Nike’s Performance Plummets amidst a Sea of Losses

The impending release of Nike’s fiscal Q3 2024 earnings has cast a shadow over the sneaker giant, with shares down nearly 8% year-to-date – a dismal performance that places them among the weakest links in the Dow Jones Industrial Average ($DOWI). The tale of woe isn’t new; 2023 witnessed a 7.2% decline in Nike’s stock value, starkly contrasting with the robust double-digit returns seen in broader markets.

The Long Shadows of Glory: A History of Highs and Lows

In hindsight, the glistening heights of November 2021, where Nike stock reached an all-time pinnacle of over $173, almost seem like a distant dream. Currently languishing approximately 42% below those peak levels, Nike has struggled to emerge from the shadows of that memorable time, consistently ending each year in the red despite the S&P 500 Index ($SPX) soaring to unprecedented zeniths.

Forecasting Nike’s Third Quarter Earnings: A Glimpse into the Crystal Ball

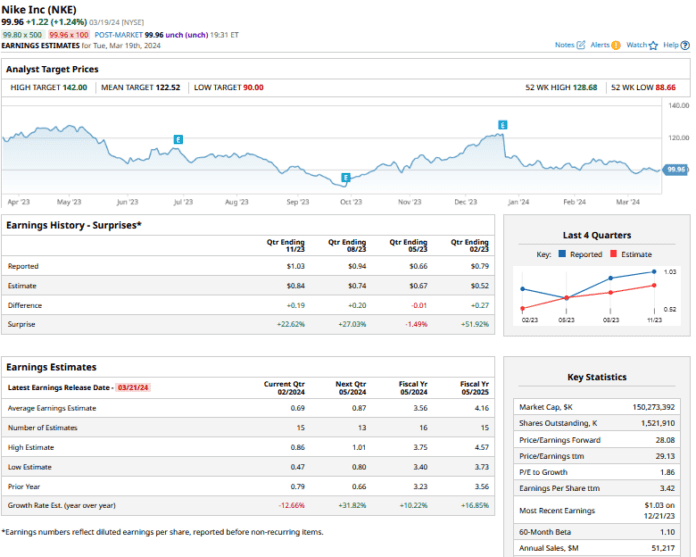

As the stage is set for Nike’s fiscal Q3 earnings, analysts brace for a predicted 0.8% year-over-year revenue decline to $12.3 billion. With the specter of unforgiving comparisons from the previous year looming large, Nike had forewarned in their last earnings call of a slight dip in Q3 revenues.

A Dance of Numbers: The Earnings Symphony Unfolds

The echo of a 12.7% anticipated tumble in earnings per share for the fiscal third quarter runs through the air, juxtaposed against a projected 32% year-over-year surge in earnings for the forthcoming quarter. The rhythm of revenue growth has a new beat, with a revised forecast of just 1% for the full year, down from the initial mid-single-digit expectations.

Deciphering Nike’s Earnings Quartet: What Lies Beneath

As Nike prepares to unveil its earnings, the eyes of the market turn inquisitive, looking beyond the revenue metrics. A cautious gaze falls on guidance, seeking insights into the company’s outlook for the coming quarter amidst the prevailing uncertainties.

- China remains a focal point of concern, with market nerves rattled by the deterring headwinds in the region. A significant revenue exposure to China has kept analysts and investors on edge, mirroring a subdued performance plaguing several other companies with a stake in the region.

- Sam Poser’s discerning eye sheds light on Nike’s evolutionary shift from a ‘pull’ to a ‘push’ model and raises a flag regarding the underwhelming launch of Jordan 11. The nuanced insights point towards the winds of change in Nike’s strategy and approach.

- The relentless pursuit of product innovation ensues, echoing whispers of a forthcoming tide of new franchises and concepts poised to reshape Nike’s portfolio. The narrative unveils a canvas rich with the promise of transformative innovation in the days to come.

Nike’s Future Unmasked: The Crystal Ball Glistens

The forecast for Nike’s future is a tapestry woven in contrasting hues – a symphony of mixed perspectives. While the tides of change sway Poser to downgrade the stock, Guggenheim’s Robert Drbul contrasts, deeming Nike his “best idea” for the year.

As the scales hang in balance, Wall Street’s verdict remains divided, reflecting a range of opinions from ‘Strong Buy’ to ‘Hold.’ Amidst the tumultuous seas, Nike’s mean target price of $122.52 glimmers as a beacon, offering hope of a 22.5% ascent over yesterday’s close.

Buying the Dip: A Daunting Decision

The somber expectations looming over Nike this quarter, coupled with its recent stumble, chart a precarious path ahead. Despite the anticipation of a post-earnings surge, caution tugs at the reins. The economic backdrop in China paints a cautionary mural, urging a prudent approach amidst the turbulent waters.

As Nike marshals its forces to navigate the storm, the horizon bears traces of optimism. The stock, though weather-worn, stands poised for a resurgence in the medium to long term, grounded in strategic moves aimed at steering it towards calmer waters.

At the time of publication, Mohit Oberoi held positions in: AAPL , NKE . The information provided in this article is intended for informational purposes only. Please refer to the Barchart Disclosure Policy for further details.

The opinions expressed in this article are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.