Trade Turbulence Averted: A Look at Market Resilience and Investor Opportunities

That was a close call.

In a gripping moment reminiscent of a financial thriller, U.S. President Donald Trump sparked a whirlwind of economic uncertainty on Saturday night. He announced new tariffs on America’s three largest trading partners: Canada, Mexico, and China. This announcement sent risk assets tumbling, marking one of the most significant market declines in recent history.

The potential for a full-blown trade war loomed ominously, threatening to dismantle years of economic advancement.

However, just as many prepared for the worst, a plot twist emerged…

On Monday, in a tense last-minute effort, Canada and Mexico secured vital deals with the U.S. that postponed these tariffs. For now, a global trade war has been sidestepped, leading to a vigorous market rebound worldwide.

While some may see this as a sign of heightened market volatility, we view it as the onset of new investment opportunities.

Let me clarify.

Crypto Markets Poised for Growth in Turbulent Times

Amid the upheaval in traditional markets, the cryptocurrency sphere often serves as a safe haven during unpredictable economic times. Given its unique position separate from conventional market dynamics, cryptocurrencies could emerge as a promising option for investors looking to navigate this sudden shift.

Although we acknowledge the potential bounce-back in stocks after averting a trade war, we believe cryptocurrencies might outperform equities in the coming weeks and months.

It appears we may be entering “altcoin season.”

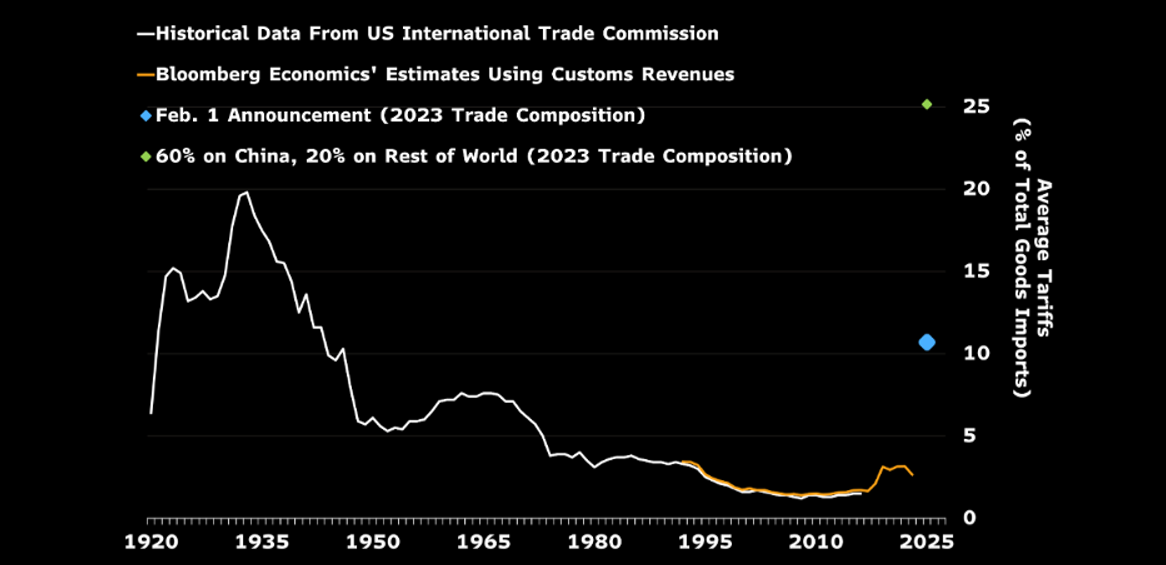

Let’s revisit the trade war that narrowly missed becoming a reality. On Saturday night, Trump proposed a 25% tariff on numerous goods from Mexico and Canada, alongside an added 10% tariff on various Chinese imports. Collectively, these tariffs could have affected approximately $1.3 trillion in trade, accounting for about 5% of U.S. GDP. Bloomberg’s analysis indicated this would elevate the average U.S. tariff rate from 3% to 11%, the highest level since prior to 1950.

The announcement of these tariffs provoked strong reactions in the market because their implementation could have severely hindered the U.S. economy and reignited inflation concerns.

