NIO Reports Wider Losses Despite Increased Vehicle Deliveries

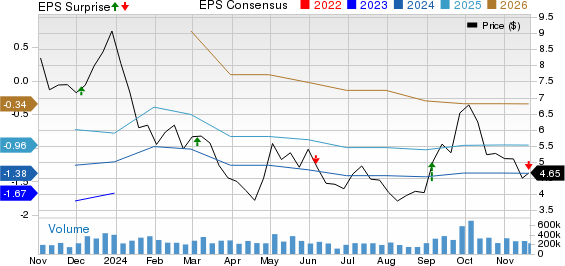

NIO Inc. reported a loss per American Depositary Share (ADS) of 36 cents for the third quarter of 2024, which was larger than the Zacks Consensus Estimate of a 32-cent loss. In the same quarter of the previous year, NIO had a loss of 37 cents. The China-based electric vehicle manufacturer generated revenues of $2.66 billion, falling short of the Zacks Consensus Estimate of $2.70 billion. This revenue also marks a decline of 2.1% compared to the same quarter in 2023.

Financial Highlights

During the third quarter, NIO delivered 61,855 vehicles, which reflects an 11.5% increase year-over-year, including 832 vehicles from its newly launched ONVO brand. Revenue from vehicle sales was $2.38 billion, representing a 4.1% decrease from the previous year due to competitive pricing pressures. Additionally, other sales reached $281.6 million, a robust 19.2% increase.

NIO’s gross profit rose to $286 million, marking a significant 31.8% increase year-over-year, attributed to significantly reduced cost of sales. The gross margin surged to 10.7%, up from 8% the previous year. Furthermore, vehicle margins improved to 13.1%, compared to 11% in Q3 2023, attributed to lower material costs per unit.

Research and development expenses increased by 9.2% year-over-year to $472.9 million, while selling, general, and administrative costs rose 13.8% to $585.5 million. Losses from operations expanded to $746.3 million due to higher operating costs. As of September 30, 2024, NIO reported $3.39 billion in cash and cash equivalents and $1.6 billion in long-term debt.

Looking ahead to the fourth quarter of 2024, NIO anticipates delivering between 72,000 and 75,000 vehicles, indicating a growth of 43.9% to 49.9% year-over-year. Revenue projections are between $2.8 billion and $2.9 billion, which would represent a year-over-year rise of 15% to 19.2%.

Currently, NIO holds a Zacks Rank #3 (Hold).

Comparative Performance of Industry Peers

XPeng (XPEV) reported a narrowed loss per ADS of 27 cents for Q3 2024, improving from a loss of 62 cents in the same quarter the previous year. Revenues climbed to $1.44 billion, compared to $1.17 billion in Q3 2023. XPeng’s vehicle margin saw a significant recovery to 8.6%, contrasting with a negative margin of 6.1% from last year. At the end of September 2024, XPeng had $1.5 billion in cash and $908 million in long-term debt.

For its fourth quarter, XPeng anticipates vehicle deliveries between 87,000 and 91,000, reflecting an anticipated growth rate of 44.6% to 51.3% year-over-year, with revenues expected to grow by 17.2% to 24.1%.

Li Auto (LI) saw its earnings per ADS rise to 52 cents from 45 cents in the prior year. The firm’s revenues increased to $6.1 billion from $4.75 billion year-over-year, driven by strong delivery growth. Vehicle margins slightly decreased to 20.9% from 21.2% in Q3 2023, but improved from 18.7% in the previous quarter. Li Auto’s cash and cash equivalents totaled $11 billion, with long-term debt standing at $1.13 billion as of September 30, 2024.

Looking ahead, Li Auto expects deliveries between 160,000 and 170,000 for Q4 2024, which would signal a year-over-year rise of 21.4% to 29%. Total revenues are projected to increase by 3.5% to 10% year-over-year.

Analysts Spotlight High-Performing Stocks

This year, Zacks Research analysts have identified a selection of promising stocks with potential for high returns. Director of Research Sheraz Mian has hand-picked one standout stock expected to exceed market expectations, especially in reaching millennial and Gen Z consumers.

Last quarter, this company recorded nearly $1 billion in revenue. A recent market dip presents an opportunity for investors to consider. Although not all picks are guaranteed successes, past recommendations like Nano-X Imaging, which surged +129.6% within three quarters, suggest that this particular stock may offer substantial growth potential.

Free: See Our Top Stock And 4 Runners Up

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.