Rising Inflation May Challenge Stock Market Predictions for 2025

Reinflation pressures are clearly heating up – before any new tariffs have even been enacted.

As we look ahead to 2025, I maintain a positive outlook for stocks. Recently, I shared my 10 big market predictions for the upcoming year, forecasting that the S&P 500 will increase by more than 20%, achieving its third consecutive year of over 20% growth.

However, there are significant hurdles that could impede stock growth this year. One specific risk has the potential to undermine this bull market entirely, leading to a decline in stock prices within the next 12 months.

Before diving deeper, it’s important to clarify that I don’t expect this risk to manifest; nonetheless, it warrants attention.

What is this looming threat?Reinflation.

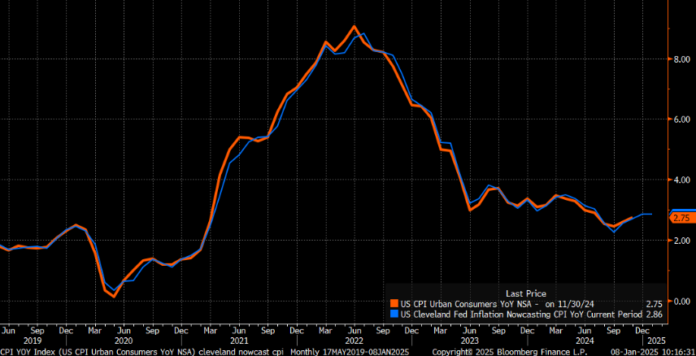

Looking back, inflation was a major concern on Wall Street during 2021 and 2022. The U.S. inflation rate skyrocketed from 1% in early 2021 to 9% by mid-2022. This prompted the U.S. Federal Reserve to initiate its most aggressive interest rate hike strategy in nearly half a century. Borrowing costs and Treasury yields surged, contributing to an economic slowdown and resulting in a bear market for stocks.

However, since the summer of 2022, this issue has been largely addressed.

From summer 2022 through late 2024, the inflation rate decreased from 9% to below 2.5%. The Fed ceased its rate hikes and began cutting rates, leading to a reduction in Treasury yields and interest rates. Consequently, the economy improved, and stock prices soared.

Most analysts expect this trend to continue into 2025.

Inflation is anticipated to gradually decline, allowing the Fed to implement further rate cuts. As lending rates and Treasury yields fall, the economy could further strengthen, which would help propel stock prices upward.

This aligns with my own expectations.

However, there is a chance the opposite could occur.

If Inflation Keeps Rising…

There exists the possibility that inflation will not continue its downward trend, which could spell trouble for the stock market.

Recently, inflation has shown signs of stagnation. Although it fell consistently from 9% in June 2022 to 2.5% in September 2024, it has started to rise once again. The inflation rate increased from 2.5% to 2.6% in October and then to 2.8% in November. Current estimates suggest it could reach 2.9% in December.

In short, we are observing three consecutive months of rising inflation.

While these increases are minor compared to the spikes seen in 2021 and 2022, they present a scenario worth monitoring.

But what if that crawl starts to pick up speed?

This scenario is a distinct possibility.

Transportation and production costs heavily depend on oil prices, which have recently surged from $67 to $74 per barrel. Additionally, the economy appears to be gaining strength, spurred by increased consumer and business confidence in late 2024, culminating in a record holiday shopping season. Nonetheless, this increased spending has generated unwanted inflationary pressures.

For instance, the Institute for Supply Management (ISM) recently reported a substantial rise in its Prices Paid index for December, reaching its highest point in a year—a notable indicator of inflation.

“`html

Inflation Concerns and Tariff Talks: What it Means for the U.S. Economy

Reinflation pressures are clearly heating up.

And this is before any new tariffs have even been enacted.

The Tariff Debate In Full Swing

As President-elect Donald Trump hits the campaign trail, he has promised substantial tariffs. While we are yet to see how these promises translate into action, Trump has recently dismissed a Washington Post report claiming he would ease off on tariffs. Since then, he has emphasized the need for tariffs in several public statements.

It appears some form of tariffs are inevitable, and they could be quite significant.

These tariffs would likely lead to increased costs, contributing to more reinflation. Historically, when Trump introduced a range of tariffs in 2018, the U.S. inflation rate surged by nearly 100 basis points in just months.

If a similar situation unfolds this time, we could see inflation reaching close to 4% by late 2025. Such a high inflation rate wouldn’t just halt any interest rate cuts from the Federal Reserve; it could actually lead to rate hikes.

This economy cannot withstand additional rate increases.

Take mortgage rates, for instance, which currently stand at 7%. The U.S. housing market is struggling, with home sales falling to their lowest levels since 1995 last year. A spike in mortgage rates could potentially trigger a collapse in the housing market.

This scenario is reminiscent of 2008, when the U.S. faced its worst economic recession since the Great Depression.

However, higher interest rates won’t only affect housing. The auto market is also at risk. With financing rates currently high, car sales have stagnated. Increased rates would only exacerbate this problem.

Adding to the concern, consumers have reached their credit limits. Total credit card debt in the U.S. rose to nearly $1.2 trillion in the third quarter of 2024, a record high.

Currently, the average annual percentage rate (APR) on all that credit card debt is about 20%. What happens if those rates rise to 30% or even 40%?

The Inflation Risk Assessment

In summary, the heavily indebted U.S. consumer cannot endure higher interest rates. However, if inflation significantly reaccelerates in 2025, that’s likely what we will face.

That said, I don’t believe this will happen. My current outlook suggests that AI-driven productivity gains and an increase in domestic energy supply will help keep inflation on a downward trend, potentially reaching 2% by 2025. Although tariffs will likely be enacted, they will probably be less extensive than promised. This should result in lower inflation, reduced interest rates, and a booming stock market.

Still, the risk of the opposite scenario is tangible, warranting close monitoring.

Given our optimistic stance, we are focused on AI stocks as we enter the new year.

To identify some of the best AI stocks to consider, we are looking to insights from Elon Musk and his AI initiatives.

Discover more about xAI now to prepare your portfolio for the coming months.

On the date of publication, Luke Lango did not hold (either directly or indirectly) any positions in the securities mentioned in this article.

P.S. Stay informed with Luke’s latest market insights by checking out our Daily Notes! For the most recent analysis, visit the subscriber sections of Innovation Investor or Early Stage Investor.

“`