NetApp Shows Strong Performance Despite Market Challenges

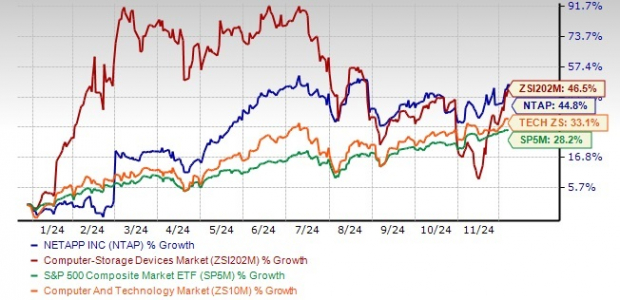

NetApp’s NTAP shares have gained 44.8% year to date, outperforming the Zacks Computer and Technology sector and the S&P 500, which grew 33.1% and 28.2%, respectively. However, NTAP’s gains are slightly below the sub-industry’s increase of 46.5%.

Year-to-Date Stock Performance

Image Source: Zacks Investment Research

NetApp specializes in enterprise storage along with data management software and hardware products. NTAP stocks closed at $127.60 in the most recent trading session, 5.8% shy of the 52-week peak of $135.45, reached on November 22, 2024. With this slight pullback and several favorable technical indicators, investors might wonder if NTAP is an appealing investment opportunity. Let’s explore this further.

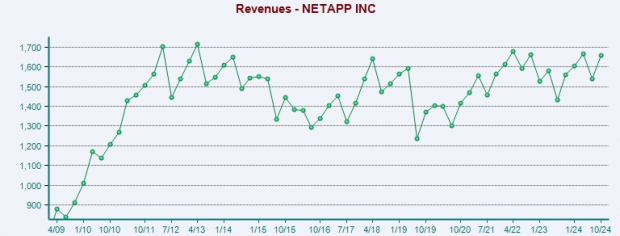

Strong Demand for Flash Storage Boosts NTAP

NetApp is experiencing increased interest in its all-flash array products, particularly the C-series and ASA block-optimized flash. Their new A-series models are also gaining traction. These products enhance workloads for both traditional enterprise applications and Generative AI. The company anticipates that the combination of its AFF A-series, C-series, and ASA products will secure additional market share in the all-flash sector.

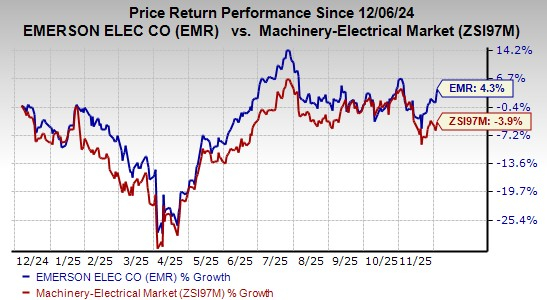

Image Source: Zacks Investment Research

In the fiscal second quarter, NetApp’s All-Flash Array Business reported an annualized net revenue run rate of $3.8 billion, a 19% increase from the previous year. Overall billings also rose by 9% year over year to $1.59 billion. Additionally, Keystone’s storage-as-a-service offering saw revenues grow more than 55% in the fiscal second quarter, with unbilled RPO up 11% quarter-over-quarter at $330 million. Unbilled RPO is a vital measure of Keystone’s growth potential.

Growth in Public Cloud Segment

NetApp’s Public Cloud business is benefitting from strong demand for hyperscaler first-party and marketplace storage services. This segment encompasses revenues from various services including cloud automation and infrastructure monitoring. For this segment, revenues rose by 9% to $168 million, driven by a significant increase of 43% in cloud storage services. Based on the current trends, NetApp expects cloud revenues to return to double-digit growth in the upcoming quarter.

AI Growth Opportunities for NTAP

Rising interest in cloud storage and AI solutions further supports NetApp’s growth. In the fiscal second quarter, the company secured over 100 AI and data lake modernization contracts. They are also collaborating with major players to develop Generative AI solutions for both cloud and on-premises applications.

NetApp expanded its partnership with Google Cloud to provide foundational data storage for the Google Distributed Cloud, aiming to deliver AI-ready infrastructure for the public sector and highly regulated industries. Leveraging ONTAP and StorageGRID solutions, NetApp enables clients to scale operations while maintaining security and compliance. Google will utilize these capabilities to support its database, AI, and analytics services.

Revised Financial Forecasts

Thanks to strong performance in various sectors, NetApp has raised its revenue outlook for the year. The company now predicts full-year revenues between $6.54 and $6.74 billion, representing a 6% growth at the mid-point compared to prior expectations of $6.48 to $6.68 billion. For fiscal 2025, non-GAAP earnings per share are expected to range from $7.20 to $7.40, a 13% increase year over year. Previously, the estimate was between $7.00 and $7.20 per share. Looking further ahead, the company anticipates mid-to-upper single-digit revenue growth and double-digit earnings growth through fiscal 2027.

