The Beguiling Rise and Harsh Fall of Startup EVs

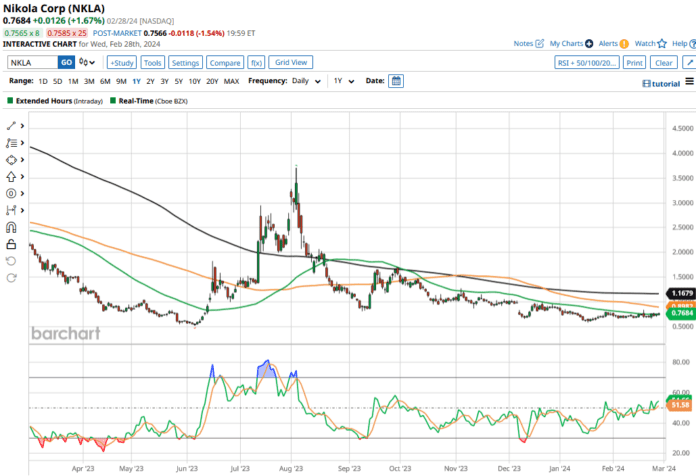

Startup electric vehicle (EV) company Nikola (NKLA) has seen better days, with its stock plummeting over 12% since the beginning of 2024. Looking back, the past three years have been brutal, witnessing an astounding 95% decline in value during that period. Once a meme stock darling, Nikola now teeters on the edge of public perception, with some retail investors still hopeful for a massive turnaround.

The SPAC Frenzy: A Cautionary Tale

Nikola’s trajectory mirrors that of several other green energy companies launched through SPAC mergers, including names like Arrival (ARVLF), Bird Global (BRDSQ), and Lordstown Motors (RIDEQ). In the heady days of 2020, Nikola briefly outstripped Ford Motor (F) in market cap, heralding the beginning of an EV bubble that was bound to burst.

The EV Bubble Bursts: Reality Strikes Hard

The EV sector’s grandiose bubble finally popped in 2022, with Rivian’s market cap reaching unprecedented heights alongside Tesla’s (TSLA). However, the party ended abruptly as the Federal Reserve initiated a severe interest rate hike, leaving cash-strapped startups gasping for air amidst a dried-up funding pool.

Nikola’s Trials: A Troubled Legacy

Beyond macroeconomic challenges, Nikola carries its own heavy baggage. A cloud of fraud allegations loomed over the company following a scathing report by Hindenburg Research shortly after its IPO. The subsequent exit of founder Trevor Milton and Lordstown Motors’ similar fate paint a grim picture of the perils lurking within the startup EV landscape.

Resilience Amidst Adversity: Nikola Reinvented

Nikola’s metamorphosis post-Milton’s exit has been remarkable. Shedding non-core assets, refocusing on hydrogen fuel cell trucks and infrastructure in targeted markets like California and Canada, the company has amassed a substantial cash reserve of $464.7 million as of 2023. Nevertheless, a bloated share count and excessive stock-based compensation continue to raise eyebrows among investors.

Drifting Towards the Horizon: 2025 Vision

Despite the tumultuous past, Nikola’s CEO Steve Girsky remains cautiously optimistic about the company’s forecast for 2025. With aspirations for a positive cash contribution margin on every truck and an eye on profitability, the company aims to navigate a challenging terrain marked by intense competition and skepticism.

The Road Ahead

While Nikola has made strides in reshaping its identity and operations, the journey ahead is fraught with uncertainties. With lingering doubts over its ability to deliver sustainable growth and overcome its turbulent history, investors tread cautiously, viewing NKLA stock as a risky proposition amidst a sea of more established green energy players in the market.

On the date of publication, Mohit Oberoi had a position in: F , TSLA. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.