“`html

Warner Bros. Discovery (WBD) has seen its shares rise by 19.9% over the past month, significantly outpacing the Zacks Consumer Discretionary sector’s 4% growth and the Zacks Broadcast Radio and Television industry’s 8.5% gain.

The surge in WBD’s stock can be linked to an expanding subscriber base for Max and a strong lineup of content, although the company still faces challenges in linear TV and studio performance.

Strategic Partnerships Boost WBD’s Future

Warner Bros. Discovery is gearing up for long-term growth by forming strategic partnerships and investing in original content. A significant factor behind its success is the Direct-to-Consumer (D2C) segment, especially the Max streaming platform.

Partnering with Disney on Hulu has enhanced Max’s market position by offering bundled services and attracting more subscribers. Max has expanded into 65 markets, boasting 110 million global subscribers.

This impressive subscriber count is fueled by popular shows like House of the Dragon, The Penguin, and Dune: Prophecy, continuing to draw in large audiences. Additionally, local content tailored to international markets, with a focus on sports and language-specific programming, has further boosted its global appeal.

However, WBD is not without its obstacles. The company’s linear television division is struggling in the U.S. amid a broader industry shift toward digital and on-demand viewing.

There are also inconsistencies in its Studios business, with films such as Joker 2 failing to deliver expected results. Increased competition from streaming giants like Netflix (NFLX), Amazon (AMZN), and new platforms is also heightening pressures in the market.

Positive Revenue Forecast for Q4

The Zacks Consensus Estimate for WBD’s fourth-quarter 2024 revenue stands at $10.52 billion, reflecting a year-over-year growth of 2.31%. Earnings per share (EPS) is estimated at 7 cents, unchanged over the past month.

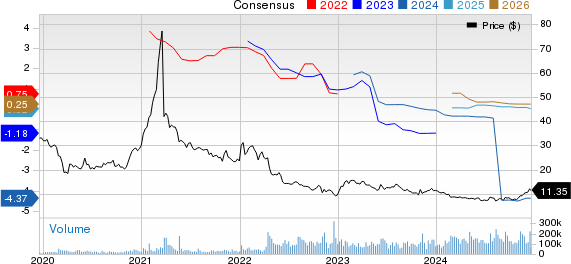

For the full year 2024, WBD’s revenues are projected at $39.76 billion, indicating a decline of 3.79% from the previous year. The consensus for the 2024 loss per share is currently estimated at $4.37, which has also not changed recently.

WBD has managed to surpass the Zacks Consensus Estimate for earnings in one of the last four quarters but missed it in the other three, with an average negative surprise of 525.45%.

Warner Bros. Discovery, Inc. Price and Consensus

Warner Bros. Discovery, Inc. price and consensus chart

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Should Investors Buy WBD Stock Now?

Although WBD is making headway in its D2C segment and expanding internationally, challenges remain from pressures on its linear TV business and underperforming studios.

Currently, WBD holds a Zacks Rank of #3 (Hold), indicating that it may be prudent for investors to wait for a more favorable opportunity to buy in.

Free Today: Insights into the Future of Energy

Electricity demand is increasing rapidly, and efforts to reduce reliance on fossil fuels are intensifying. Nuclear energy is poised to be a significant alternative.

Recently, leaders from the U.S. and 21 other nations committed to tripling global nuclear energy capacity, presenting an opportunity for substantial profits for investors who act quickly.

Our report, Atomic Opportunity: Nuclear Energy’s Comeback, highlights key players and technologies involved, identifying three standout stocks that may benefit most. Download this report free today.

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click for your free report.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Netflix, Inc. (NFLX): Free Stock Analysis Report

The Walt Disney Company (DIS): Free Stock Analysis Report

Warner Bros. Discovery, Inc. (WBD): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`