All figures are in $CAD unless otherwise noted

All financial information is from Seeking Alpha unless otherwise noted.

Investment Proposition

Nexus Industrial REIT (TSX:NXR.UN:CA)(OTC:EFRTF) has shown relentless aggression in the industrial property acquisition market in recent years. This determined focus has not only expanded Nexus’s portfolio but also streamlined its operations, solidifying its status as a pure-play industrial REIT. From an investment standpoint, Nexus offers a compelling opportunity, characterized by promising rental growth that is expected to surpass its peers, along with an appealing relative valuation. The prospect of decreasing interest rates could further bolster Nexus’s growth trajectory. However, investors should be mindful of potential challenges, including the possibility of a dividend cut and the impact of recessionary pressures in the short term.

Despite these concerns, I am optimistic about Nexus’s ability to navigate these hurdles effectively. For investors with a long-term view, Nexus represents an attractive proposition, combining a robust dividend yield with growth potential, all available at a favorable price point. This blend of income and growth potential positions Nexus as a noteworthy option for those seeking to diversify their investment portfolio in the real estate sector.

Introduction and Property Portfolio

Nexus Industrial REIT, based in Oakville, Ontario, specializes in industrial real estate and boasts a portfolio of 115 properties, spanning an impressive 13.6 million square feet in gross leasable area or GLA. Nexus directly owns approximately 12.1 million square feet, representing 89.11% of the total GLA.

Their diverse property mix includes 84 industrial sites, 16 retail spaces, 13 office buildings, 2 parcels of industrial land marked for redevelopment, and 1 mixed-use facility. All of these assets are located within Canada.

Asset Mix and Geographical Presence

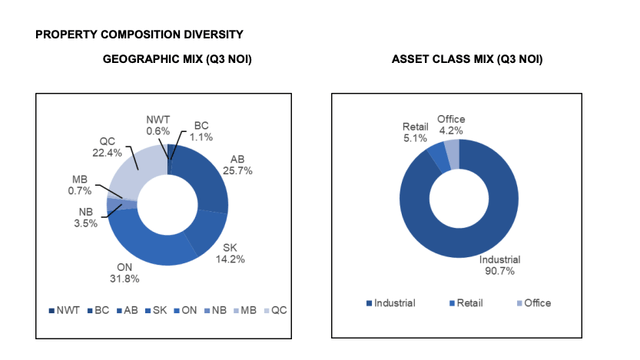

Nexus REIT’s 2023 Q3 financials highlight that their industrial properties are the cornerstone of their business, contributing a significant 90.7% to the net operating income or NOI. Retail and office properties make a smaller impact, contributing 5.1% and 4.2% respectively. Geographically, Ontario leads with 31.8% of the NOI, followed by Alberta at 25.7%, and Quebec City contributing 22.4%. Saskatchewan accounts for 14.2%, while New Brunswick adds 3.5%. The remaining 2.4% is split between British Columbia (1.1%), Manitoba (0.7%), and the Northwest Territories (0.6%).

Nexus Industrial REIT holds a strong tenant profile, with their top 10 tenants accounting for 39.5% of the annualized base rent. This tenant roster includes nationally recognized tenants such as Loblaws (11.8%), Ford (3.9%), and Sobeys (3.4%).

Acquisitions, Dispositions, and Development Activity

Nexus Industrial REIT has shown a high level of activity in the property acquisition market. In the first 3 quarters of 2023, they expanded their portfolio significantly, acquiring five industrial properties for about $322 million, thereby adding approximately 1.43 million square feet to their gross leasable area. In 2022, Nexus spent roughly $317 million acquiring various industrial properties across Canada.

Concurrently, they’ve streamlined their assets by selling two properties including one industrial and one retail property. This aligns with their strategic focus on becoming a purely industrial REIT, as evidenced by their plans to sell four office properties valued at $31.6 million.

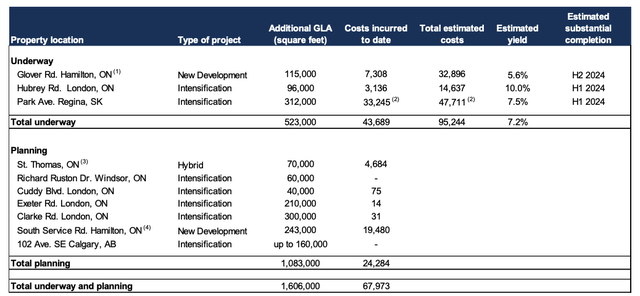

On the development front, Nexus has also been aggressive, investing $42.4 million in various projects during the first three quarters of 2023. They are currently developing an additional 523,000 square feet, with plans for another 1,083,000 square feet in the pipeline. The projects that are currently underway are expected to be completed in 2024 and are anticipated to yield an average return of 7.2%.

Property Metrics and Financials

As of September 30, 2023, Nexus Industrial REIT’s total portfolio boasted a 97% occupancy rate. Breaking it down, the industrial segment led with a 98% occupancy rate, followed by retail at 88%, and office spaces lagging somewhat at 75%.

The lease maturity profile across Nexus’s portfolio is well-staggered. About 11.1% of leases are set to expire in 2024, 13% in 2025, 9.1% in 2026, 4.4% in 2027, and the remaining 60.7% extends from 2028 and beyond. The industrial segment has a weighted average lease term or WALT of 7 years, with the retail and office segments at 3.8 and 4.5 years respectively. Across the entire portfolio, the WALT stands at 6.7 years, favorably aligned with the 5.87-year average term to maturity on their mortgages.

In Q3 2023, Nexus successfully renewed 166,805 square feet of expiring leases at a remarkable rental growth rate of 69% and also managed to lease an additional 15,215 square feet of vacant property. Notably, all new leases incorporate rental steps to help mitigate the impact of inflation.

During the first three quarters of 2023, Nexus realized a fair value adjustment of $60.4 million, reflecting an increase in property values. It’s important to recognize that these are unrealized gains, contributing 38.3% to the year-to-date net income (Author’s calculation). This increase is primarily driven by the growing appeal of industrial properties among investors in Canada. However, I anticipate that this trend might decelerate as we head into 2024.

To conclude our overview of Nexus Industrial REIT, let’s turn to their financing structure, particularly focusing on their mortgage and credit facility obligations. As of September 30, 2023, the weighted average interest rate on their property-secured mortgages stood at 3.31%, a slight increase of just 10 basis points from the year-end 2022 rate of 3.21%. The outstanding mortgage balance is approximately $705 million, with these mortgages having a weighted average term to maturity of 5.87 years. Nexus’s investment properties are valued at $2.26 billion. However, it’s crucial to consider their additional debt from credit facilities, which amounts