The Roundhill Magnificent Seven ETF Soars, But Alternatives Await in 2025

A Closer Look at 2024’s Uneven Market Gains

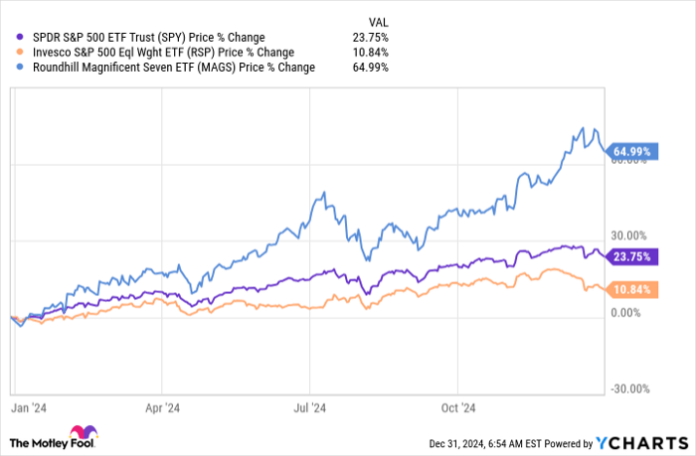

The Roundhill Magnificent Seven ETF (NASDAQ: MAGS) jumped about 65% in 2024, significantly outpacing the S&P 500 index (SNPINDEX: ^GSPC), which saw a 23% rise for the year. The ETF, which focuses on just seven companies—Nvidia, Meta Platforms, Alphabet, Amazon.com, Microsoft, Apple, and Tesla—is largely driven by a handful of major players in the growth sector. For those cautious about putting money into stocks that are largely influenced by this small group, the Vanguard Mega Cap Value ETF (NYSEMKT: MGV) may offer a more balanced choice for 2025.

When Most Stocks Lagged Behind the High Flyers

While the S&P 500’s overall gain of 23% appears promising, a closer examination reveals a diverging trend. The Invesco S&P 500 Equal Weight ETF (NYSEMKT: RSP) presents a different perspective. By equally weighting all S&P 500 stocks rather than focusing on their market capitalization, it managed only a 10% return in 2024. This stark difference highlights the dominance of the seven ultra-large companies tracked by the Roundhill ETF in driving overall market performance. Such disparities raise concerns, particularly regarding current valuation metrics.

The S&P 500 index now has a price-to-earnings (P/E) ratio nearing 24, while the average P/E for the Magnificent Seven ETF hovers around 32. Although a P/E of 32 might not seem excessively high, it is significantly above the market average, by about 33%. Investors with a value-oriented approach should consider steering clear of these stocks and potentially the broader S&P 500 as well.

Why the Vanguard Mega Cap Value ETF Is a Smart Move

The Vanguard Mega Cap Value ETF offers an average P/E ratio of about 21, which is more appealing compared to the S&P 500 and the Magnificent Seven. While some value investors might argue that a P/E above 20 disqualifies it from being a true value investment, its unique selection process makes it worthwhile. The ETF targets the largest companies but employs a multi-factor valuation model to sift through those stocks based on several metrics, including price-to-book ratio and price-to-dividend ratio. Currently, the ETF comprises 136 stocks, notably excluding any from the Magnificent Seven. Furthermore, its expense ratio is an impressively low 0.07%.

The Vanguard ETF’s Recent Performance

The Vanguard Mega Cap Value ETF’s performance closely mirrored that of the equal weight version of the S&P 500 in 2024. Investors should remember that this ETF intentionally seeks out companies that lag the market’s top performers. If you’re concerned about the skyrocketing valuations of the Magnificent Seven, this ETF provides an option to invest in large-cap stocks without the associated risk of those high valuations.

Anticipating Market Shifts

The market is known for its volatility, often oscillating between extremes. The current focus on large growth stocks exemplified by the Magnificent Seven may not sustain itself indefinitely. As interest shifts towards value-oriented companies, adding the Vanguard Mega Cap Value ETF to your portfolio as 2025 approaches may make sense. This strategic move prepares investors for a potential downturn affecting the more expensive stocks in the market.

Seize This Opportunity for Future Gains

Have you felt left out of past investment successes? There may be another chance on the horizon.

Occasionally, our team of experts identifies stocks they believe are on the verge of significant growth, termed “Double Down” stocks. If you’re worried you’ve missed your opportunity to invest, now is the ideal time to act before prices rise. Consider these numbers:

- Nvidia: Invest $1,000 when we doubled down in 2009, and you’d have $358,640!

- Apple: Invest $1,000 in 2008, and you’d have $46,181!

- Netflix: Invest $1,000 in 2004, and you’d have $478,206!

Currently, we are issuing “Double Down” alerts for three exceptional companies, and this may be one of those rare chances.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 30, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.