On Wednesday, the Federal Reserve trimmed interest rates aggressively and penciled in further rate cuts by the end of the year. It slashed the benchmark interest rate by a half-point to 4.75-5% for the first time since March 2020.

Interest rates have been hovering at a 23-year high to combat relentless price pressures. However, signs of inflationary pressure have ebbed recently, giving the Fed all the more reason to cut interest rates aggressively and let investors know that the central bank is not behind the curve.

A lower interest rate scenario may lead to stock gains for major artificial intelligence (AI) tech players like NVIDIA Corporation NVDA, Microsoft Corporation MSFT and Micron Technology, Inc. MU. This is because interest rate cuts reduce their borrowing costs and boost profit margins. Interest rate cuts also don’t disrupt the cash flows needed for growth initiatives to enhance shareholder’s wealth.

By the way, the euphoria about the AI revolution hasn’t faded. It’s here to stay and should drive the prices of NVIDIA, Microsoft and Micron northward. After all, NVIDIA provides technology for AI applications, Microsoft builds AI resources for its customers and Micron is a memory specialist. AI’s data centers require a lot of memory.

According to Statista, the AI industry is expected to grow beyond $184 billion in 2024 and continue to expand until 2030, with an estimated market size of $826 billion (read more: What AI Bubble? NVIDIA & 2 Other Chip Stocks With Strong Price Upside).

Even so, let’s look at other reasons why NVIDIA, Microsoft and Micron’s shares have more room to run.

Key NVIDIA Tailwind: Supremacy in the GPU Space

According to CEO Jensen Huang, as huge chunks of data are transferred from the central processing units to graphic processing units (GPU), NVIDIA will gain due to its bulk share in the GPU market. Precedence Research noted that the GPU market is expected to grow to $1,414.39 billion in 2034 from $75.77 billion in the current year at a CAGR of 13.8%.

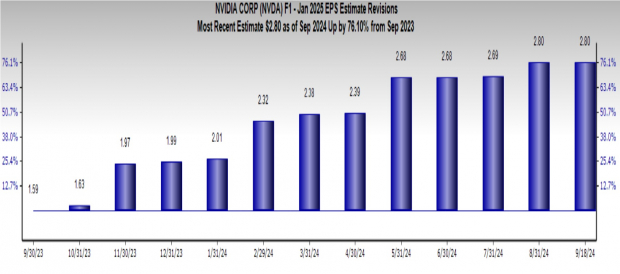

Since developers rely more on the CUDA software platform than Advanced Micro Devices, Inc.’s AMD ROCm software platform, NVIDIA’s GPUs have a wide competitive moat. NVIDIA’s data center GPU business revenues were $26.2 billion in the second quarter, up 154% year over year. As a result, the Zacks Consensus Estimate of $2.80 for NVDA’s earnings per share (EPS) is up 76.1% from the prior year (read more: NVIDIA Approves $50 Billion Stock Buyback: Time to Buy?).

Image Source: Zacks Investment Research

Key MSFT Tailwind: Azure Growth

Microsoft’s Azure and cloud services business has picked up steam, with revenues from this segment increasing 29% year over year in the fiscal fourth quarter. Microsoft’s Azure cloud infrastructure unit is expanding faster than Amazon Web Services (AWS), which has dominated the cloud computing market for quite some time.

Microsoft’s Azure could soon overtake AWS since it has grown from half the size of AWS in 2019 to about three quarters now. Hence, the Zacks Consensus Estimate of $13.04 for MSFT’s EPS is up 5% year over year (read more: Microsoft Unveils $60 Billion Stock Buyback: Time to Buy MSFT Stock?).

Image Source: Zacks Investment Research

Key MU Tailwind: Optimism About HBM Chips

Increasing demand for Micron’s high-bandwidth memory chips (HBM) has led the company to use its full production capacity and is expected to boost the bottom line. Management noted that revenues from the HBM market are estimated to be $86 billion by 2030 from $1.8 billion last year.

NVIDIA’s AI graphic cards also use Micron’s HBM chips, so the demand is expected to improve. Thus, the Zacks Consensus Estimate of $1.20 for MU’s EPS is up 160.3% on a year-over-year basis (read more: Death Cross for MU Stock: Time to Buy Micron Based on Fundamentals?).

Image Source: Zacks Investment Research

Strong Price Upside for NVDA, MSFT, MU

Given the positives, well-known brokers have jacked up the average short-term price target of NVDA by 28.8% from the stock’s last closing price of $115.59. Analysts’ highest price target is $200, an upside of 73%.

Image Source: Zacks Investment Research

Prominent brokers have also increased MSFT’s average short-term price target by 14.8% from the stock’s last closing price of $435.15. The highest price target is $600, an upside of 37.9%.

Image Source: Zacks Investment Research

MU’s average short-term price target, too, has been raised 74.4% from the stock’s last closing price of $88.73. The highest price target is $225, an upside of 153.6%.

Image Source: Zacks Investment Research

Over the past year, the shares of NVIDIA, Microsoft and Micron have soared 168.4%, 34.3%, and 25.4%, respectively.

Image Source: Zacks Investment Research

All these stocks carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.7% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.