Infosys Sees Strong Growth Amid AI Innovations

Infosys (INFY) shares have appreciated by 25.8% year-to-date (YTD), surpassing the Zacks Computers – IT Services industry’s return of 16.1%.

This strong performance underscores Infosys’ market resilience and competitive advantage, primarily driven by its advancements in artificial intelligence (AI). The company’s commitment to building robust databases for clients has been a significant contributing factor. With a steady influx of contracts and a growing repository of AI expertise, INFY shows promising potential for revenue growth.

In a bid to enhance its AI offerings, INFY has teamed up with Google Cloud to establish a Google Cloud center of excellence. This initiative aims to foster enterprise AI innovation, powered by Infosys Topaz.

Both Google Cloud and Infosys have a legacy of delivering state-of-the-art AI and data analytics solutions to ensure client success. Currently, Infosys has made over 60,000 employees accessible on Google Cloud.

This new center intends to integrate Google Cloud’s generative AI capabilities with Infosys’ Topaz and Cobalt cloud services, providing sophisticated enterprise AI solutions to tackle intricate business and technology challenges. Organizations will be able to co-create tailored solutions that enhance efficiency across various applications, including contact center AI and application modernization.

Strategic Alliances Boosting Infosys’ Future

With over 40 years of experience managing worldwide corporate operations, Infosys adeptly guides its clients through digital transformations powered by cloud and AI.

Recently, Infosys Compaz, a subsidiary of Infosys, partnered with StarHub to accelerate its digital transformation. This collaboration will involve the integration of generative AI technologies with Infosys Topaz, as well as enhancements in cloud capabilities through Infosys Cobalt. Both companies aim to develop AI models tailored to StarHub’s telecom data.

Infosys also joined forces with RheinEnergie, a leading energy provider in Germany, targeting sustainability and transition goals in energy use. The partnership leverages Infosys Energy Cloud—part of the Infosys Cobalt suite—to facilitate the deployment of advanced cloud, data, AI, and Industry 4.0 solutions.

Latest Developments and Collaborative Efforts

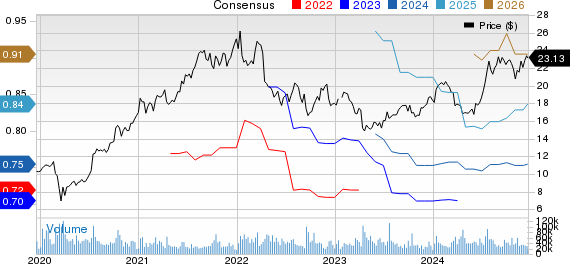

Infosys Ltd. price-consensus-chart | Infosys Ltd. Quote

Infosys has also made significant strides with Kardex, a global provider of intralogistics solutions, by utilizing SAP S/4HANA to enhance operational processes. This initiative aims to streamline Kardex’s ERP systems across over 30 countries, boosting efficiency and scalability with Infosys Cobalt.

In another notable partnership, INFY expanded its collaboration with Microsoft (MSFT) to accelerate the adoption of generative AI and Microsoft Azure among clients. This strategic alliance is designed to deliver transformative results and optimize technology investments for joint customers.

Furthermore, Infosys is enhancing its AI capabilities through alliances with industry players like NVIDIA (NVDA) and ServiceNow (NOW). By integrating its Topaz with NVIDIA’s NIMs, Infosys is set to provide innovative solutions such as TOSCA Network Service Design, a generative AI-powered network operating center.

With ServiceNow, Infosys has developed a product that merges the Now Platform with its Enterprise Service Management Cafe, improving enterprise business services’ efficiency.

Economic Headwinds Challenge Infosys

Amid this progress, Infosys is navigating several macroeconomic challenges. Persistent inflation and elevated interest rates have dampened spending among its enterprise clients. Moreover, the unpredictable economic landscape has led to weaker digital transformation initiatives and slower decision-making processes, affecting overall business volumes.

Since a significant portion of INFY’s revenue is generated in the U.S. market, fluctuations in the Indian Rupee’s value against the U.S. dollar pose additional risks to its operations.

What Investors Should Consider

Despite these hurdles, INFY maintains a steady contract flow and expanding AI expertise, indicating strong growth potential. Nevertheless, the stock’s current valuation appears stretched, as indicated by a Zacks Value Score of D, which could raise concerns for investors.

Currently, INFY holds a Zacks Rank of #4 (Sell), suggesting that existing shareholders should consider selling, while new investors may want to refrain from adding the stock to their portfolios.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Exploring Future Energy Solutions

The demand for electricity is on the rise, paralleling the global effort to phase out fossil fuels like oil and natural gas. Nuclear energy emerges as a promising alternative.

Leaders from the U.S. and 21 other countries have pledged to triple global nuclear energy capacities. This ambitious shift may yield significant profits for nuclear-related stocks, benefiting early investors.

Our report, Atomic Opportunity: Nuclear Energy’s Comeback, outlines the key players and technologies driving this trend, highlighting three standout stocks poised to gain the most.

Download Atomic Opportunity: Nuclear Energy’s Comeback free today.

For the latest recommendations from Zacks Investment Research, download 5 Stocks Set to Double for free.

Microsoft Corporation (MSFT): Free Stock Analysis Report

American Noble Gas Inc. (INFY): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

ServiceNow, Inc. (NOW): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.