Dear readers,

I’ve been rather bearish on Nvidia (NASDAQ:NVDA) ever since the stock hit $400 per share, following the extraordinary guidance provided by management in their Q1 2023 earnings call. My primary concerns were centered around valuation and some lingering doubt regarding the company’s ability to deliver on such aggressive guidance.

Most recently, in September, I published an article urging investors to join me in a pairs trade: selling NVDA and buying ASML Holding (ASML). I deemed ASML a much safer investment due to its lower P/E and a more modest growth forecast. To date, the trade has paid off, with ASML returning 24.2%, while NVDA has “only” returned 18.8% over the same period.

Nvidia Surpasses Expectations

Since those articles, however, NVDA has consistently outperformed with their earnings reports (most recently Q3 2023), consistently beating consensus estimates. The company achieved an 18% beat in Q1, followed by a 29% beat in Q2 and an 18% beat in Q3.

Moreover, with every earnings release, management has raised their forward guidance, leading analysts to increase their consensus expectations. Following the Q2 earnings release, forward earnings expectations jumped by about 60%. Subsequently, after the Q3 results announcement, they surged by an additional 20%.

The rapid growth in NVDA’s earnings has caused the stock’s P/E relative to 2023e earnings to decrease from 50x to 39x. While still high, projecting one year forward at the consensus forecast for 2024 of additional 66% growth, the forward P/E stands at just 25x – notably below ASML’s forward P/E of 34x and a bargain for a company of NVDA’s caliber.

Following significant positive EPS surprises in Q2 and Q3, my confidence in NVDA reaching the ambitious forecast EPS of $20 per share next year has significantly increased. I’m not fully onboard yet, but I must admit that my stance on NVDA has shifted somewhat.

Key Risk Factors

Several factors will influence whether NVDA achieves the 2024 forecast and, more importantly, what happens to earnings beyond. These include:

1 – Demand for chips

While NVDA’s chips are unparalleled for training AI models, concerns loom over potential over-ordering by NVDA’s customers. If confirmed, this could lead to lower earnings growth post-2024, potentially skewing the forward P/E relative to 2024e to the downside.

2 – Competition

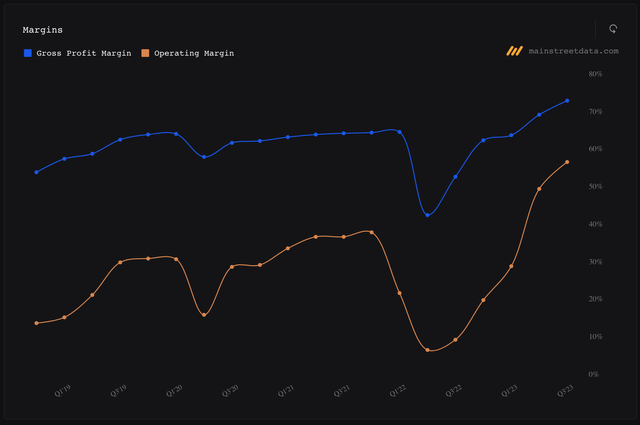

With AI dominating the conversation, competitors are likely to vie for NVDA’s market share, potentially pressuring the company’s leading margins. Notably, Advanced Micro Devices (AMD) is positioned as a strong contender with their Mi300x chip, while tech giants like Alphabet (GOOGL) and Microsoft (MSFT) have announced their foray into developing their own chips.

3 – Use Cases for AI

The determination of NVDA’s future earnings hinges on actual AI use cases. The plethora of viable use cases, now surpassing 100, will play a crucial role in ascertaining whether the recent hype has substance. As we approach 2024, it will be essential to witness corporations outlining strategies for integrating AI into their processes to drive additional profitability. The readiness to launch AI applications, evidenced by robust capacity demand at most data centers, offers a strong indication of companies gearing up for AI deployment.

4 – Geopolitical Risks

The formidable power of AI has motivated countries to vie fiercely for dominance. The escalating U.S.-China tensions underscore this struggle. The U.S. government’s embargo on exporting cutting-edge technology chips to China, affecting companies like Nvidia, could impede business. However, Nvidia, akin to AMD with their RX7900 chip, has been devising a slightly weaker chip tailored for the Chinese market, indicating a potential mitigating strategy. Despite the tangible risk, particularly if you believe in AI’s potential to drive significant productivity improvements, it doesn’t constitute a dealbreaker in my estimation.

Bottom Line

Assessing Nvidia’s prospects is intricate, hinging on the outlook for future earnings, especially beyond 2025. Initially skeptical about the company’s ability to meet the 2023 and 2024 forecasts, the robust earnings beats and heightened guidance and consensus in 2023 have swayed me towards a more bullish stance.

While I believe AI will unlock a myriad of practical use cases, the specter of over-ordering poses a genuine risk to earnings post-2024. Consequently, I advise investors not to bestow too much significance on the forward P/E of 25x, as it may ascend next year if over-ordering manifests as an issue.

Thus, I am not prepared to issue a BUY rating on Nvidia, but I am upgrading the stock to a HOLD owing to the aforementioned factors. I will be closely monitoring the Q4 2023 results on February 21 to reaffirm my confidence in the company’s ability to fulfill its ambitious forecast.