“`html

Energy Sector Gains Fuel Optimism as Traders Anticipate Trump’s Second Term

Analyzing trading opportunities, Trump’s impact on businesses, and potential for a “peace dividend”

As energy prices rise, those who followed Jeff Clark’s insights may find themselves with profitable trades as the market shows more potential for growth.

In last week’s Digest, we introduced Jeff Clark, our newest expert analyst, who has over 40 years of trading experience and boasts more than 1,000 winning trades. He recently identified a promising trading opportunity that could benefit many investors.

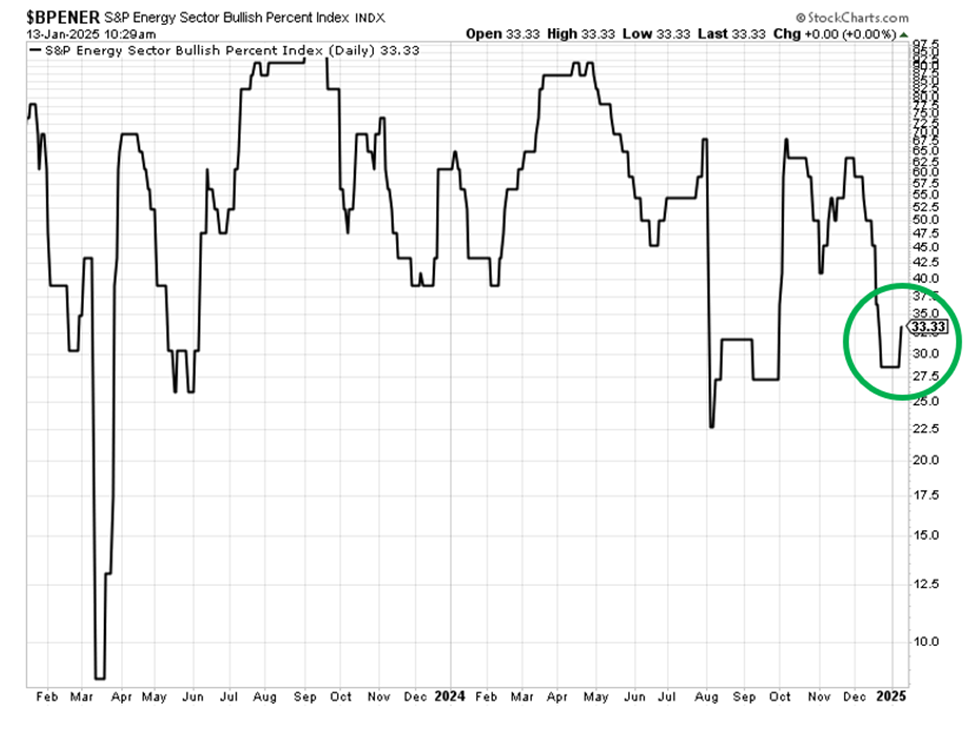

Jeff pointed out a bullish trend in XLE, the Energy Select Sector Fund, based on the performance of the Bullish Percent Index for the Energy Sector (BPENER).

According to Jeff,

The BPENER is close to generating a buy signal. If this signal behaves like past ones, oil stocks might play catch-up soon.

He noted that when the BPENER dips below 30, it often indicates an oversold market, setting the stage for a rebound. Therefore, he looks to initiate trades when he sees stocks recover above this threshold.

Last Thursday, the indicator registered at an oversold 28.57. However, following a surge in oil stocks the next day, it climbed back above 30.

Check out the latest trends in the BPENER:

Source: StockCharts.com

Between Wednesday and Thursday, XLE saw a rise of more than 5%, demonstrating the potential rewards of following Jeff’s insights.

Source: TradingView

Beyond Energy: Significant Opportunities as Trump Resumes Leadership

Long-time readers of the Digest are aware that our analysts are optimistic about investment prospects stemming from Donald Trump’s return to the presidency.

Jeff anticipates increased volatility in the markets, particularly during Trump’s initial 100 days. He expressed the potential for significant trading opportunities during this time.

Jeff stated,

With Trump’s second term, expect a wave of change and volatility ahead.

Regardless of one’s opinion on him, I’m excited about the profit opportunities this will create.

Trump’s leadership is notorious for bold and aggressive actions that influence markets. In his previous term, a few tweets could dramatically shift market dynamics.

This time, he focuses on four main areas:

Technology, Taxes, Takeovers, and Trade—commonly referred to as “the Four Ts.” Jeff believes these will unlock extensive market opportunities across various sectors.

As Jeff points out,

Anticipate sweeping deregulation in the technology sector, especially with Elon Musk at his side.

