Investing Insights: Evaluating Netflix’s Stock Recommendations

When deciding whether to Buy, Sell, or Hold a stock, many investors seek the advice of Wall Street analysts. But how much do those recommendations truly influence a stock’s performance? Let’s examine Netflix (NFLX) and consider the validity of these brokerage insights.

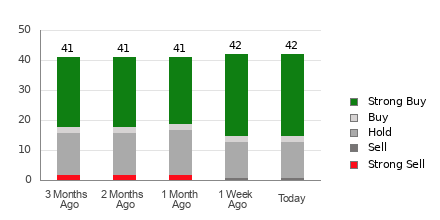

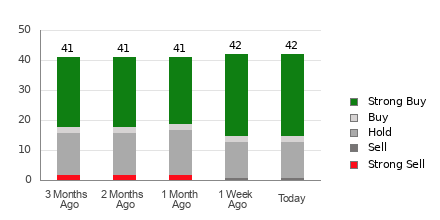

Currently, Netflix holds an average brokerage recommendation (ABR) of 1.68 on a scale of 1 to 5, where 1 indicates a Strong Buy and 5 signals a Strong Sell. This figure is derived from the evaluations of 42 brokerage firms. Essentially, an ABR of 1.68 suggests a preference for buying Netflix shares.

Out of the 42 recommendations, 27 fall into the Strong Buy category, while two are rated as Buy. Together, these recommendations represent 64.3% and 4.8% of the total, respectively.

Understanding Current Recommendations for Netflix

Explore price targets and forecasts for Netflix here>>>

Despite a favorable ABR, making an investment based solely on this rating might not be prudent. Research indicates that brokerage recommendations may not reliably lead investors to stocks with the highest potential for price increases. Why? Analysts often display a bias due to the interests of the brokerage firms they work for, frequently favoring their rated stocks.

For every recommendation of “Strong Sell,” there are about five “Strong Buy” ratings. This disparity raises questions about the alignment of analysts’ interests with those of retail investors, potentially obscuring the true direction of stock prices.

Instead of relying solely on brokerage recommendations, investors might use this information to support their own research or other successful indicators when assessing stock movements.

Our Zacks Rank system stands out as a robust tool for evaluating stock performance, classifying shares on a scale from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). Backed by external audits, this method effectively predicts a stock’s near-term price movements more reliably than typical brokerage recommendations.

Differentiating Between Zacks Rank and ABR

While both Zacks Rank and ABR utilize a 1-5 scale, they assess different criteria. The ABR is calculated solely from brokerage ratings and usually presented in decimal format (e.g., 1.28). Conversely, the Zacks Rank is based on earnings estimate revisions and represented in whole numbers.

Brokerage analysts have a history of providing overly optimistic recommendations due to their firms’ vested interests. Consequently, these ratings frequently misguide investors rather than assist them. In contrast, Zacks Rank focuses on earnings estimate revisions, which have consistently shown a strong connection to price movements in the near term.

Furthermore, the Zacks Rank applies its grades uniformly across all stocks for which earnings estimates exist from brokerage analysts, ensuring a balanced view among its rankings.

This brings us to another distinction: timeliness. The ABR may not reflect the latest data, while the Zacks Rank quickly incorporates revisions, making it a timely predictor of future stock prices.

Considering an Investment in Netflix

Recent data indicates that the Zacks Consensus Estimate for Netflix’s current year earnings has risen by 4% over the past month to $24.58.

Analysts appear increasingly optimistic about Netflix’s earnings potential, as reflected by their coordinated upward revisions of earnings per share (EPS) estimates, positioning the stock for possible growth in the near term.

This significant shift in consensus estimates, along with additional factors related to earnings predictions, has led to a Zacks Rank of #2 (Buy) for Netflix. For a complete list of Zacks Rank #1 (Strong Buy) stocks, click here>>>>

Thus, while the Buy-equivalent ABR may provide some guidance, it is essential for investors to conduct thorough research.

Recently Released: Zacks Top 10 Stocks for 2025

Act now to discover the top 10 stocks for 2025, handpicked by Zacks Director of Research Sheraz Mian. This well-vetted portfolio has consistently outperformed expectations, with a staggering gain of 2,112.6% since its inception in 2012, far surpassing the S&P 500’s return of +475.6%. You could be among the first to explore these newly identified opportunities with high potential.

See New Top 10 Stocks >>

Want to stay informed with the latest recommendations from Zacks Investment Research? You can download 7 Best Stocks for the Next 30 Days now for free.

Netflix, Inc. (NFLX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.