, this segment has generated steady growth, which is likely to benefit Amazon Web Services (AWS) as AI investments continue.

Amazon has favorable conditions to boost its profit margins in 2025. The North American retail operating margin has risen consistently, now standing at 5.9%, with further growth potential. Furthermore, Amazon’s rapidly growing segments—advertising and AWS—offer the highest profit margins, which will positively impact overall profitability.

If Amazon can achieve a consolidated operating margin of 15% in 2025 (up from 10% recently) and its revenue increases from $620 billion to $650 billion, the company would generate nearly $100 billion in operating income. This makes Amazon a low-risk AI investment given its current $2.3 trillion market cap.

Seize this Potentially Profitable Opportunity

Have you ever felt you missed out on some of the most successful stocks? If so, this could be your chance.

Occasionally, our team of analysts suggests a few “Double Down” stock recommendations for companies they believe are poised for growth. If you think you’ve already missed your opportunity, now’s the perfect time to act before it gets away. The numbers tell a compelling story:

- Nvidia: A $1,000 investment made when we identified this stock in 2009 would now be worth $346,349!*

- Apple: Investing $1,000 in 2008 would yield $43,229!*

- Netflix: $1,000 invested back in 2004 would be worth $454,283!*

Currently, we are issuing “Double Down” alerts for three remarkable companies, with limited opportunities on the horizon.

Discover 3 “Double Down” stocks »

*Stock Advisor returns as of January 13, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Brett Schafer has positions in Amazon. The Motley Fool holds positions in and recommends Amazon, Microsoft, and Nvidia, while also recommending C3.ai and related options. The Motley Fool follows a strict disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.