AI Stocks Face Corrections: Is Now the Time to Buy?

Artificial intelligence (AI) stocks provided significant returns for investors last year, boosting the Nasdaq Composite index to a double-digit gain. However, this positive trend faced challenges recently, as these leading stocks began to falter.

Concerns about the economy and potential tariffs imposed by President Donald Trump on imports from Canada, China, and Mexico have particularly hurt high-growth stocks. As a result, the Nasdaq Composite (NASDAQINDEX: ^IXIC) is now in correction territory, down more than 10% from its December peak.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Despite these market fluctuations, savvy investors recognize that such declines present buying opportunities. The dip in major AI stock prices signals the potential for bargains, especially for those willing to invest during this correction.

While uncertainty prevails regarding the economy, it’s crucial to remain mindful of the long-term outlook for AI. Today’s $200 billion AI market is projected to exceed $1 trillion by the decade’s end, indicating potential growth for select AI companies.

Two key players poised for future gains are Nvidia (NASDAQ: NVDA) and Advanced Micro Devices (NASDAQ: AMD). Both companies have recently faced valuation declines, making them interesting options during the Nasdaq correction.

Image source: Getty Images.

Nvidia: Market Leader in AI Chips

Nvidia holds a commanding 80% market share in the AI chip arena. While the company’s graphics processing units (GPUs) are among the most expensive in the industry, they also deliver outstanding performance, attracting major tech companies. The keen interest in Nvidia’s latest Blackwell architecture has outstripped supply.

This strong demand has led to impressive growth for Nvidia amidst the AI boom. The company’s quarterly revenues continue to surge, with recent figures showing a 78% rise to a record $39 billion, while full-year revenue jumped 114% to $130 billion.

Investors express concerns that Nvidia’s high GPU prices may eventually impede growth, especially as competitors develop new technologies. However, Nvidia’s commitment to annual GPU updates positions it well against rivals, potentially staving off significant market share loss.

Given its recent price drop—trading at 25 times forward earnings estimates, down from 50 earlier this year—Nvidia stands out as a compelling long-term investment.

AMD: A Strong Challenger

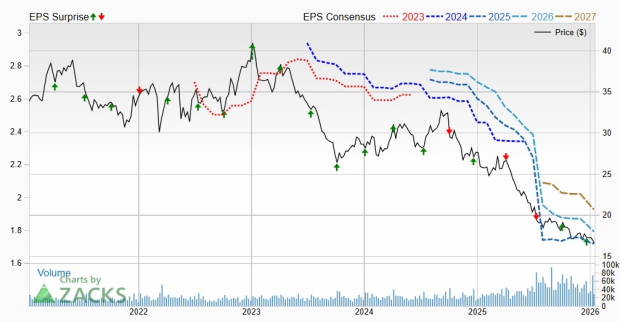

Advanced Micro Devices (AMD) is the second-largest player in the AI chip landscape, boasting a market share of approximately 10%. Though AMD’s growth has not been as rapid as Nvidia’s, it provides cost-effective GPUs for AI workloads, appealing to budget-conscious clients.

Even though major companies like Microsoft prefer Nvidia’s GPUs, they also utilize AMD products. Microsoft’s flagship MI300X GPUs, for instance, power various GPT 4-based Copilot services, creating a dual partnership between the two companies.

AMD is also focusing on innovation to remain competitive with Nvidia, with a strategy to launch new products annually. Even if Nvidia leads, AMD could experience substantial growth with this approach.

Last year proved to be a transformative one for AMD, with quarterly data center revenues surging 69% to $3.9 billion, while annual revenue jumped 94% to $12.6 billion.

Recent valuation declines have made AMD an attractive buy as well, now trading at 21 times forward earnings estimates, down from over 27 times earlier in the year.

Choosing the Best Investment

Both Nvidia and AMD present excellent additions to an AI-focused portfolio. However, if tasked with selecting one during this Nasdaq correction, Nvidia stands out. Its solid market position and innovative strategy suggest a robust long-term outlook, likely resulting in continued earnings growth.

The recent dip in Nvidia’s valuation may indeed present an opportune moment for investors ready to enter the market.

A Unique Opportunity for Investors

Do you regret missing out on investing in successful stocks previously? If so, there’s good news.

Occasionally, our expert analysts issue a “Double Down” Stock recommendation for companies set to rise significantly. If you’re concerned that you’ve already lost your chance, now might be the optimal time to invest. Recent performances emphasize the potential gains:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $300,143!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $41,138!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $495,976!*

Right now, we’re issuing “Double Down” alerts for three exceptional companies, and another opportunity like this may not arise soon.

Continue »

*Stock Advisor returns as of March 10, 2025

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.