Netflix’s Ascension to a 52-Week High

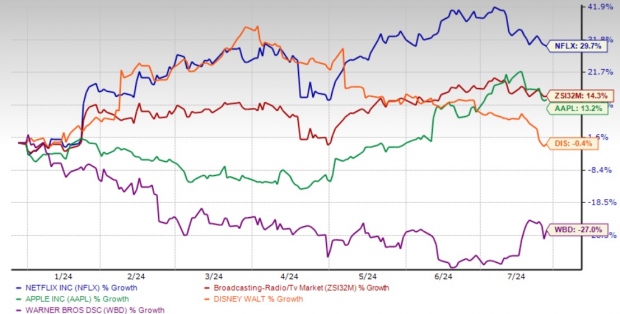

Amidst the tumultuous waves of the stock market, Netflix (NFLX) has ridden a high tide, cresting at a 52-week peak of $715.66 before settling at $704.32 on September 19. This surge, symbolic of investors’ unwavering faith, comes on the heels of a series of strategic maneuvers that have bolstered the company’s trajectory. Over the past year, Netflix has witnessed an impressive 83.3% uptick in its stock value, outstripping its competitors and affirming the company’s prowess in the streaming domain.

NFLX’s Innovative Strategy and Content Pipeline

A standout factor propelling Netflix’s momentum has been its crackdown on password sharing. Despite initial skepticism, this move has proven to be a stroke of genius, attracting more paying subscribers and amplifying revenues. The company’s emphasis on original content production further solidifies its position in the cutthroat streaming realm, with numerous critically acclaimed series and films expanding its viewership.

Netflix’s recent Geeked Week unveiled a tantalizing array of upcoming shows, enhancing anticipation among subscribers and reinforcing the company’s commitment to engaging content. Moreover, the streaming giant’s foray into the realm of mobile gaming and merchandising suggests a multifaceted approach to revenue diversification, positioning Netflix for sustained growth.

Challenges on the Horizon for NFLX

While Netflix’s surge to a 52-week high is commendable, challenges loom on the horizon. Competition from industry heavyweights like Disney, Warner Bros. Discovery, and Apple, along with the proliferation of alternative entertainment platforms, poses a significant threat to Netflix’s market share and profitability. Maintaining its vanguard position amidst this fierce competition is paramount to Netflix’s continued success.

Furthermore, the inflated valuation multiples attributable to Netflix’s soaring stock price raise concerns about future growth potential. Investors are left pondering whether the current rally is sustainable or if a correction is imminent, prompting a cautious approach.

Deciphering the Future Outlook

Netflix’s enthralling journey to its 52-week pinnacle underscores its resilience and adaptability in a dynamic market. While the company exhibits promising growth drivers, the lofty stock price may already encapsulate much of this optimism. New investors are advised to await a more opportune entry point, particularly given Netflix’s current Zacks Rank of #3 (Hold).

In essence, Netflix’s navigation of the stock market’s ebbs and flows mirrors its content – unpredictable yet enthralling. As the streaming giant continues its evolution, investors must remain vigilant, poised to capitalize on potential opportunities while weathering market challenges.

Want the latest recommendations from Zacks Investment Research? Download 5 Stocks Set to Double today to uncover potential market gems like Apple Inc. (AAPL) and The Walt Disney Company (DIS).