Market Response: The Impact of Geopolitical Tensions on Gold and Oil Stocks

On Tuesday afternoon, the market is navigating through growing geopolitical tensions linked to Russia, which have raised concerns over the past few days.

While the current bull market seems to be holding steady, it’s crucial not to ignore the underlying risks.

Let’s take a step back to September. At that time, the U.S. was considering allowing Ukraine to use Western-made long-range missiles to target sites deep within Russia. Russian President Vladimir Putin warned:

“If this decision is made, then it will mean nothing less than the direct participation of NATO countries—the U.S., European states—in the war in Ukraine. And that will substantively change the very essence, the very nature, of the conflict. It will mean NATO countries are fighting against Russia.”

Putin also declared:

“Russia reserves the right to use nuclear weapons in case of aggression, including if the enemy using conventional weapons poses a critical threat.”

Fast forward to yesterday—a headline from the Wall Street Journal read:

Biden Approves Ukraine’s Use of Long-Range Missiles Inside Russia

This marks a significant shift from Biden’s previous hesitance to authorize such actions. Deputy National Security Adviser Jon Finer noted that the situation has evolved, particularly with the involvement of thousands of North Korean troops supporting Russia.

Ukraine Already Uses Long-Range Missiles in Russia

This morning, reports indicated that Ukraine has indeed launched long-range missiles into Russia. The Russian Defense Ministry stated that most missiles were intercepted, but debris from one missile struck a military target, fortunately resulting in no casualties.

In response, Russian Foreign Minister Sergei Lavrov remarked:

“The fact that ATACMS were used repeatedly tonight in the Bryansk region is, of course, a signal that they [in the West] want escalation. And without the Americans, it is impossible to use these high-tech missiles.”

Consequently, Putin’s government has revised its nuclear doctrine, broadening the circumstances under which Russia might utilize nuclear weapons, now including the long-range missiles just launched by Ukraine.

Understanding Putin’s Nuclear Threats: Bluster or Real Risk?

Many analysts view the nuclear threats as bluffing. For example, a recent Newsweek article quoted defense expert Gustav Gressel:

“It’s a bluff. If they’d mean it, we’d all have had a nuclear escalation already. The change in nuclear doctrine is nonsense.”

This belief was echoed in comments from Timothy Ash, an emerging markets strategist at BlueBay Asset Management, who stated:

“Putin is bluffing again. He is terrified of getting into a conventional war with NATO, which he would likely lose in weeks.”

While these analysts may offer a reassuring perspective, it’s essential to recognize the tension surrounding the issue. A full-scale nuclear conflict would likely lead to catastrophic results and neither side desires such an escalation.

Bloomberg adds another layer to this conversation, questioning whether Putin, along with leaders like Kim Jong-un of North Korea and Xi Jinping of China, may indeed have strategies that utilize nuclear capabilities to avoid a conventional military defeat against the U.S.

Interestingly, these countries share a common understanding: in a conventional war, they would likely face defeat against America. Thus, they are developing nuclear strategies as a way to deter U.S. intervention or involvement in conflicts, potentially using smaller tactical nukes to signal their serious intent without triggering full-scale war.

While the nuclear threats may be perceived as a high-stakes game, the ongoing situation is not conducive to a market-friendly “peace dividend” that would typically benefit stock performance.

The Importance of Gold and Oil in Your Investment Portfolio

As of today, gold prices have risen by almost 2%, and oil prices have increased by more than 3%. It’s easy to get wrapped up in daily fluctuations of these commodities and question your investment strategy.

Considerations about potential overextension, the impact of a strong dollar, and possible government policy challenges are all valid concerns for short-term traders. However, for long-term investors holding quality oil stocks and gold, these concerns might be distractions.

