Nutrien Ltd Options Trading Insights: February 14th Contracts Analyzed

New Options Available for Investors in Nutrien Ltd

Investors in Nutrien Ltd (Symbol: NTR) can now explore new options trading for contracts set to expire on February 14th. At Stock Options Channel, our YieldBoost formula has pinpointed noteworthy put and call contracts within the NTR options chain.

The put contract at the $40.00 strike price currently has a bid of 10 cents. By selling this put contract, an investor agrees to buy the stock at $40.00, while also collecting the premium, which effectively lowers the cost basis of the shares to $39.90 (before broker commissions). Given that the current trading price of NTR is $45.50 per share, this strategy may present a more attractive opportunity for prospective shareholders.

Notably, the $40.00 strike represents an approximate 12% discount to the stock’s current trading price, placing it out-of-the-money by that percentage. The available analytical data suggests there’s an 83% chance the put contract could expire worthless. Stock Options Channel will track these odds over time and share updates on our website under the contract detail page. If the contract does expire worthless, the premium earned would equate to a 0.25% return based on the cash commitment, translating to an annualized return of 2.12% — a feature we label as the YieldBoost.

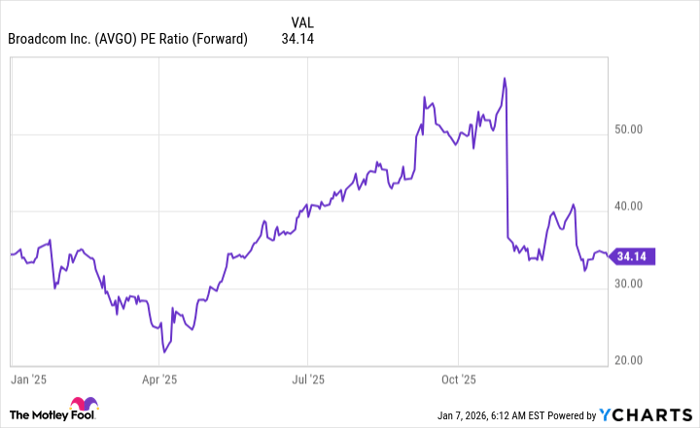

The chart below illustrates Nutrien Ltd’s trading history over the past twelve months, clearly marking the position of the $40.00 strike price in green:

Shifting to the call side of the options chain, the call contract at the $53.00 strike price shows a current bid of 5 cents. An investor purchasing shares of NTR at $45.50 and selling this call contract as a covered call would commit to selling the stock at $53.00. Including the premium collected, this strategy could yield a total return of 16.59% if the stock is called away at the February 14th expiration (before broker commissions). However, retaining some upside potential is crucial, especially if NTR shares experience a significant rise. For this reason, examining Nutrien’s trading history, along with its business fundamentals, is essential. Below is a chart displaying the company’s trading history over the past twelve months, highlighting the $53.00 strike price in red:

The $53.00 strike represents an approximate 16% premium over the current trading price, marking it out-of-the-money by the same percentage. There’s a chance the covered call contract may expire worthless, allowing the investor to keep both their shares and the premium collected. Analytical data suggests an 83% probability of this scenario occurring. Stock Options Channel will monitor these probabilities and provide updates on our website, including graphs of the options trading history. If the covered call expires worthless, the premium would yield an additional return of 0.11%, equating to an annualized return of 0.93%, another instance of our YieldBoost.

The implied volatility for the put contract stands at 37%, while the call contract has an implied volatility of 44%. Meanwhile, we have calculated the actual trailing twelve-month volatility, based on the last 251 trading day’s closing values and today’s share price of $45.50, to be 26%. For additional put and call options strategies worth exploring, visit StockOptionsChannel.com.

![]() Top YieldBoost Calls of the S&P 500 »

Top YieldBoost Calls of the S&P 500 »

Also see:

Ex-Dividend Calendar

Funds Holding BSCJ

LNN Historical Earnings

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.