Research from the Federal Reserve highlights that each percentage point increase in the average U.S. tariff rate tends to align with a 0.15% decrease in GDP growth coupled with a 0.1% increase in the core PCE inflation rate. Therefore, an eight-point increase in the average tariff due to Trump’s proposed tariffs could theoretically slow GDP by 1.2% and raise core PCE inflation by 0.8%. If this were to happen, we might witness a sluggish U.S. economy with around 1% growth and inflation over 3%.

Such numbers are concerning.

Stocks typically struggle in these conditions. Historically, since 1947, the stock market has rallied in two out of every three quarters, enjoying an average quarterly return of over 2%. However, when GDP growth hovers around 1% and inflation exceeds 3%, the stock market rises only 44% of the time, with an average quarterly decline of more than 2%. This graphic illustrates the trend:

Market Stability: Tariffs Avoided and Opportunities Ahead

The stock market had been anxious about the potential impact of President Trump’s tariffs. Investors feared an economic slowdown and rising inflation, which could harm stock values. This concern led to a sell-off in risk assets.

However, recent last-minute agreements mean that these tariffs will not take effect. This trend suggests that significant tariffs may be avoided in the near future.

Navigating Tariffs: A Strategic Approach

Trump appears to utilize tariffs strategically as a bargaining chip to reach other objectives, such as border security. When his goals are met, he often retracts the tariffs.

For example, Trump threatened Mexico and Canada with tariffs, leading both nations to negotiate with the U.S. and ultimately postpone the tariffs.

This could create a consistent pattern going forward.

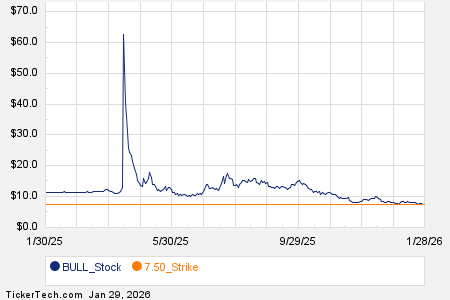

Typically, Trump threatens tariffs, causing stock and cryptocurrency prices to fall, and then the affected country capitulates, leading to a recovery in the market.

The potential risk lies in whether other countries will resist these pressures. Nevertheless, the U.S. currently retains significant economic power, far exceeding most nations, which likely gives the U.S. leverage in these discussions. While China poses a challenge, the trade disputes have been ongoing for years.

Assuming many countries do agree to negotiate, we may continue to see this “lather, rinse, and repeat” dynamic regarding tariffs, with other nations mirroring Canada and Mexico by reaching agreements to stave off confrontations.

This suggests that a full-scale global trade war may be avoided for the remainder of 2025.

This indicates a favorable moment to invest in cryptocurrencies.

What This Means for You

In addition to cryptocurrencies, it could also be a prime time to invest in stocks. The market is positioned to rebound this year due to advancements in AI, regulatory changes, and increasing consumer and business confidence.

However, cryptocurrencies might yield even better returns.

We stand at the brink of a new era for cryptocurrencies, with the possibility of three specific policies emerging that could trigger a significant crypto boom in 2025.

Yet a word of caution: Don’t just buy Bitcoin and assume that’s enough.

After nearly a year of research, I’m excited to introduce the Great American Crypto Project. This quant-based trading algorithm aims to identify patterns where cryptocurrencies could substantially increase in value—tenfold, fiftyfold, or even a hundredfold—within 90 days or less.

For those interested in learning more, I will be hosting an emergency crypto market webinar this Thursday, Feb. 6, at 10 a.m. ET.

During the webinar, I will share my predictions for the crypto market in 2025 and explain why this year could mirror 2021, when numerous altcoins surged over 5,000% in just one year.

I’ll also reveal my crypto trading algorithm, used to identify three cryptocurrencies set to soar in 2025.

Reserve your seat now.

As of the publication date, Luke Lango does not own, directly or indirectly, any positions in the securities mentioned in this article.

P.S. Stay updated with Luke’s latest market insights by checking out our Daily Notes! Find the latest edition on your Innovation Investor or Early Stage Investor subscription site.