Investing in AMD Amid Mixed Signals and Market Volatility

Although China’s DeepSeek model poses a challenge to the artificial intelligence landscape, semiconductor leader Advanced Micro Devices Inc AMD faces additional pressures. With the company’s key fourth-quarter earnings report approaching, investors may benefit from adopting a neutral strategy like an iron condor.

AMD Faces Unique Challenges

Advanced Micro is receiving mixed messages in the market. On the downside, the looming DeepSeek cloud continues to cast uncertainty. Recently, semiconductor powerhouse Nvidia Corp. NVDA experienced a staggering loss of nearly $600 billion in market value, leading to a 17% drop in its stock price. This shift dropped Nvidia from the title of the world’s most valuable company to third place.

On the other hand, Melius Research’s analyst Ben Reitzes notes that concerns about DeepSeek don’t fully capture the skepticism surrounding AMD stock. He downgraded it from Buy to Hold and adjusted the price target from $160 to $129, mainly due to expectations of slowing demand for AMD’s graphics processors and caution regarding its x86 servers and PCs.

However, it’s essential to maintain perspective. Goldman Sachs analyst Peter Oppenheimer expressed that recession fears might be overstated. He sees the DeepSeek backlash as more of a market correction than a signal of a broader downturn, citing the U.S. economy’s stability.

Adding to the positive sentiment, investor Cathie Wood has taken advantage of the dip in AMD stock through her Ark Invest exchange-traded funds. Still, AMD struggles to regain levels seen just last week, and Nvidia, along with other tech giants, remains focused on the effects of DeepSeek, implying a cautious stance for investors.

Lack of Clear Direction for AMD Stock

Speculatively, some may view AMD stock as an attractive dip-buying opportunity. Prior to the DeepSeek concerns, the focus was primarily on generative AI, with the belief that success in this sector would positively affect all tech stocks. With recent doubts surrounding the effectiveness of DeepSeek, AMD may appear undervalued.

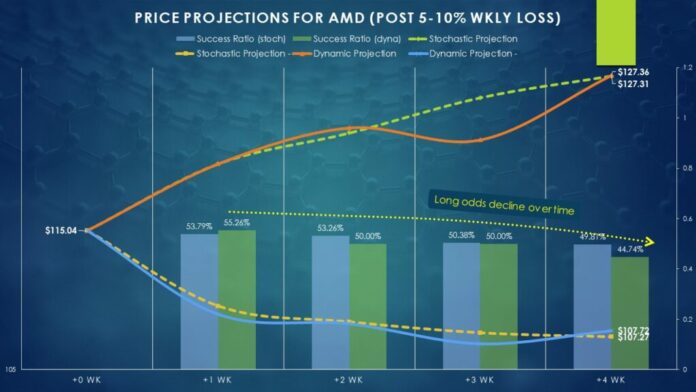

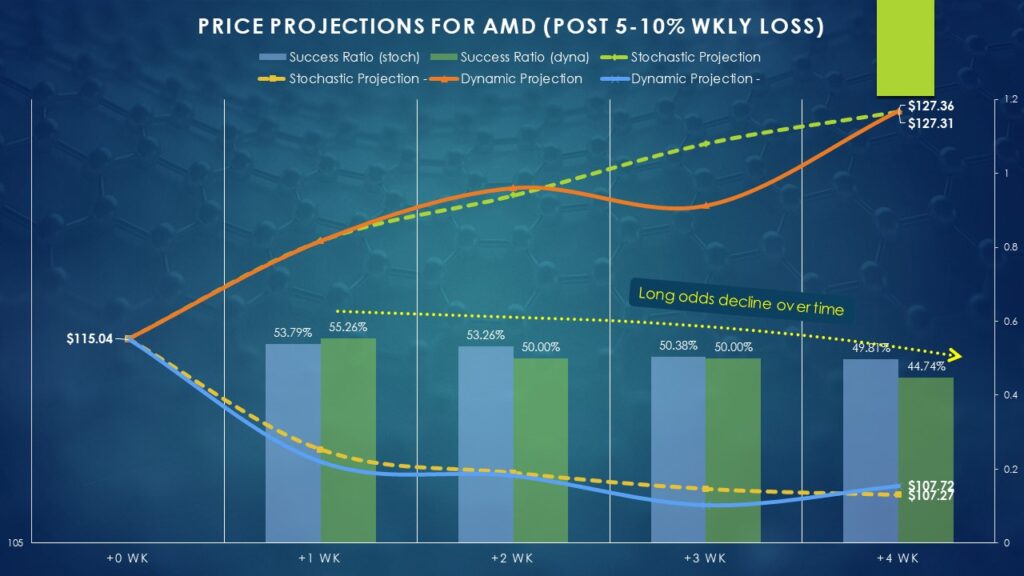

Yet, AMD’s stock lacks clear directional confidence. While Nvidia displays a strong upward trend, AMD’s stock reveals a more uncertain path. Analyzing stochastic factors over the last five years, there is a 53.79% chance that a position taken at the beginning of the week will increase by week’s end. Unfortunately, the likelihood drops to 49.81% over a four-week period.

In contrast, Nvidia’s stock shows a stronger upward bias, with a 66.3% probability of profitability over a similar four-week timeframe.

When examining AMD’s stock further, it closed at $115.04 on Monday, marking a roughly 6% decline within the week. Historically, when a stock declines between 5% to 10% over one week, the chances of a profitable long position in the following four weeks drop to 44.74%.

On a positive note, during a four-week period following significant losses, the median positive return for AMD stands at 10.71%, while the median loss is 6.36%. Under stochastic conditions, the median return is similarly reflective, at 10.67% positive against a 6.75% loss.

Iron Condors: A Strategic Middle Ground

For traders, betting against AMD stock might seem risky given the company’s overall appeal. Additionally, the presence of notable investors like Cathie Wood adds a layer of intrigue. Consequently, a long iron condor strategy — a mix of bull call spreads and bear put spreads — could serve as a sensible compromise in these uncertain times.

Iron condors are intricate trades that require considerable knowledge. Simply put, this strategy creates two profit zones, allowing traders to profit regardless of whether the stock rises or falls, as long as it moves within designated ranges.

In essence, fluidity is crucial for iron condor traders, while stagnation presents challenges.

Current market analysis indicates AMD stock could potentially reach over $127 by the options chain expiration on February 21. Conversely, under less optimistic projections, it may fall to about $107.

Notably, the implied volatility within the market suggests that significant price movements are expected, with only the ultimate direction remaining uncertain.

At present, the suggested trade involves a 110P | 113P || 122C | 125C long iron condor, combining a bear put spread with a bull call spread. This strategy presents a risk of $235 with a potential return of up to $65.

Read Next:

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.