For fiscal 2025, NetApp expects non-GAAP gross margins between 71-72%, while operating margins are anticipated to be around 28-28.5%, an increase from the previous 27-28% forecast.

Solid Capital Strategy

As of October 25, 2024, NetApp reported $2.22 billion in cash and cash equivalents, alongside long-term debt of $1.244 billion. In the fiscal second quarter, the company generated $105 million in net cash from operations, resulting in a free cash flow of $60 million. This solid balance sheet provides NetApp with the flexibility to potentially pursue growth opportunities, including acquisitions.

The robust financial position supports NetApp’s commitment to shareholder returns. The firm returned $406 million to shareholders through dividends and share repurchases in the fiscal second quarter, and it has $800 million left in share repurchase authorization.

NetApp declared a dividend of 52 cents per share, with a payment date of January 22, 2025, for shareholders of record by January 3.

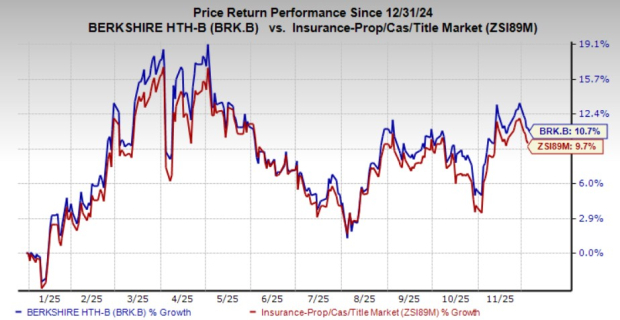

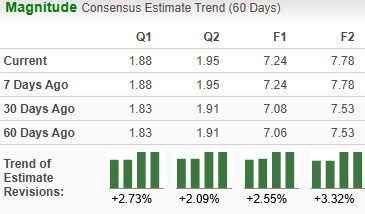

Positive Analyst Outlook

Over the last two months, analysts have raised their earnings estimates for the current and next quarter by 2.7% and 2.1%, resulting in projections of $1.88 and $1.95 per share, respectively. Estimates for the current fiscal year increased by 2.6% to $7.24 per share.

Image Source: Zacks Investment Research

Challenges Ahead for NTAP

Despite its positive outlook, NetApp faces some challenges, including anticipated declines in free cash flow for fiscal 2025 due to cash outflows related to SSD costs. Additionally, the company expects a slight reduction in product gross margins during the second half of fiscal 2025, although margins are expected to remain in the high 50% range. This situation arises from higher costs tied to SSD contracts, which were secured at elevated prices to mitigate supply chain risks.

The company must also navigate a tough IT spending environment and significant competition from firms like Pure Storage (PSTG), Western Digital Corporation (WDC), and Teradata Corporation (TDC) in the flash and cloud marketplace.

High Valuation for NTAP

Lastly, NTAP stock is currently trading at a forward Price/Earnings ratio of 16.86X, indicating a premium valuation in the market.

“`html

Analyzing NetApp (NTAP): Cautious Optimism for 2025

NetApp (NTAP) has shown robust capabilities in the all-flash storage and cloud markets, but challenges lie ahead that investors should consider.

Strength in Key Markets

NetApp continues to benefit from its strong presence in the all-flash storage and cloud sectors. The momentum in artificial intelligence (AI) applications also offers potential growth opportunities. However, the company could face several difficulties that may impact its stock price.

Potential Challenges Ahead

While NTAP shows promise, it is not without its challenges. Factors such as potential margin compression and reduced free cash flow from solid-state drive (SSD) outflows could exert downward pressure on the company’s stock. Furthermore, a sluggish IT spending environment and intense competition pose additional risks.

Currently, NTAP holds a Zacks Rank #3 (Hold), indicating that now may not be the ideal time to buy. Investors might want to wait for a more advantageous entry point. For more insights, check the complete list of Zacks #1 Rank (Strong Buy) stocks here.

Insights for Future Success

Looking ahead to 2025, Zacks has identified ten stocks that may outperform the market significantly. Historical performance has been impressive; from 2012 to November 2024, the Zacks Top 10 Stocks portfolio saw a return of +2,112.6%, far surpassing the S&P 500’s +475.6% over the same time frame. Director of Research Sheraz Mian plans to select the best stocks from a pool of 4,400 companies. Don’t miss the chance to learn about these choices when they become available on January 2.

Be First to New Top 10 Stocks >>

If you’re seeking more knowledgeable investment tips, consider downloading “5 Stocks Set to Double” for free by clicking here.

For detailed analysis reports, check out the links below:

- NetApp, Inc. (NTAP) : Free Stock Analysis Report

- Western Digital Corporation (WDC) : Free Stock Analysis Report

- Teradata Corporation (TDC) : Free Stock Analysis Report

- Pure Storage, Inc. (PSTG) : Free Stock Analysis Report

To read this article on Zacks.com, click here.

The views expressed in this article reflect the author’s opinions and do not necessarily represent those of Nasdaq, Inc.

“`