Buffett Sells Off Shares: What It Means for Bank of America

In the third quarter alone, Warren Buffett and his team at Berkshire Hathaway sold an impressive 235 million shares of Bank of America (NYSE: BAC). This marked a significant transaction, as Berkshire’s prior stake exceeded 10%. Such a high ownership requirement necessitated public disclosure via Form 4 to the Securities and Exchange Commission (SEC) whenever a sale occurred.

Bank of America has faced challenges due to rising interest rates over the past few years, leading to $89.4 billion in unrealized losses on its bond portfolio. However, predictions of falling interest rates in the next year could provide relief for the bank. For those considering investing or currently holding Bank of America stock, here are key points to weigh.

Why Investors Might Consider Selling Bank of America

Investing in banks like Bank of America can be challenging, especially in light of fluctuating interest rates. Banks typically borrow short-term funds through customer deposits and lend them long-term, meaning their profitability largely depends on the difference between loan interest earned and deposit interest paid. Consequently, banks’ stock prices are sensitive to interest rate shifts.

The recent increase in interest rates has had mixed effects on Bank of America. Net interest income swelled to $56.9 billion, marking a 33% increase over two years ending in 2023. On the downside, unrealized losses in the bank’s loan portfolio skyrocketed from $14 billion in 2021 to $102 billion last year.

Although unrealized losses do not equate to realized losses if the bank holds its assets to maturity, they could become a reality if the bank has to liquidate its securities to raise capital or manage deposit withdrawals. This risk was demonstrated by the incident involving Silicon Valley Bank (a subsidiary of SVB Financial), which faced a deposit run in March 2023, necessitating the liquidation of underwater assets and resulting in significant losses that led to federal intervention.

Despite these unrealized losses appearing concerning, Bank of America remains stable, underpinned by a solid $1.9 trillion deposit base from diverse client groups and industries.

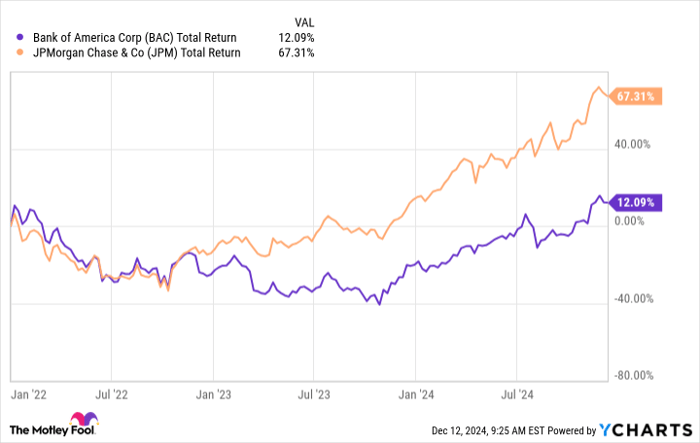

Nevertheless, the opportunity cost of capital tied up in lower-yielding investments could be hampering its profit potential. In contrast, other banks such as JPMorgan Chase have stockpiled cash since 2021, positioning themselves to take advantage of higher rates during this interest cycle.

BAC Total Return Level data by YCharts

Investors concerned about Bank of America’s handling of its loan portfolio may find it prudent to take some profits during this time.

Reasons to Consider Buying or Holding Bank of America

The Federal Reserve last year paused its cycle of increasing interest rates and has begun to lower its benchmark rate. Consequently, Bank of America’s net interest income fell approximately 3% during the first three quarters of this year. However, the decline in rates has helped reduce its unrealized losses to $89.4 billion by the end of the third quarter.

A positive aspect is that the securities in its held-to-maturity (HTM) portfolio are continuously maturing. As reported by Chief Financial Officer Alastair Borthwick, about $9 billion was freed up from its HTM portfolio in the third quarter, providing the bank an opportunity to reinvest at higher interest rates than pre-2022 levels. This, in conjunction with a steepening yield curve, puts the bank in a prime position to boost net interest income next year.

Additionally, recent election outcomes could be favorable for banks, as investors anticipate a revival in investment banking activity and potentially less stringent Basel III endgame reforms, possibly providing banks more capital than initially projected.

BAC PE Ratio data by YCharts

Currently, Bank of America is trading at a slightly elevated valuation of 16.7 times earnings and 1.74 times tangible book value. However, Buffett’s share sales shouldn’t overly concern investors. His motivations could range from reducing Berkshire’s ownership below the 10% threshold to reallocating capital in preparation for transitioning management of the investment portfolio to his team.

Despite its performance being influenced by the U.S. economy and market trends, Bank of America has demonstrated resilience. While the stock’s higher valuation may limit its upside potential, it continues to be a sound long-term investment choice.

A Potential Second Chance for Savvy Investors

Do you ever feel as though you missed out on investing in some of the most successful stocks? If so, there’s an opportunity on the horizon.

Our team of expert analysts occasionally issues a “Double Down” stock recommendation for companies they believe are poised for significant growth. If you’re apprehensive that you’ve already missed your chance to invest, now may be the perfect time to act before it’s too late. Here are some compelling examples:

- Nvidia: If you had invested $1,000 when we doubled down in 2009, you’d have $361,233!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $46,681!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $505,079!*

At this moment, we are issuing “Double Down” alerts for three remarkable companies, and these opportunities may not come around again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 9, 2024

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.