Consider the investment potential in cutting red tape for emerging technologies such as AI, cryptocurrency, and autonomous vehicles.

Trump’s advocacy for a strategic bitcoin reserve has already propelled bitcoin prices and yielded notable returns for traders.

Loosening restrictions on AI firms might accelerate artificial general intelligence development, creating a technological race with vast implications for profits.

2025 is unlikely to be a traditional buy-and-hold market.

Expect more of Jeff’s insights in the coming days. He’ll be sharing strategies at a trading event on January 22 at 1:00 ET, titled The Most Profitable 100 Days of Your Life. This event focuses on the first 100 days of Trump’s administration and offers traders important strategies.

Stay tuned for more updates.

The Business Community is Energized by Trump’s Return

The business landscape is also showing signs of buoyancy, indicating optimism around Trump’s next term. Recently, Goldman Sachs CEO David Solomon shared insights on this improving climate.

In a call reported by CNBC, he stated that CEOs are increasingly confident about the economic outlook following the election results, even before Trump officially steps into the role.

Solomon remarked, “There has been a meaningful shift in CEO confidence, particularly following the results of the U.S. election.”

“Additionally, there is a significant backlog from sponsors and an overall increased appetite for…

“`

Investor Optimism Rises Amid Improving Economic Indicators

Positive Outlook Fuels Confidence in Small Business Growth

Solomon noted an increase in dealmaking supported by a favorable regulatory environment. His comments align with findings from the latest Chicago Fed Survey of Economic Conditions, which revealed a more optimistic outlook for the upcoming year.

On Tuesday, the NFIB Small Business Optimism Index surged to its highest reading since October 2018. Bill Dunkelberg, NFIB’s Chief Economist, explained:

Optimism on Main Street is rising due to a better economic outlook following the election.

Small business owners express increased confidence in the economic plans of the new administration.

Expectations for economic growth, reduced inflation, and favorable business conditions have improved as pro-business policies are anticipated in the new year.

In the Digest, we have repeatedly discussed the current high valuations of stocks. Generally, the market appears to be overbought.

However, this doesn’t necessarily indicate an immediate market decline. Two truths can coexist: while many stocks may be overvalued, rising economic optimism and positive sentiment among investors might push prices higher for longer than expected.

This is why our stance has remained consistent for several months:

Develop a comprehensive investment strategy detailing your approach during significant market downturns (specifically, identify which stocks to sell at predetermined stop-loss levels). With a solid plan in place, continue participating in the ongoing bull market. After all, bullish momentum often prevails…until it doesn’t.

Peace Talks Could Create Major Economic Opportunities

Recently, Israel and Hamas reached a deal to halt hostilities in the Gaza Strip and release hostages held by Hamas.

As of Thursday, the agreement faces uncertainty, with Israel claiming Hamas has caused a “last-minute crisis.” Initially, the deal appeared promising:

According to The Wall Street Journal:

The agreement will unfold in phases, starting with a hostage exchange and progressing to broader discussions aimed at ending the conflict…

This arrangement is not significantly different from proposals made months ago when more Israeli hostages were alive and before extensive loss of Palestinian lives. Recent developments have brought the parties closer together…

One catalyst has been President-elect Donald Trump’s impending return to office. He warned a week ago that “all hell will break out in the Middle East” if hostages are not released by his inauguration on January 20, reiterating an earlier threat.

Details regarding the current hurdles remain unclear. NBC News reports:

Israel’s Cabinet has declined to convene to approve the ceasefire and hostage release with Hamas, citing a “last-minute crisis” created by the militant group. Prime Minister Benjamin Netanyahu’s office did not provide further details.

Meanwhile, Hamas has confirmed its commitment to the ceasefire agreement announced by mediators.

If an agreement is reached, peace in the region could have significant benefits—not only for affected populations in Israel and Gaza but also for investors in the U.S.

Louis Navellier discussed the potential investment impacts in his January Monthly Update in Growth Investor:

One goal for Trump’s next term is to bring an end to ongoing conflicts in the Middle East and between Russia and Ukraine.

If successful, this could yield a “peace dividend” similar to what occurred during Bill Clinton’s presidency. With global stability, annual GDP growth of 5% becomes attainable.

If the U.S. economy is thriving in 2025, 4% to 5% GDP growth could indeed be realistic.

Louis recently compiled a research video on investing during Trump’s second term—available for viewing here.

In Conclusion

We are witnessing an invigorated business sector, enthusiastic investors, and the prospect of a peace dividend. This combination could create favorable trading conditions.

Keep an eye on your stop-loss levels and manage your portfolio size, but with a solid strategy in place, it’s wise to stay committed to this bull market.

Best regards,

Jeff Remsburg