Nvidia: A Leading Force in the AI Market, But Watch Out for Risks

Nvidia (NASDAQ: NVDA) is undeniably profiting in the booming artificial intelligence (AI) sector. Their AI accelerator chips are highly sought after for advanced AI-training systems, which are increasingly in demand.

Investing in Nvidia shares is closely tied to the ongoing AI expansion. Although it may seem like a sure bet, there are significant risks that investors should keep in mind before committing funds. Success for Nvidia could lead to even greater stock market gains.

Here’s a closer examination of the risks associated with investing in Nvidia and what it would require for the company to maintain its market leadership.

Competition in the AI Chip Market

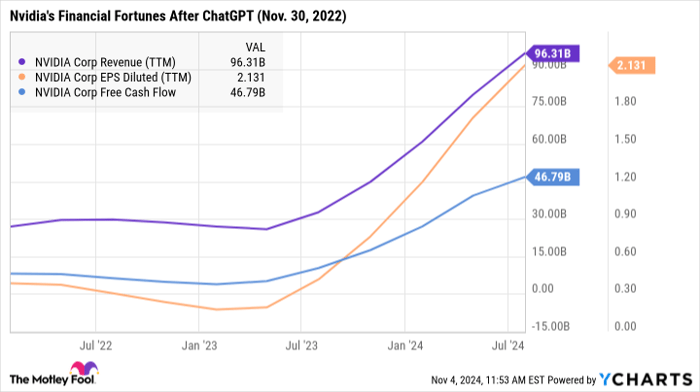

Nvidia has established a strong position, having initially provided over 10,000 V100 accelerators for OpenAI’s first public ChatGPT model. Each subsequent version will likely depend on even more advanced and costly chips. This surge in business is evident in Nvidia’s revenue growth chart, showcasing a notable increase around the ChatGPT launch:

NVDA Revenue (TTM) data by YCharts

However, Nvidia doesn’t operate in a vacuum. Competitors like Advanced Micro Devices (NASDAQ: AMD) and Intel (NASDAQ: INTC) are introducing their own chips, such as the Instinct and Gaudi processors. Major cloud providers like Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) and Amazon (NASDAQ: AMZN) order Nvidia’s products but are also developing in-house AI solutions to cut costs and meet specific needs. Even OpenAI is collaborating with Broadcom (NASDAQ: AVGO) on custom chip designs.

Each chip has its own strengths, weaknesses, and price points. With Intel boasting its own manufacturing capabilities, competitors could challenge Nvidia’s current dominance. If another company emerges victorious in the AI chip race, Nvidia’s stock could face a sudden drop.

Nvidia’s Valuation Raises Questions

The rise in Nvidia’s stock price has been striking, gaining 928% over the last two years and 216% in the past year alone. With a current market cap of $3.4 trillion, Nvidia trades at a very high valuation of 74 times free cash flow and 36 times sales.

This valuation is typical for an ambitious growth company. Nvidia will have to consistently deliver significant sales growth and profits to justify its high stock price. Any missteps could lead to a quick market correction as investors reassess the company’s future prospects.

External Factors Affecting Nvidia

Despite Nvidia’s impressive statistics, the company cannot control everything.

Economic downturns could impact the demand for AI products, while competitors might introduce more appealing offerings in upcoming product generations. Regulatory actions in major markets such as China and the U.S. pose additional challenges, as do supply chain disruptions from natural disasters or international conflicts.

No investment is devoid of risk, and the sudden emergence of unforeseen events can destabilize even the most vibrant companies.

Reasons to Consider Investing in Nvidia

Nonetheless, many investors are motivated to buy Nvidia shares.

The revenue and earnings growth depicted in the earlier chart reinforces why Nvidia is an attractive investment, even with its high valuation ratios, which have decreased since their peak summer of 2023. The company’s robust financial results support investor optimism.

While it’s wise to consider competition, Nvidia remains a leader in the AI hardware market. Rivals will need considerable effort to catch up. Additionally, Nvidia has recently replaced Intel in the Dow Jones Industrial Average (DJINDICES: ^DJI), signaling a major shift in the semiconductor landscape. The company’s substantial cash profits are expected to fuel its ongoing product development efforts, maintaining its competitive edge.

Weighing Optimism Against Potential Risks

Understanding Nvidia’s appeal in today’s volatile market is important, given the mix of high valuation and considerable business risks. The company’s presence in the AI market is substantial, and the impressive cash flow may contribute to its long-term success.

Personally, Nvidia has performed well in my portfolio. Although I sold some shares in February, I’ve retained the majority of my holdings. While I believe the current stock price may be a bit high considering the risks, I’m optimistic about Nvidia’s future, making a small position in the company appealing for growth investors looking ahead to 2024.

Seize Your Opportunity with “Double Down” Stocks

Do you feel like you missed opportunities with major stocks? There’s good news.

Occasionally, our analysts spot “Double Down” stock opportunities—companies expected to experience significant growth soon. If you’re concerned about missing out, now may be the best time to invest. Consider these impressive growth stories:

- Amazon: $1,000 invested in 2010 would be worth $22,050!*

- Apple: $1,000 invested in 2008 would be worth $41,999!*

- Netflix: $1,000 invested in 2004 would be worth $407,440!*

Currently, we’re issuing “Double Down” alerts for three exceptional companies, representing a potential opportunity you won’t want to miss!

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 4, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Anders Bylund has positions in Alphabet, Amazon, Intel, and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, and Nvidia. The Motley Fool recommends Broadcom and Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.