Northland Capital Markets Rates Serve Robotics as a Strong Buy

Analysts Predict Significant Growth for Serve Robotics

On October 18, 2024, Northland Capital Markets began coverage of Serve Robotics (NasdaqCM:SERV) with an Outperform recommendation.

Price Target Indicates Substantial Upside Potential

As of September 25, 2024, the average one-year price target for Serve Robotics stands at $16.32 per share. This forecast varies, with estimates ranging from a low of $16.16 to a high of $16.80. Notably, the average price target indicates a potential increase of 74.36% from its most recent closing price of $9.36 per share.

For a broader perspective, take a look at our leaderboard featuring companies with the highest price target upside.

Annual EPS Forecast Remains Negative

The projected annual non-GAAP earnings per share (EPS) is -0.88.

Growing Institutional Interest in Serve Robotics

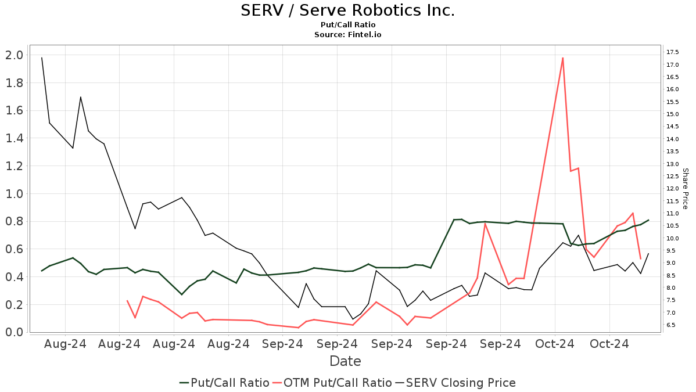

Currently, 28 funds or institutions have reported stakes in Serve Robotics, marking a significant increase of 24 new owners or 600.00% in just the last quarter. The average portfolio weight dedicated to SERV across all funds is 0.12%, which reflects a remarkable rise of 27,428.23%. Over the past three months, the total shares owned by institutions surged by 432,927.10%, reaching 8,661K shares.  The current put/call ratio for SERV is 0.81, suggesting a positive market outlook.

The current put/call ratio for SERV is 0.81, suggesting a positive market outlook.

Nvidia represents a significant stakeholder, holding 3,727K shares, which accounts for 8.69% of the company. AWM Investment possesses 1,818K shares, or 4.24%. Other notable shareholders include Alyeska Investment Group with 925K shares (2.16% ownership), Polar Asset Management Partners with 542K shares (1.26%), and MYDA Advisors with 478K shares (1.11% ownership).

Fintel is a leading investment research platform catering to individual investors, traders, financial advisors, and small hedge funds.

Our expansive data encompasses global fundamentals, analyst reports, ownership insights, fund sentiment, insider trading activity, options flow, and much more. Furthermore, our unique stock picks utilize advanced, backtested quantitative strategies aimed at enhancing profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.