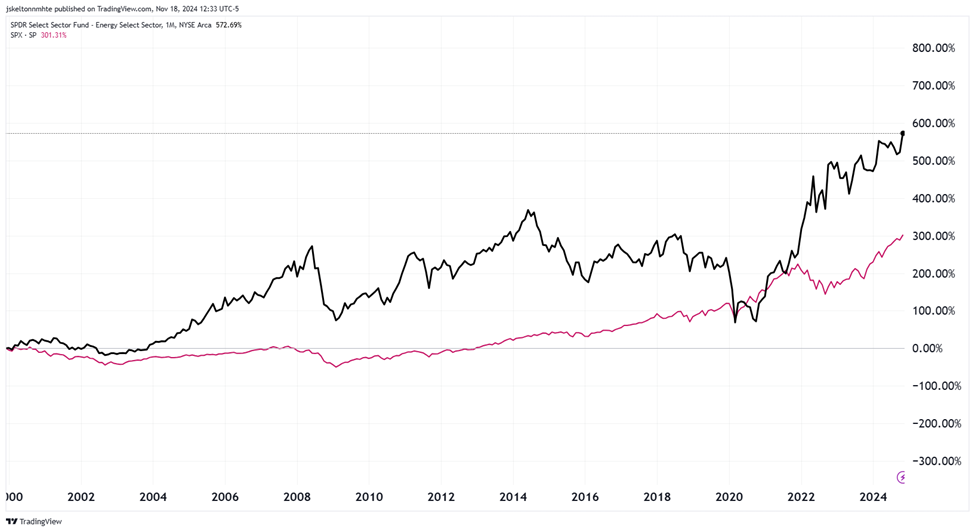

To illustrate this point, two charts below visually represent the performance of the SPDR Energy Select Sector ETF (XLE) compared to the S&P 500 over the past 25 years.

When dividends are reinvested, XLE has outperformed the S&P 500 by nearly 2-to-1.

Understanding Options: Safeguard Your Investments in Today’s Market

Some may argue, “Jeff, that proves the benefits of reinvesting and compounding dividends. In reality, investors often cash in their dividends for daily expenses or vacations.”

This perspective assumes that dividends were also reinvested in the S&P 500. However, let’s set that aside and explore another perspective through our second chart.

As illustrated below, gold—which provides no dividends—has outperformed the S&P 500 by more than 2.5 times over the same timeframe.

Surprisingly, most investors are unaware that gold has significantly surpassed the average stock in the S&P over the last 25 years.

Should You Consider Hedging Your Portfolio with Put Options?

At first glance, this might seem unusual as your portfolio continues to thrive in the ongoing bull market. Yet, the gains you’re experiencing are precisely what you should aim to protect.

The term “options” often brings to mind negative connotations. Many believe they are a fast track to losing large amounts of money. While that reputation exists, it is overly simplistic and unfair. It’s akin to saying that all cars are dangerous just because some drivers cause accidents.

Options are merely tools. Their effectiveness relies heavily on how they are utilized.

Notably, several successful investors leverage options strategically. Renowned figures such as Bill Ackman, Michael Burry, Ray Dalio, Stanley Druckenmiller, and George Soros utilize them to hedge their investments.

If you’re not familiar with options, a “put option” is designed to increase in value when the price of its underlying asset decreases.

For instance, if you own a substantial amount of Nvidia stock and anticipate potential disappointments in an upcoming earnings report, your profit could take a dive. Selling your Nvidia shares might incur hefty capital gains taxes, creating a dilemma.

Utilizing Put Options in Uncertain Times

Should Nvidia report disappointing earnings, your put options would gain value, potentially offsetting Nvidia’s losses. Conversely, if the report is positive and the stock price rises, the cost of your put options would effectively be lost, similar to paying an insurance premium.

Many investors shy away from put options, feeling that spending money on them without a payout is wasteful. However, this viewpoint seems inconsistent.

Consider how readily investors buy insurance for their homes, cars, or lives. Would we be upset if a tree doesn’t fall on our house after paying for home insurance?

The Importance of Understanding Options Now

Given the current market, with stocks at historically high valuations, now might be the best time to learn about options. I recommend marking your calendar for Tuesday, November 26. Master trader Jonathan Rose from Masters in trading Live will be hosting a special presentation aimed at showing how options can safeguard your investments.

Here’s what Jonathan has to say:

To truly grasp the potential of these options strategies, I’ve prepared a presentation that reveals how to spot the best quick trading opportunities available.

You will learn how trading professionals manage uncertainty by incorporating both upside and downside protections, keeping them adaptable to market fluctuations.

This session will also clarify how volatility influences the options market and provide essential insights for executing informed trades based on the criteria outlined.

Though we primarily discussed using options defensively, they can also serve offensive purposes, allowing for substantial gains in a brief period.

Consider this instance: when the Nasdaq surged 2% on September 19, savvy traders capitalized on this rise, making gains of 344%, 1,402%, or even 1,788%—sometimes within hours. This means a $500 investment could have escalated to as much as $9,440 in no time at all.

We will delve into this offensive strategy further in the Digest, highlighting noteworthy returns. To register for this valuable session next Tuesday, click here.

The Bull Market Outlook for 2025 and Beyond

Looking ahead, there’s a solid argument that this bull market could extend through 2025 or even longer. Yet, uncertainty remains ever-present, as seen by recent events in Ukraine and Russia, reminding us that unexpected occurrences can shake the markets.

If your financial situation cannot withstand a sharp decline in value, or if you have key stocks with large profits that need safeguarding, I encourage you to attend Jonathan’s presentation next week.

Even if options aren’t your preferred strategy, gaining insights into their use by experienced investors will enhance your investing acumen.

Best wishes,

Jeff Remsburg