Netflix’s Skyrocketing Growth Signals Bright Future for Investors

Netflix‘s NFLX stunning performance in the fourth quarter of 2024 could usher in a new transformative phase for the company. The streaming service added 18.9 million subscribers in this quarter, marking its highest ever, and pushing its total global subscriptions beyond 300 million. This impressive increase, paired with effective strategies and strong financials, suggests that Netflix shares could reach around $1,100 by 2025, indicating significant growth potential from current prices.

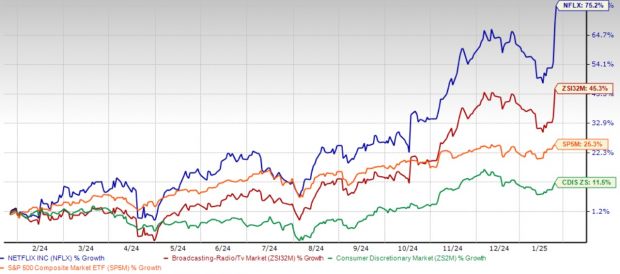

Investors have eagerly responded to Netflix’s latest results, driving NFLX shares up by an impressive 75.2% over the last year. This outperformance is notable compared to tech rivals like Apple AAPL, Amazon AMZN, and Disney DIS, in addition to the broader Zacks Consumer Discretionary sector.

One-Year Stock Performance

Image Source: Zacks Investment Research

Strong Financials and Growing Margins

The company showcased robust financial performance, with fourth-quarter revenues climbing 16% year-over-year to $10.25 billion, surpassing analyst expectations. Operating income also saw a substantial increase of 52%, reaching $2.27 billion, while operating margins improved to 22.2%. Looking ahead, Netflix has adjusted its operating margin forecast for 2025 from 28% to 29%, signaling strong profit prospects in the future. Viewing engagement remains steady at nearly two hours per membership daily, reinforcing Netflix’s value and pricing ability.

For 2025, Netflix plans to generate revenues in the range of $43.5-$44.5 billion, an increase of $0.5 billion from earlier projections. This updated guidance reflects stronger business fundamentals and benefits from the better-than-expected fourth-quarter performance, despite challenges from a stronger U.S. dollar over recent months.

Advertising Revenue and Monetization Advances

The introduction of Netflix’s advertising tier has yielded impressive results, with ad-supported subscriptions making up over 55% of new sign-ups during the fourth quarter where available. Memberships in ad-supported plans rose by nearly 30% from the previous quarter. The company anticipates that its advertising revenues will double in 2025. Recent price hikes, including raising the standard plan to $17.99, highlight Netflix’s pricing power and its capacity to increase average revenue per user while maintaining subscriber growth.

Content Strategy and Industry Leadership

Looking ahead, Netflix’s content offerings for 2025 are notably strong, featuring anticipated seasons of major hits like Squid Game, Wednesday, and Stranger Things. Netflix has also entered the live programming arena, recently achieving record viewership numbers for events like the Jake Paul-Mike Tyson fight and notable NFL games streamed on Christmas Day. Additionally, acquiring rights to the FIFA Women’s World Cup for 2027 and 2031 further enhances its content lineup and solidifies its presence in live sports.

Growth Potential and Market Opportunities

Netflix estimates it has captured just 6% of its total addressable market, which equates to over $650 billion in entertainment revenue across its regions. With approximately 750 million broadband households in its target areas (excluding China and Russia), the potential for growth is substantial. The company’s focus on expanding its subscriber base and enhancing monetization positions it favorably for market share gains. The rollout of its in-house ad-tech platform, starting in Canada and expanding to other regions in 2025, is set to improve advertising capabilities and revenue.

Despite this encouraging outlook, the forward 12-month sales ratio for Netflix stands at 9.62, higher than its five-year average of 6.69. This indicates the stock may currently be trading at a premium compared to its historical valuations. Furthermore, this ratio surpasses the Zacks Broadcast Radio and Television industry’s forward earnings multiple of 3.64, implying that Netflix’s valuation is high relative to its competitors.

Forward Price-to-Sales Comparison

Image Source: Zacks Investment Research

The Case for $1,100

Achieving a price target of $1,100 seems feasible for Netflix by 2025, fueled by a multitude of growth drivers and solid operational pace. Projected revenue growth between 12-14%, anticipated margin expansion to 29%, and the expected doubling of advertising revenues create a strong argument for this target. With a forecasted free cash flow of $8 billion and recent price adjustments reflecting its strategic advantages, Netflix is strongly positioned for ongoing success. Only capturing 6% of its $650 billion addressable market further underscores its growth trajectory. The Zacks Consensus Estimate projects revenues of $44.11 billion for 2025, reflecting a year-over-year growth of 13.1%. Likewise, the consensus forecast for earnings indicates $24.17 per share, suggesting a 21.89% increase from the prior year.

Image Source: Zacks Investment Research

Discover the latest EPS estimates and surprises on Zacks Earnings Calendar.

Final Investment Thoughts

Given Netflix’s solid financial performance, expanding profit margins, various revenue growth drivers, and ample market potential, reaching $1,100 in 2025 seems increasingly attainable. The company’s competitive strength, combined with its innovative approaches and ability to monetize a growing subscriber base, positions it as a promising investment option for those interested in the expanding streaming sector.

NFLX’s strategic investments in content, technology, and new revenue streams, in addition to a disciplined capital allocation approach including a $15 billion share repurchase authorization, create numerous pathways for stock value appreciation. Netflix’s focus on profitability, showcased by its notable $10 billion operating income milestone in 2024, indicates balance in it pursuing growth while maintaining earnings.

For investors eager to benefit from the continued shift towards streaming entertainment, Netflix presents a compelling opportunity with significant upside potential. The mix of strong subscriber growth, improving margins, and multiple revenue sources positions the company well for appreciation toward the $1,100 target by 2025. While previous performance doesn’t guarantee future results, Netflix’s clear strategy and strong execution history make it a viable candidate for long-term portfolio inclusion. Currently, NFLX holds a Zacks Rank #2 (Buy). Explore the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Identifies Top Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA, which has surged over 800% since our recommendation. While NVIDIA remains strong, our new leading chip stock can grow even more.

With robust earnings growth and an expanding customer base, it stands ready to meet the surging demand for artificial intelligence, machine learning, and the Internet of Things. The global semiconductor manufacturing market is expected to skyrocket from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Want the latest picks from Zacks Investment Research? Download our report on the 7 Best Stocks for the Next 30 Days at no cost.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Netflix, Inc. (NFLX): Free Stock Analysis Report

The Walt Disney Company (DIS): Free Stock Analysis Report

To view this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions presented here are those of the author and do not necessarily reflect those of Nasdaq, Inc.